Discover Taktile

Turn onboarding complexity into

compliant AI workflows.

Use agentic AI to automate identity and business checks end-to-end — with human-in-the-loop controls that keep your teams fully in charge.

Trusted by leading financial institutions worldwide.

Build, test, and deploy onboarding

strategies on one holistic platform.

Design and operationalize your entire onboarding workflow in one workspace, combining KYC/B data, agentic AI, human-in-the-loop reviews, and granular governance controls to run compliant automation at scale.

A single command center where AI does the heavy lifting and your team stays in control.

Consolidate data, workflows, and review queues in one place.

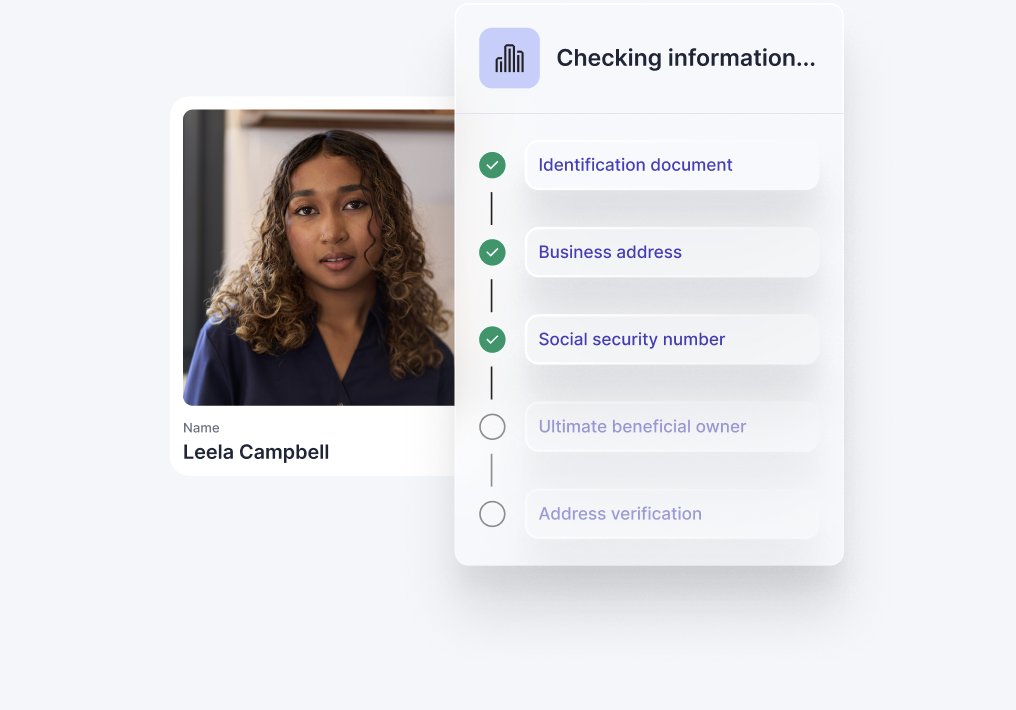

Use agentic AI to drive faster, more accurate verification.

Maintain expert oversight with transparent, auditable decisions.

Global financial services organizations stop fraud faster on Taktile.

Agentic AI that unifies and accelerates

your entire onboarding workflow.

