AI, Data 5 min read

Tecton x Taktile: Unlocking faster risk modeling with rapid feature and logic deployment

High stakes decisions are central to success in today’s evolving fraud and credit landscape. Whether it’s underwriting new customers or preventing account takeovers, risk practitioners require real-time, accurate, and scalable decision-making systems.

However, this is easier said than done—especially when faced with challenges such as high volumes of data, tight latency requirements, or slow iteration on decision strategies before deployment.

In this article, we dive deep into how credit, fraud, and compliance teams can build a complete risk decision stack by combining Tecton’s feature platform with Taktile’s decision platform to accelerate feature development, improve model accuracy, and empower both technical and non-technical individuals to make high-stakes decisions with confidence.

Key takeaways

- We have teamed up with Tecton to streamline how risk teams build, test, and deploy real-time decision workflows.

- The integration empowers teams to launch new strategies faster by combining Tecton’s production-grade features with Taktile’s low-code decision logic.

- Risk practitioners can significantly reduce engineering overhead while increasing model accuracy and operational agility.

- This joint solution is built for scale—enabling both technical and non-technical users to make decisions with confidence across credit, fraud, and compliance use cases.

Introducing: A rapid deployment framework for features and logic

Building and optimizing feature-rich decision logic, no matter the risk use case, has long been a cumbersome process for credit, fraud, and compliance teams. Often, the heavy time and resources required to do so are due to the limitations of an organization's systems and infrastructure that hold back risk and fraud practitioners from moving quickly.

Ingesting and processing large data volumes across multiple data sources, testing features, and safely deploying logic can consume hundreds of engineering hours – significantly slowing the launch of new products or optimization of existing use cases, across credit underwriting, onboarding, and fraud prevention.

This is why Taktile and Tecton have teamed up to empower practitioners across financial services organizations to rapidly build and deploy real-time, accurate, and scalable risk decisions across every use case.

By leveraging Taktile’s low-code/no-code decision platform to rapidly build and deploy logic alongside Tecton’s rapid feature development framework, risk practitioners are able to:

- Lower operational costs: Reduce the engineering resources needed to build and maintain risk systems.

- Reduce fraud losses: More accurate, real-time risk detection leads to fewer successful fraud attempts.

- Decrease false positives: Better feature engineering and decision logic reduce legitimate transaction rejections.

- Adapt to changing patterns: Deploy new fraud detection strategies in weeks instead of months with faster time-to-market and future-proof architecture.

- Improve customer experience: Make accurate decisions in milliseconds without adding friction

