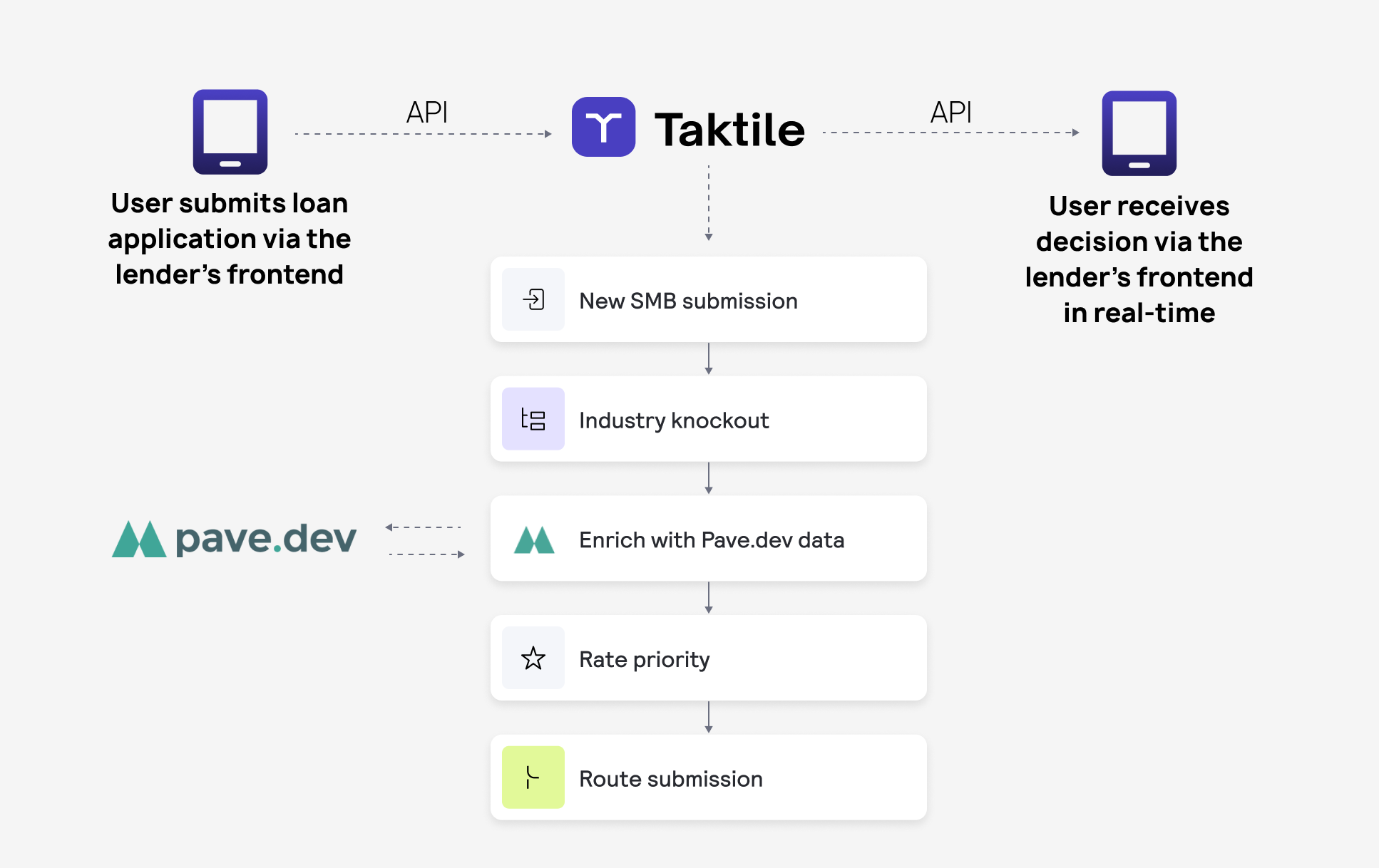

As many small business lenders struggle with manual processing work this new partnership will empower them to automate and optimize their financial decisions. Pave.dev’s AI-powered cashflow analytics and scores enable consumer and SMB lenders to drive lift in credit risk models - now fully integrated into Taktile’s next-generation decision platform.

As Maik Taro Wehmeyer, Co-Founder & CEO at Taktile, explains, “Pave.dev’s cashflow analytics combined with Taktile’s credit decision capabilities create a powerful synergy. Together, we can provide lenders with the tools they need to reduce manual processing work and increase their decision performance.”

Ema Rouf, co-founder of Pave.dev, shares her enthusiasm about the collaboration: “Taktile’s innovative solutions and focus areas align perfectly with our mission to provide superior cashflow analytics for business lenders.”

Key benefits of this integration include:

- Reduced manual processing

- Advanced underwriting capabilities

- Simple yet powerful workflows

- Seamless data integration

Using Pave.dev’s cashflow-driven attributes and scores

Pave.dev’s cashflow-driven attributes and scores assess the likelihood of a borrower repaying a loan based on their cashflow data.

By incorporating real-time cashflow analytics into their decision-making processes via the Taktile/Pave integration, lenders can make more accurate credit decisions, all while freeing up resources and making operations more efficient.

In partnership, Pave and Taktile will be working with innovative SMB lenders and financial institutions looking to adopt cashflow analytics to increase access to underserved businesses.

As Ema Rouf notes, “Our strategy will focus on SMB lenders who are eager to adopt advanced analytics for better financial insights. This collaboration with Taktile will help us deliver even greater value to our customers.”