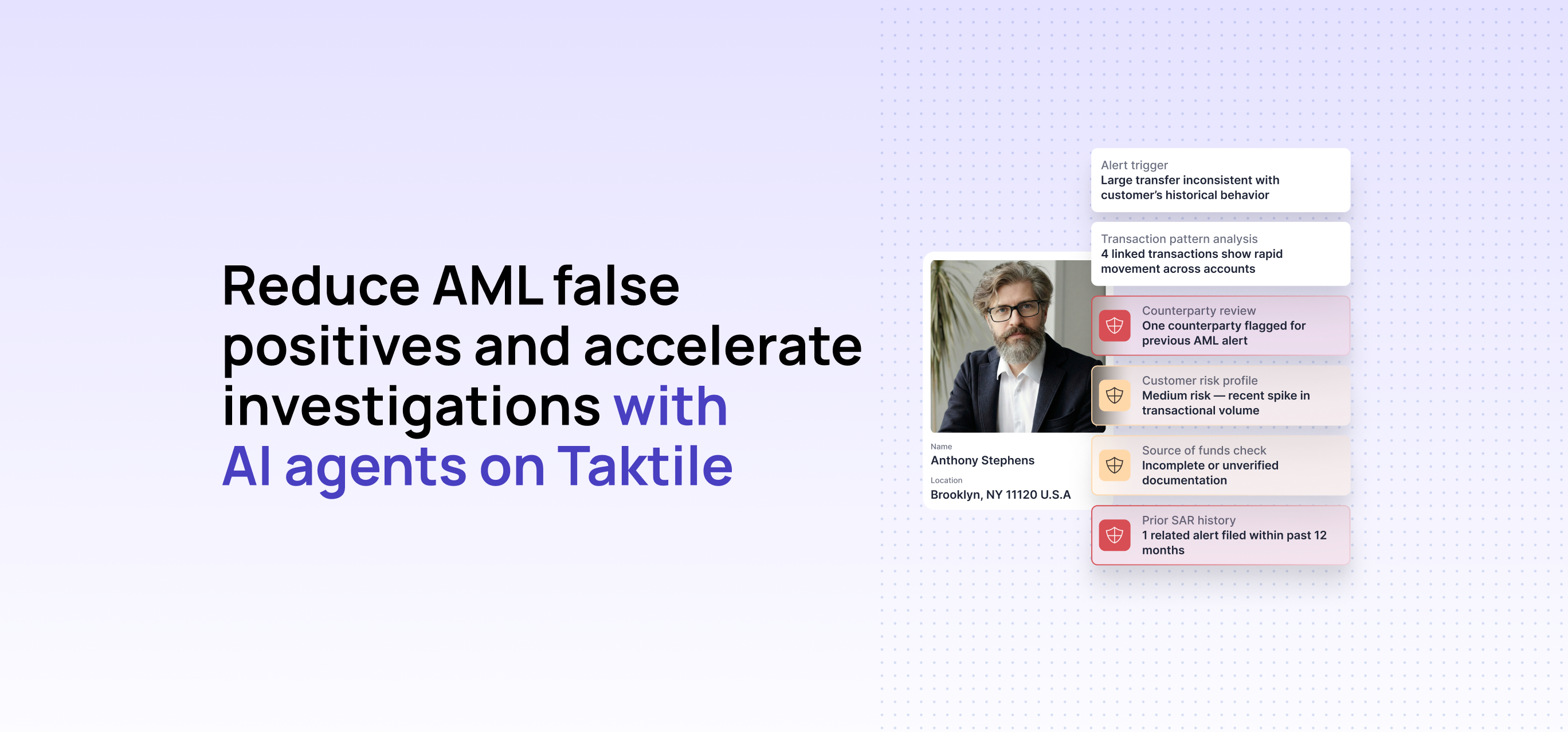

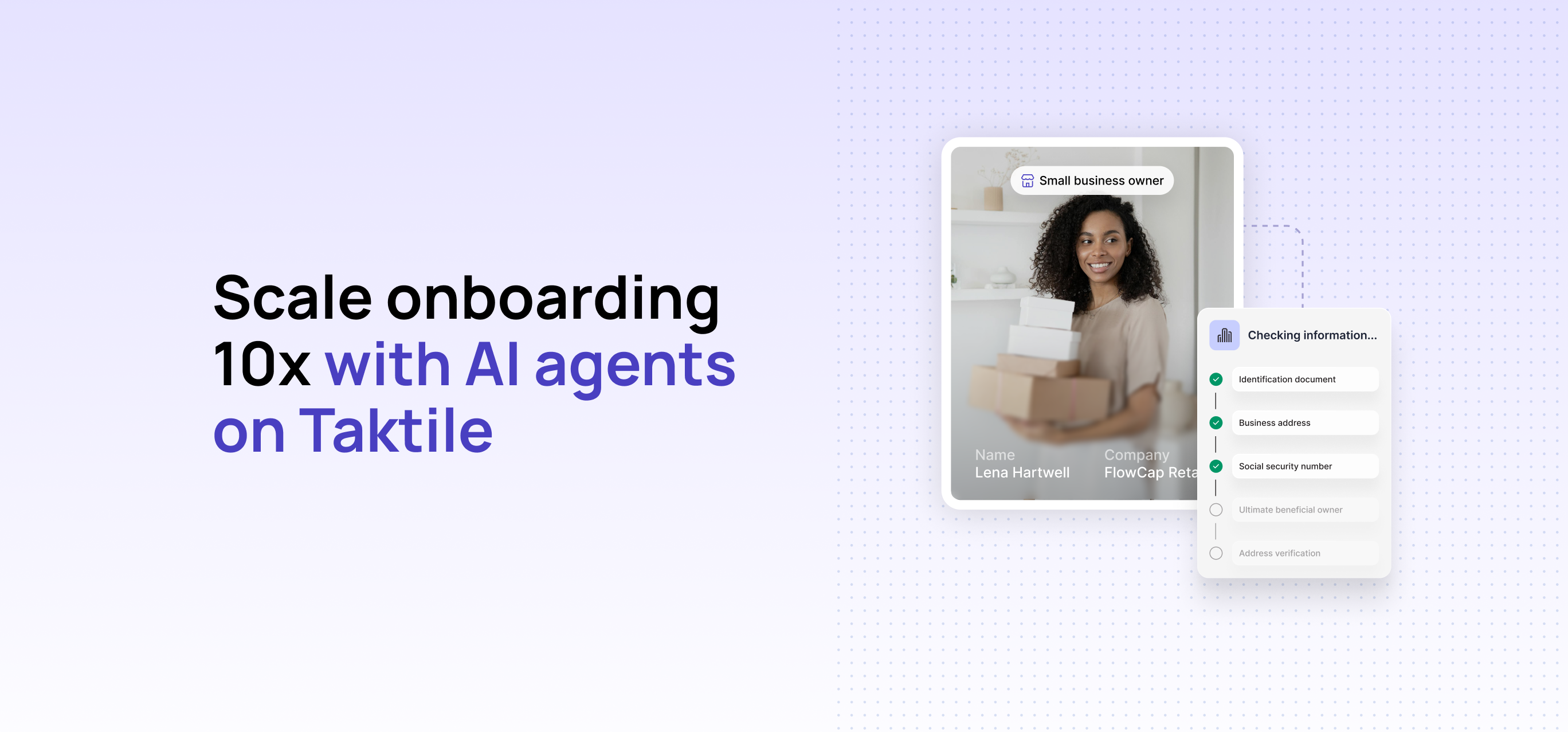

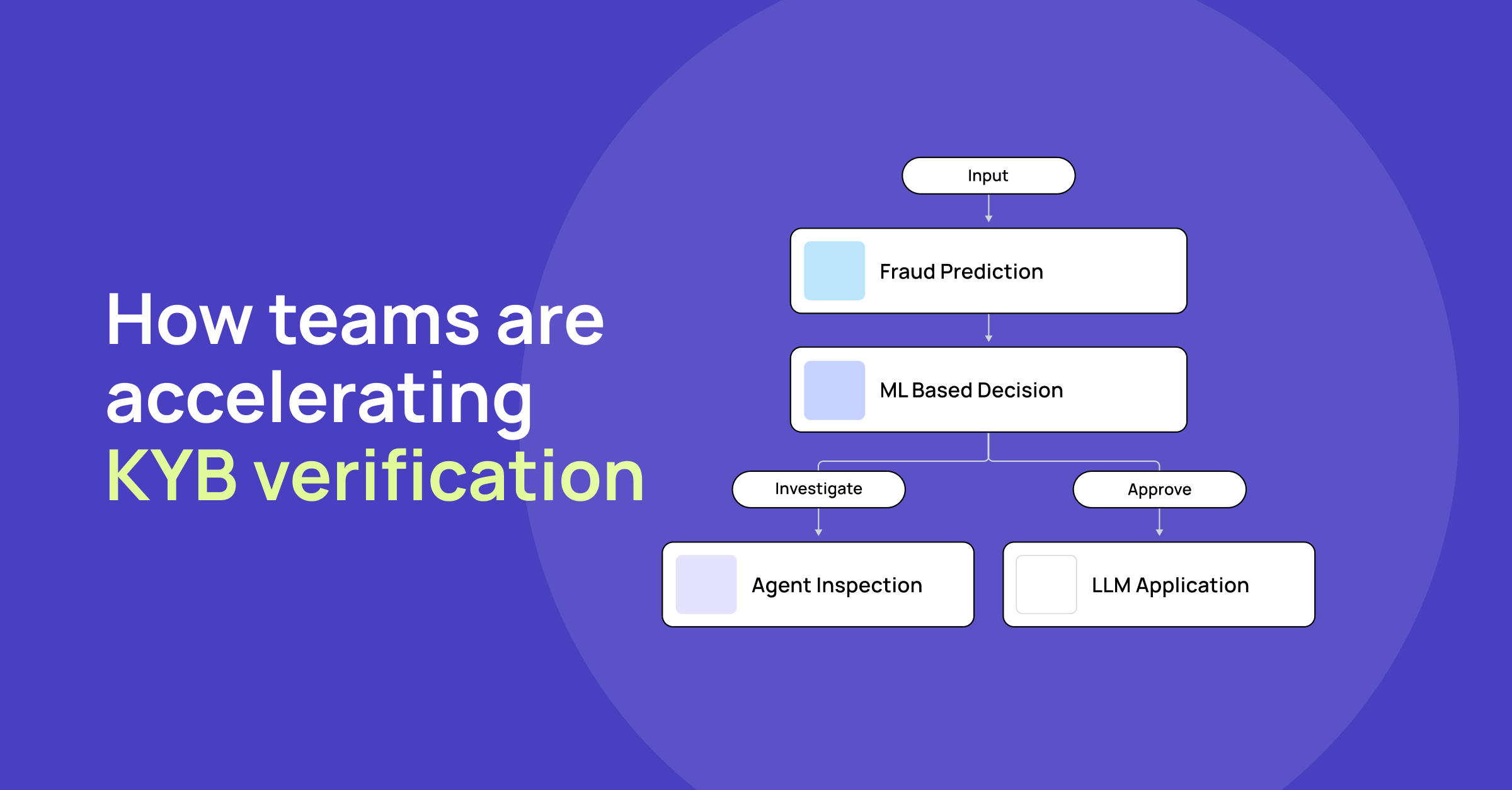