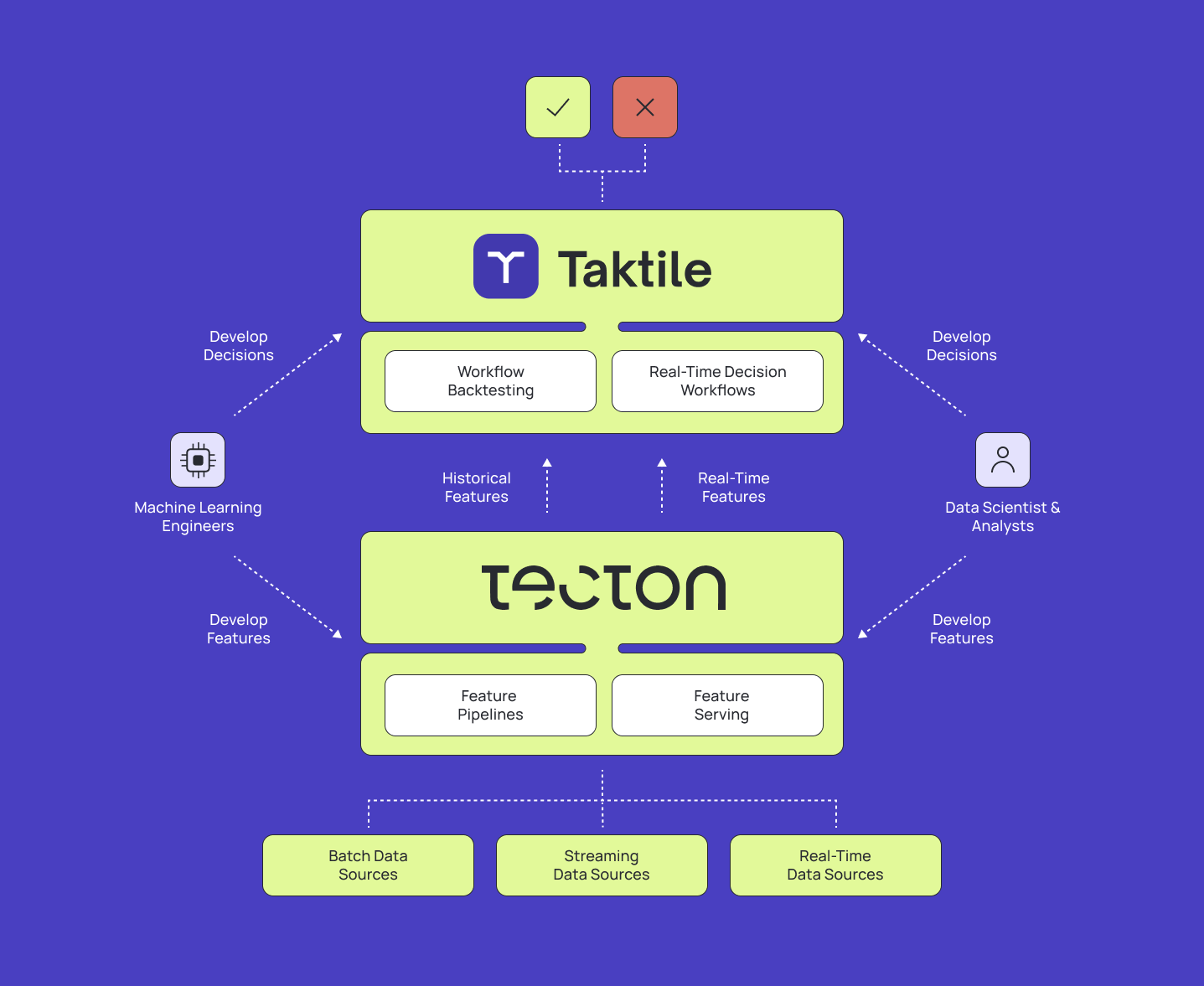

How Taktile and Tecton’s features work together to deliver maximum impact to risk teams

When used in tandem, Taktile and Tecton deliver speed, agility, and accuracy in risk decisions. Risk teams can harness their combined strengths to drive better outcomes across every use case with:

Seamless feature-to-decision pipeline

Tecton enables users to transform raw streaming or batch data at any scale into production-grade features, and these features can be served directly into decision logic on Taktile. This setup enables low-latency, real-time decisions—and historical feature recall for reliable backtesting.

Faster development cycles for decision logic

Speed is critical in risk. By combining reusable features from Tecton with Taktile’s decision logic, teams can iterate on decision strategies in days instead of months—without depending on engineers for every change.

Enhance decision quality with richer features and higher model performance

Tecton delivers complex features that improve model accuracy and eliminate training-serving skew. Taktile’s backtesting and champion/challenger testing validate performance before going live—ensuring decisions are high quality from day one.

Scale confidently with enterprise-grade tools

Both platforms are built for scale. Tecton brings feature versioning, governance, and security; Taktile adds decision logic controls, explainability, and auditability—making the entire stack ready for regulated environments.

These benefits stem directly from the unique capabilities of each platform.

A closer look at how Tecton and Taktile enable speed and efficiency when building and optimizing decision logic

Unlocking rapid feature development with Tecton

Tecton is the feature platform that transforms raw data into real-time, production-ready signals for machine learning. On a more granular level, Tecton shines in feature engineering, training data generation, and real-time serving:

- Rapid development iterations: Python-native workflows and reusable definitions speed up production.

- Consistent online/offline serving: Avoid costly skew with standardized feature creation.

- Scalable real-time calculations and streaming aggregations: Calculate features from payment or fraud signals in milliseconds using streaming data.

- High-scale, low-latency online serving: Serve features fast—even under extreme workloads.

Building and deploying logic with confidence with Taktile’s modular, low-code/no-code platform

Taktile empowers risk practitioners to build, test, and optimize automated risk strategies across the entire customer lifecycle with AI-driven insights and real-time data. For non-technical teams, Taktile makes decision-making more agile, transparent, and user-friendly:

- Low-code/no-code decision logic: Build and manage complex decision workflows without engineering resources.

- Workflow backtesting: Test new decision strategies against historical data before deployment.

- Real-time decision-making: Execute decision workflows in real-time with millisecond latency.

- Champion/Challenger testing: Deploy multiple models and rules simultaneously to find optimal strategies.

- Compliance and explainability: Generate decision explanations and audit trails automatically.

- Business user empowerment: Enable risk managers to implement and adjust decision strategies without IT involvement.

While Tecton’s robust data processing and Taktile’s powerful decision automation each offer significant value on their own, it’s their synergy that truly drives impactful results.

Leveraging the Taktile + Tecton integration to accelerate risk decision operations—in the real world

Whether testing a strategy or making a live decision, Taktile and Tecton deliver flexibility at every stage:

