Product 3 min read

Taktile unveils fully customizable data architecture for entities, events, and features

In today's digital landscape, fraud tactics have evolved beyond the capabilities of traditional prevention systems. Static identity verification techniques and rule-based fraud detection no longer protect businesses against sophisticated attacks. With nearly 2.5 million synthetic identities currently hiding in US bank accounts and recent advances in Generative AI, there is an urgent need for financial institutions to transform how they detect and prevent fraud across the customer lifecycle.

To help teams combat fraud with greater speed and precision, today, Taktile has announced a major release that redefines the approach to fraud prevention. Our platform now combines every data point from every system and every team along the various use cases of the customer lifecycle. This enables risk teams to detect sophisticated fraud patterns in real-time by connecting insights that were previously siloed. Teams can monitor any type of customer interaction, from address changes to login attempts, and quickly implement countermeasures without engineering dependencies.

Key takeaways

- Taktile’s new customizable data architecture unifies entities, events, and features, enabling teams to track any relationship, activity, or behavior relevant to fraud.

- Custom events expand fraud detection beyond transactions, letting teams monitor logins, address changes, and other signals in real time.

- Custom features turn raw data into actionable fraud patterns, reducing reliance on generic scores and enabling faster adaptation to new threats.

- The Customer 360 view connects every data point across the lifecycle, giving risk teams visibility into fraud attempts that would be invisible in isolation.

- Early adopters like Cobre and Finom report faster execution, lower costs, and stronger protection, all without heavy engineering dependencies.

Why traditional fraud prevention approaches fall short

Financial institutions have traditionally approached fraud prevention by using separate vertical SaaS solutions for different stages of the customer lifecycle - one system for onboarding, another for transaction monitoring, and yet another for account changes. While each solution excels at its specific function, this fragmented approach has created significant data silos, preventing teams from seeing the complete picture of customer behavior and risk signals.

This newest release addresses two critical problems that risk teams face:

- Fraud patterns go unnoticed

When fraud signals are spread across multiple disconnected systems, crucial patterns go unnoticed. For example, suspicious transaction patterns might not be connected with recent changes in login behavior or account details, leaving teams blind to sophisticated fraud attempts that span multiple touchpoints. - Missed opportunities for optimization

Risk teams need to leverage insights from across all customer interactions to make informed decisions. Without the ability to connect data from onboarding, transaction monitoring, and account management systems, teams can't effectively answer crucial questions such as "Are we missing fraud signals by evaluating each interaction in isolation?" or "How can we better predict risk by understanding the complete customer journey?".

Beyond traditional fraud prevention

This release fundamentally changes how financial institutions approach fraud prevention. Instead of making decisions based on partial information, risk teams can:

- Combine insights from every system and team to detect sophisticated fraud patterns

- Connect patterns across the entire customer lifecycle to prevent account takeover attempts

- Create comprehensive fraud detection strategies without engineering dependencies

- Continuously optimize detection accuracy through powerful testing and experimentation capabilities

- The platform enables teams to block more fraud while reducing false positives, creating a balanced approach that protects both the business and the customer experience.

Real-time pattern detection across use cases, teams and systems

This release introduces three key innovations on Taktile’s platform:

- Custom entities

Financial institutions can now model their exact risk assessment needs instead of relying on generic solutions. This flexibility allows teams to track and connect any type of relationship relevant to fraud detection. For example, a payment provider can monitor connections between merchants, sub-merchants, and payment facilitators to identify coordinated fraud rings. - Custom events

Every customer interaction becomes an opportunity for fraud detection. Teams can monitor and evaluate any type of activity in real-time, not just transactions. When a customer changes their shipping address, the platform automatically evaluates this against their device location, recent login patterns, and transaction history to prevent account takeover attempts. - Custom features

Risk teams can transform raw data into sophisticated fraud detection patterns without relying solely on pre-packaged insights. Instead of purely relying on aggregated fraud scores from point solutions, teams can now create custom aggregations from various data sources. This enables quick response to new fraud tactics while maintaining operational efficiency.

