Company 5 min read

Five quarters running: Taktile named Category Leader in G2’s Fall 2025 Report

For the fifth quarter in a row, Taktile has been named a Category Leader in G2’s Fall 2025 Report for Decision Management Platforms – an achievement powered by the voices of our customers.

This consistency underscores more than just positive reviews. It reflects a growing shift in financial services: risk teams are demanding decision platforms that combine automation, self-service, and agility to adapt faster than ever before. At Taktile, we’re proud to be the partner enabling that transformation with our AI Decision Platform.

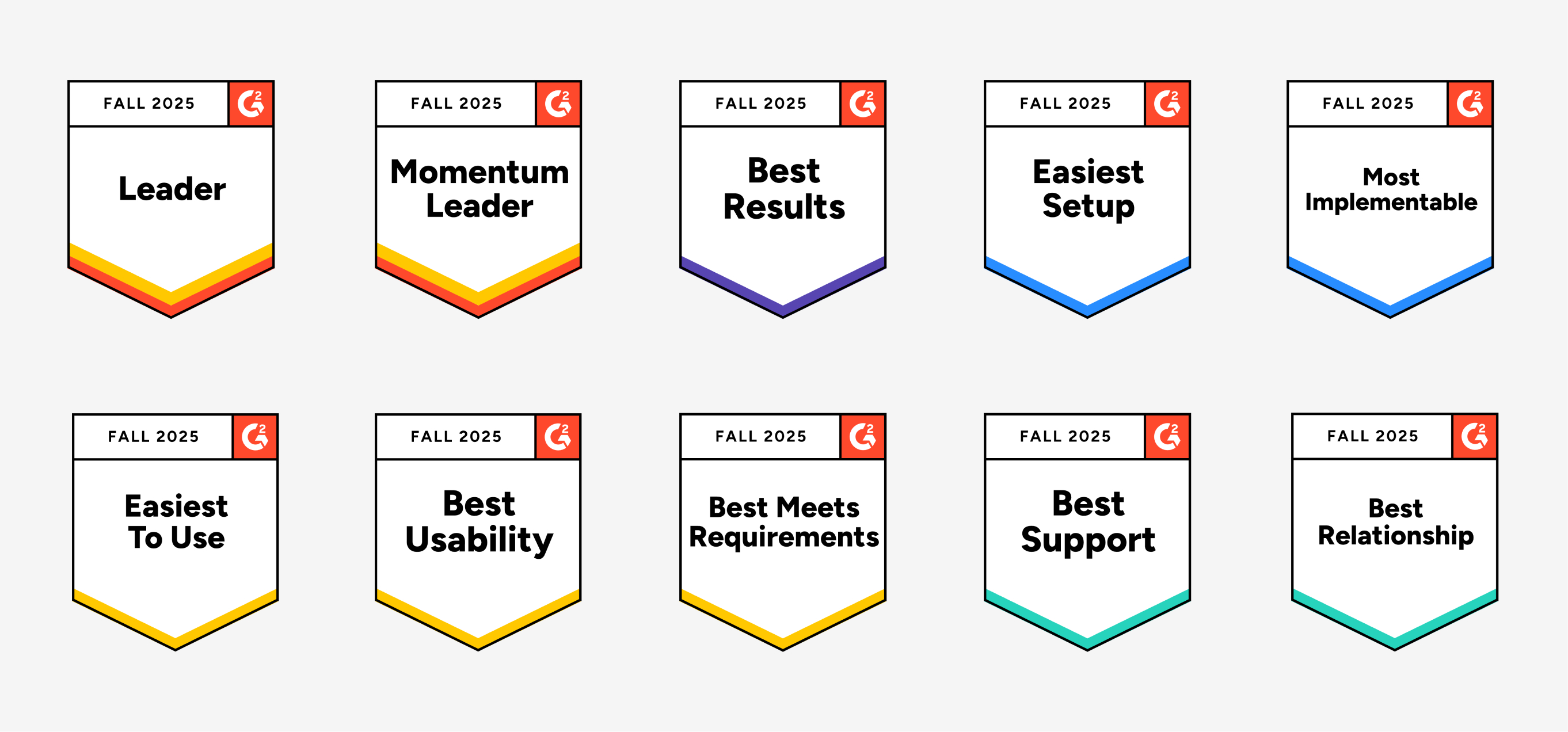

Taktile’s Fall 2025 Badges

We're honored to have earned top rankings across 10 categories, highlighting the tangible business impact our customers achieve with Taktile:

- Category Leader: Rated highly by users for Satisfaction and Market Presence.

- Momentum Leader: Ranked among the top 25% of decision management platforms.

- Best Results: Driving measurable outcomes that matter to our customers.

- Easiest Setup: Leading in ease of setup, ensuring a fast start for new teams.

- Most Implementable: #1 in Implementation for our seamless onboarding process.

- Easiest to Use: The most user-friendly platform in the category.

- Best Usability: Simplifying complex decisions with intuitive tools.

- Best Meets Requirements: Delivering exactly what risk teams need to excel.

- Best Support: Delivering world-class guidance to help teams succeed.

- Best Relationship: Top-rated for building lasting, trusted customer partnerships.

These accolades are a testament to the collaboration between our product, engineering, and customer success teams – and most importantly, the forward-thinking financial institutions we serve.

As Maik Taro Wehmeyer, CEO and Co-Founder of Taktile, says:

“Sustained recognition from G2 highlights the trust our customers place in Taktile. Together, we’re building the decision infrastructure that risk teams need to operate with speed, confidence, and impact.”

What do G2 users say about Taktile’s Decision Platform?

Nothing speaks louder than the voices of our customers. Here’s how G2 users describe the impact of Taktile on their risk decision strategies:

Developed loan decision flows with ease and confidence

“The Taktile platform is intuitive. All workflows are visible and easily trackable, making it simple for different managers to understand, change, and oversee operations. Additionally, the system allows for rapid deployment of code changes. For example, if a faulty code release occurs, it only takes a few seconds to revert to a previous version. This makes it easier for non-technical users to understand and modify credit decision logic.”

Powerful and configurable credit decisions in a user-friendly, low-code environment

“Taktile enriches our credit applications via connections with our credit bureau partner, as well as automates regulatory screening via our third-party service providers. We are also working with Taktile to ingest financial applications from our borrowers to move toward fully automated credit decision flows. Using Taktile has made credit underwriting faster and more efficient for our business, with much more room to grow as we continue to leverage the functionalities that Taktile makes available to their users.”

Intuitive platform that requires little technical aptitude

“We are using Taktile for assigning risk and AML scores to customers. The platform is fairly intuitive to use, and the AI features really help with errors when you are stuck. The integration with our CRM (Salesforce) has been straightforward and has not required a lot of engineering resources on our side. My team uses Taktile daily!”

Outstanding implementation experience!

“Taktile is a very flexible decision engine that can be tailored to any user’s needs, but the shining stars at Taktile are the people. My implementation team was one of the best I've worked with in my very long career. I would recommend Taktile a million times over – they are proof that creating a good product and having the best people to support it are a winning combination.”

Want to see more? Explore Taktile’s G2 reviews and discover why we’re the trusted Decision Platform for leading risk teams.