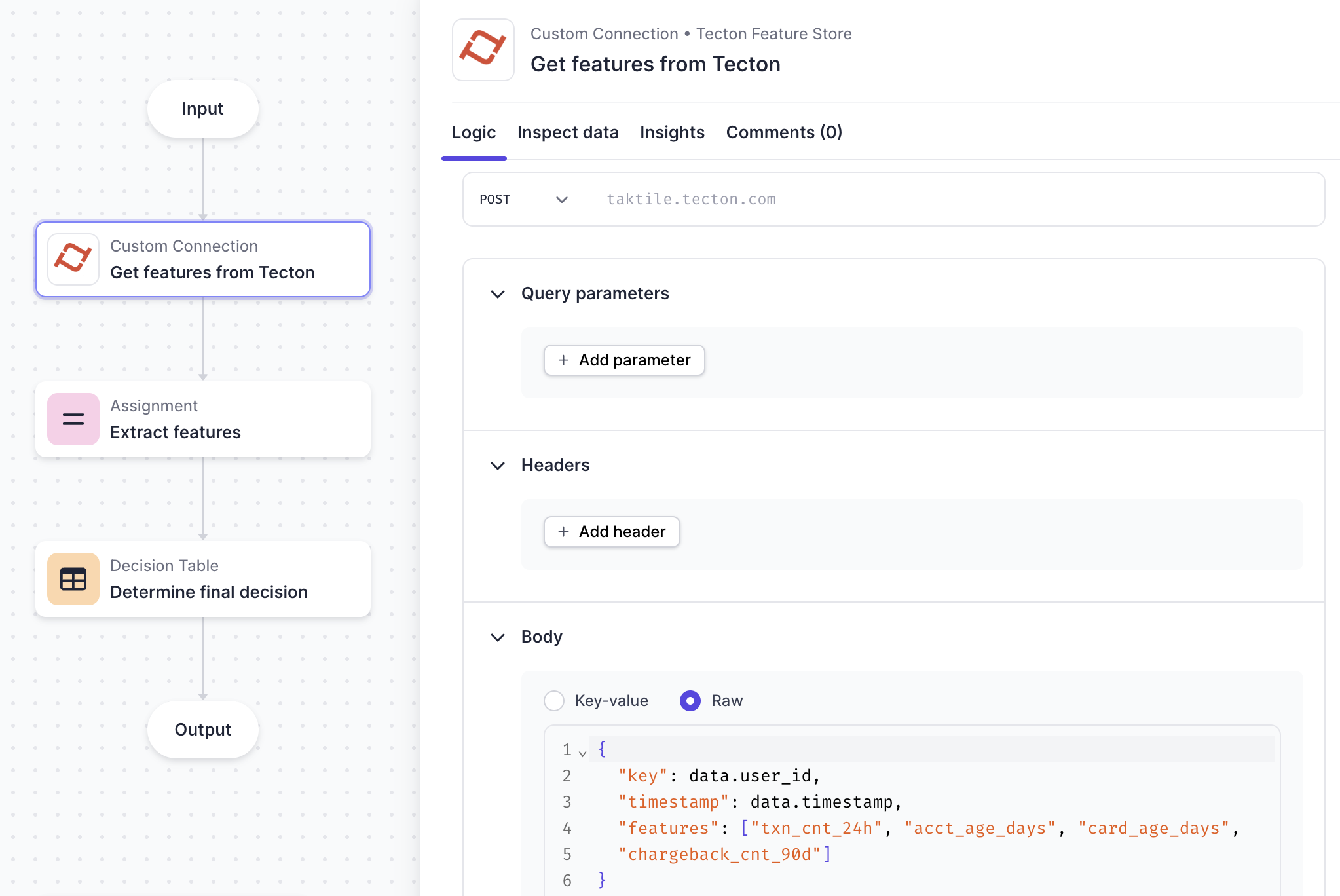

- Enabling real-time decision-making in production: In production, when Taktile receives a decision request, such as a credit limit increase, it can reach out to Tecton to enrich the data with features, before running the decisions and getting back to the client.

- Testing a decision workflow before production: When running a backtest, users have the option to upload historical data, which can be enriched with valuable features from Tecton.

Example use case: Curate an enriched historical dataset to test a decision workflow

What if you’re testing a new decision workflow, and you want to answer a question like, "What would this underwriting workflow's decision have been for User X and credit line increase Y?"

In Taktile, you can upload a historical dataset that tells Taktile what a decision workflow's node's input data would have been for a given entity; for instance, a credit report for User X. Then, enhance the dataset with features from Tecton to give you a richer view of User X. Here is how the process might look:

- Create a "historical dataset" on Taktile that includes user IDs and timestamps

- Download historical dataset to CSV

- Join additional feature data from Tecton to the CSV, enriching the dataset with advanced, point-in-time correct features, such as "trailing 30min transaction-sum on credit card X at point in time t.”

- Re-upload the CSV to Taktile. The historical feature data will be used to mock the Tecton API response in testing, thereby overwriting the original Tecton API response.

- When you’re happy with the dataset, you can update the Tecton node to include the new features and do some integration testing in Taktile.

- Move the flow to production!

Tecton integrates as a node in the Taktile logic using Tecton’s Universal API connector. To add Tecton features, you specify the key (user_id), feature set and version of the feature. For more information about the integration and how to use Taktile and Tecton together, reach out to our team!

Supercharge your risk strategies with Taktile and Tecton

With fintech transforming at breakneck speed, staying ahead of risk requires more than just data—it demands the right infrastructure. By combining Taktile’s decision platform with Tecton’s powerful feature platform, companies can create a modern risk stack that not only adapts to emerging threats but also fuels smarter, faster growth. Together, these tools empower teams to make high-quality decisions at scale—turning risk into a competitive advantage.