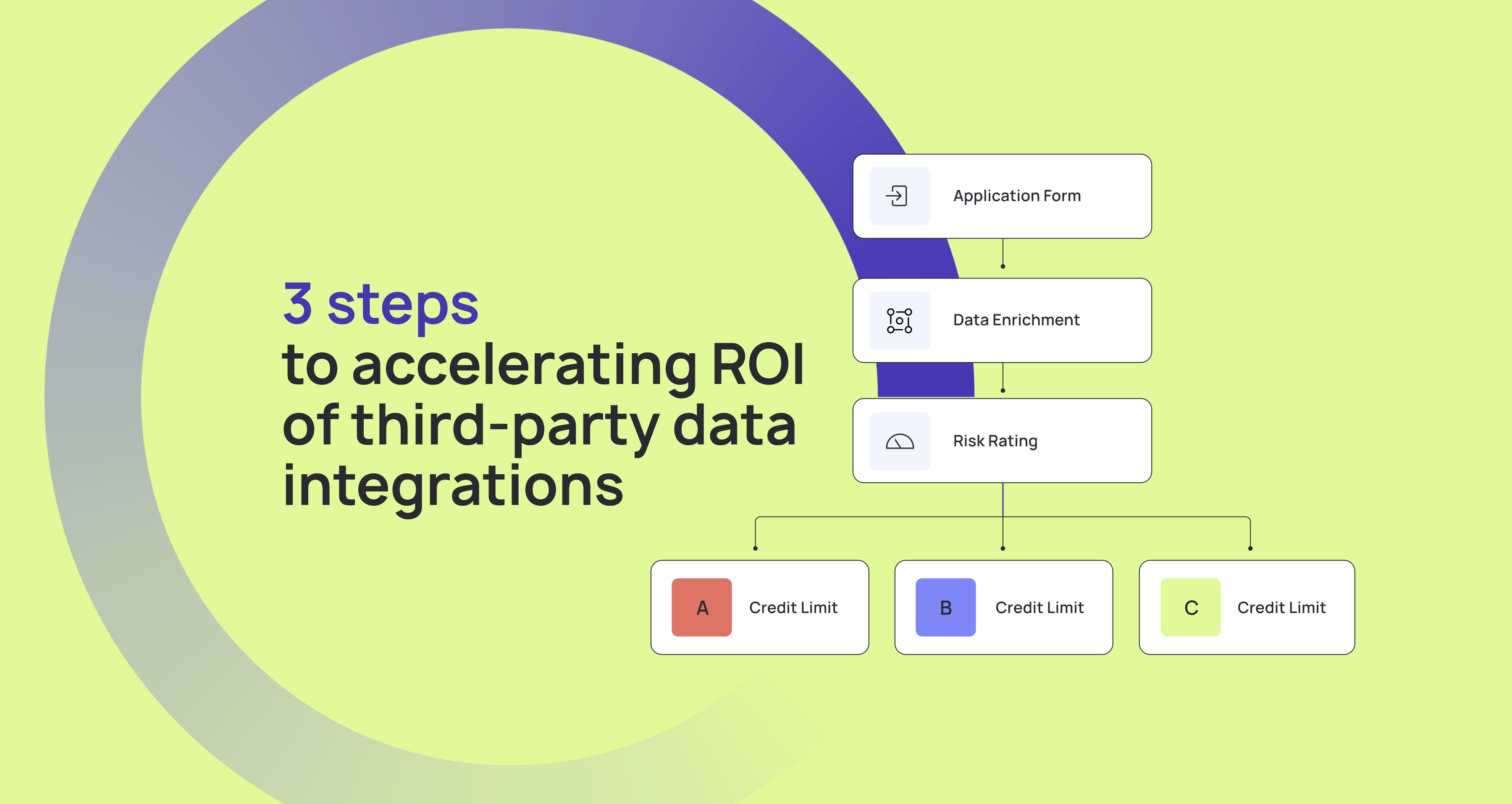

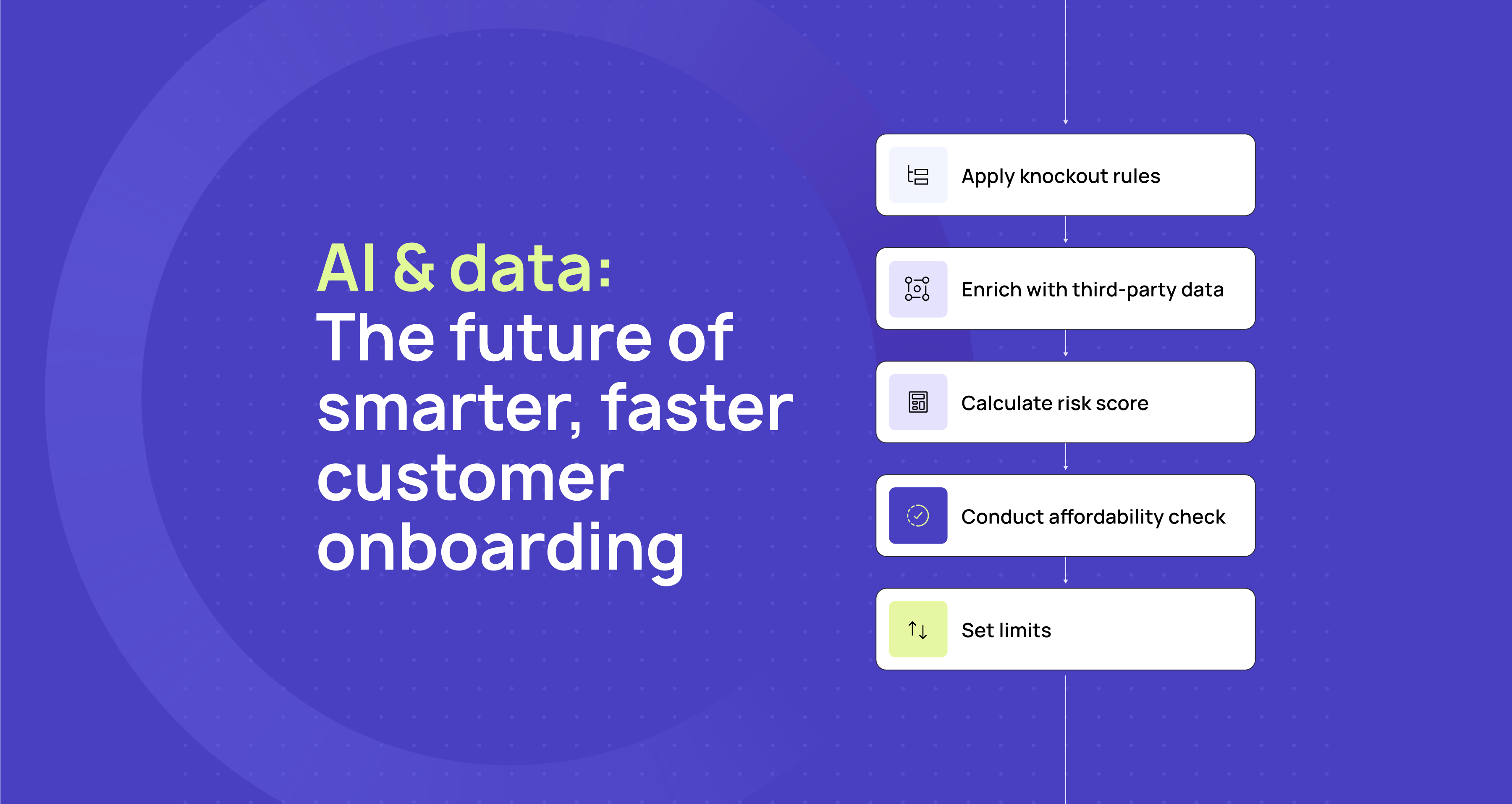

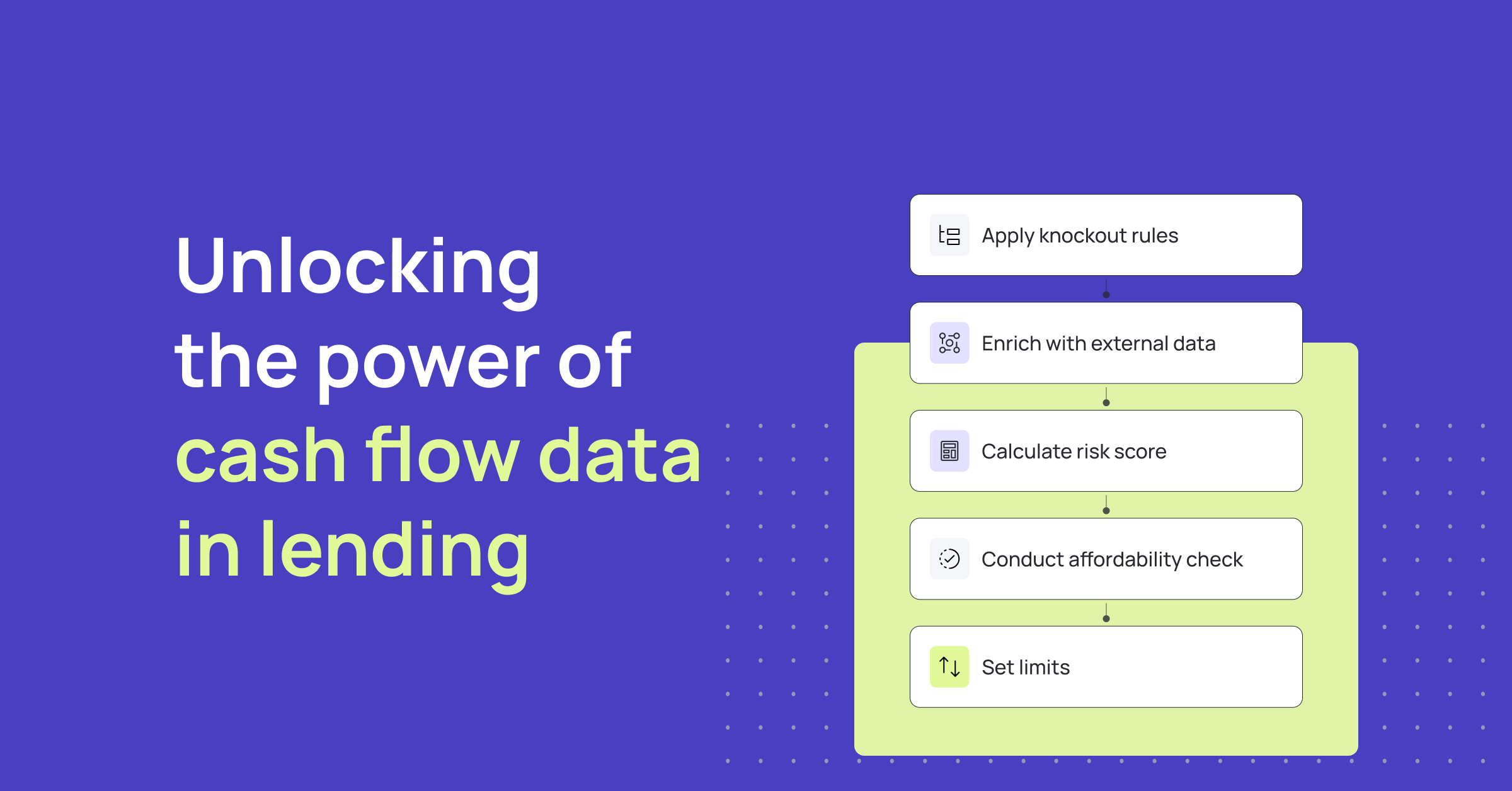

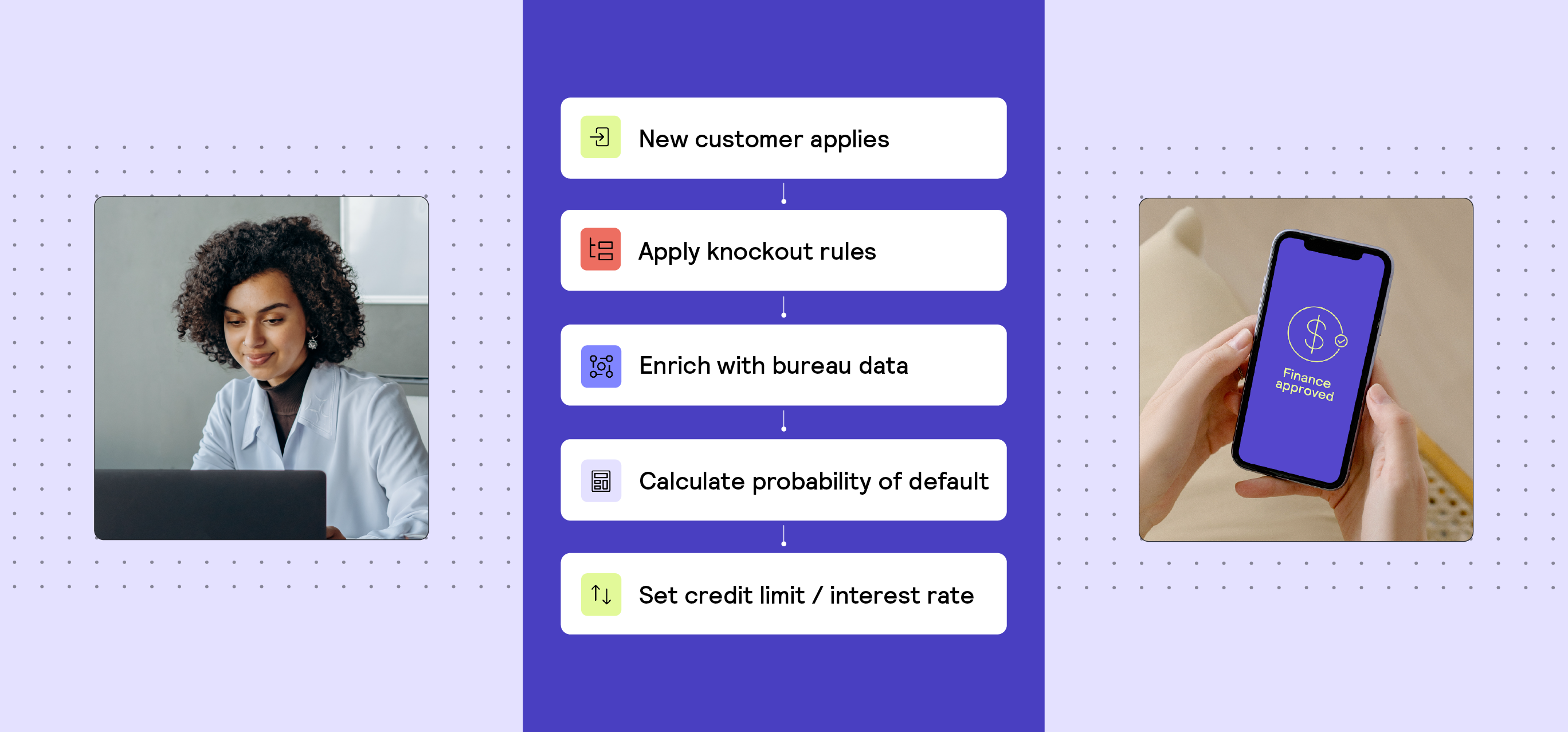

Taktile is an AI Decision Platform that helps financial institutions automate and improve their risk management strategies across the entire customer lifecycle. From onboarding and credit underwriting to fraud detection and transaction monitoring, Taktile empowers risk teams to build, test, and optimize their critical decision processes, without relying on engineers.

Taktile has been recognized as category leader - for four quarters in a row - in G2’s Quarterly Report for Decision Management Platforms, and is trusted by leading fintechs, banks, and insurers across the globe. The company is headquartered in New York City and has offices in Berlin and London.