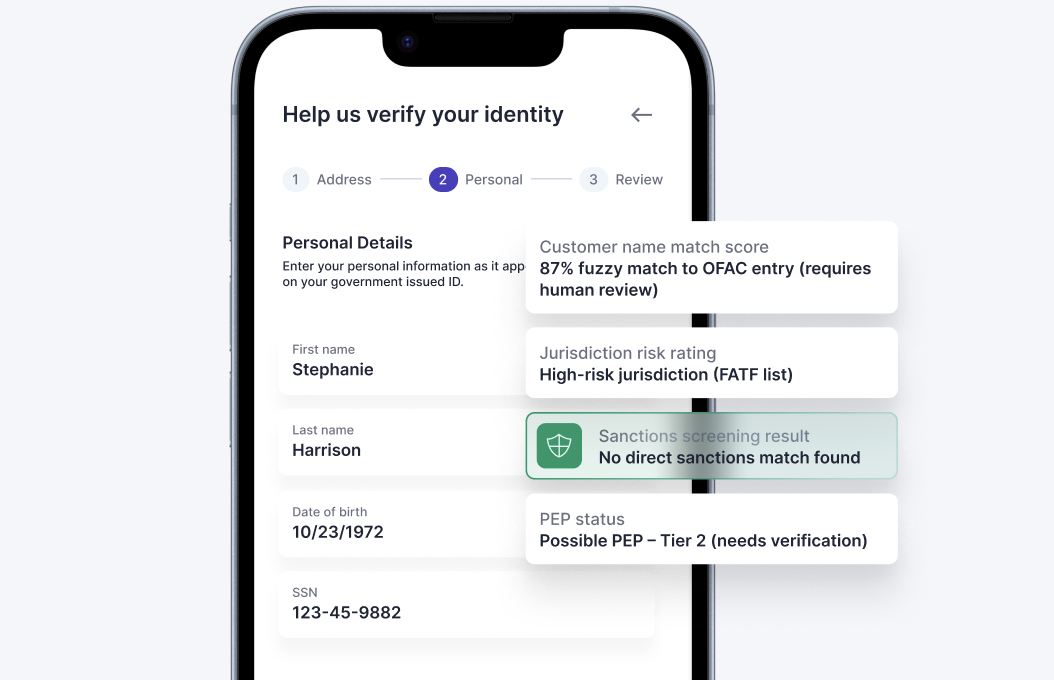

Automate high-volume verification tasks, surface hidden risks faster, and guide reviewers through complex cases, all within a secure, compliant onboarding platform.

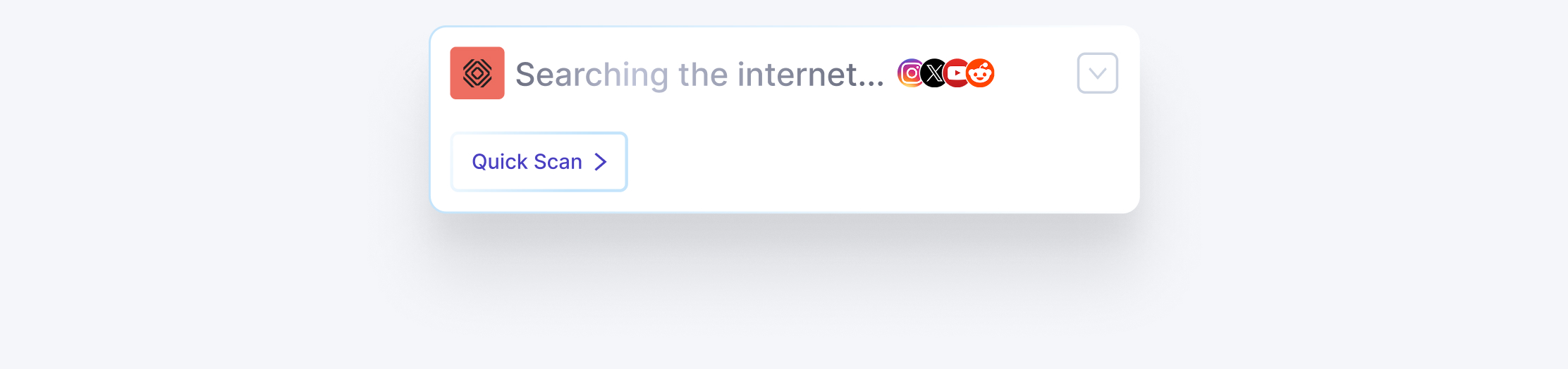

Scans global sources for negative news, highlights relevant risks by severity, and delivers concise summaries to accelerate enhanced due diligence.

Retrieves registry data, ownership details, and business documents automatically — converting raw records into structured compliance insights with minimal manual effort.

Screens entities against global sanctions lists and watchlists using intelligent fuzzy matching to reduce false positives and maintain regulatory accuracy.

Instant access to the data that powers

frictionless onboarding and safer decisions.

Tap into pre-integrated KYC/B, fraud, and AML data sources through Taktile’s Data Marketplace.

Discover the latest insights on AI-driven fraud prevention.

See why financial services organizations trust Taktile to transform their businesses with unmatched safety and control.

Discover Taktile