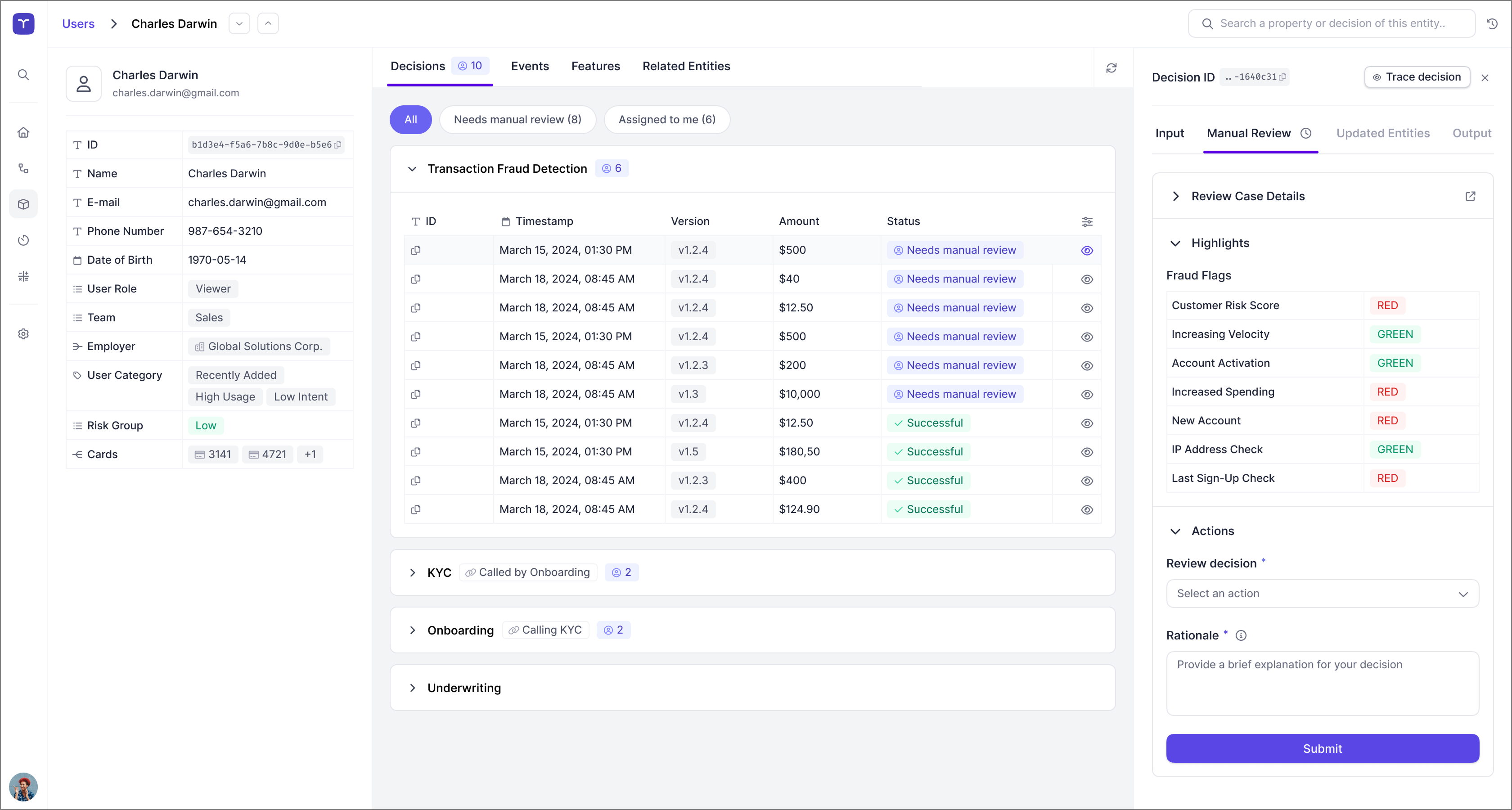

Insights from connected data points across the customer lifecycle

Risk teams can instantly see how a customer's profile, related accounts, and behavioral patterns connect across systems. This unified view enables teams to detect sophisticated fraud attempts that would be invisible when looking at each interaction in isolation.

What makes this approach transformative is its ability to break down traditional data silos. Each new customer interaction is automatically enriched with relevant historical data and behavioral patterns. Risk teams can finally move beyond fragmented assessments to evaluate comprehensive patterns that span systems, teams, and use cases.

Real impact for risk teams

For companies managing rapid growth, the ability to unify decision processes across teams while maintaining strong fraud prevention is crucial. Cobre's experience demonstrates how combining data across systems enables stronger protection:

"Taktile's platform is a core part of our infrastructure because it allows us to unify and streamline decision processes at Cobre, which we will ultimately scale across teams, departments, and use cases. The platform has enabled us to quickly build and iterate on critical transaction monitoring and low-latency real-time decision flows, helping us build an even more robust shield that protects us, our clients, and our financial institution partners."

The impact on operational efficiency is particularly notable for risk and compliance teams who previously relied on engineering resources for strategy updates. Finom's experience shows how non-technical teams can now own and optimize their fraud prevention strategy:

"Taktile has empowered me to own strategy and accelerate execution of Transaction Monitoring decision-making at Finom, without the latency and resource burden previously required from technical resources. It is simple to own, update and deploy iterations to our logic, and I heavily utilize the AI Co-Pilot for writing and debugging logic. The platform has allowed me to optimize for effectiveness and accuracy while detecting and preventing fraud, resulting in lower alert volumes without impacting the experience of our genuine customers."

See it in action

Want to see how our enhanced platform can help your team leverage every available data point for fraud prevention?