AI 5 min read

Introducing Taktile AI agents: The future of SMB credit underwriting

Credit underwriting teams are under pressure like never before. Demand for SMB loans continues to climb, yet manual reviews, scattered data, and backlogged applications mean that good businesses wait weeks for loan decisions – or get turned away altogether.

AI has the potential to transform this process, but most initiatives today stall as experiments or force lenders into rigid, one-size-fits-all models. What underwriters really need isn’t just efficiency – it’s a way to make faster, fairer, and more consistent credit decisions at scale, without losing human oversight.

That’s exactly what Taktile’s customizable AI agents deliver: a dedicated digital workforce that works alongside underwriters, supercharging their capacity while ensuring every decision is standardized, transparent, and regulator-ready.

Key benefits of Taktile AI agents for SMB lenders

- Scalable capacity: Process up to 5x more loans with the same team, eliminating backlogs and meeting demand head-on.

- Customizable blueprints: Avoid one-size-fits-all tools — tailor each agent instantly to your underwriting strategy.

- Continuous optimization: Deploy updates in minutes without engineering support, accelerating ROI from day one.

- Controlled automation: Blend AI workflows with rules-based logic to keep humans in the loop where judgment matters most.

- Data at your fingertips: Extend capabilities via Taktile’s Data Marketplace, with instant access to best-in-class providers.

AI agents explained: How they work in credit underwriting

AI agents are autonomous systems that gather information, reason over it, and act – like digital teammates who handle the repetitive work that drains human focus. In credit underwriting, they’re especially powerful for tasks that must be both highly accurate and highly repeatable.

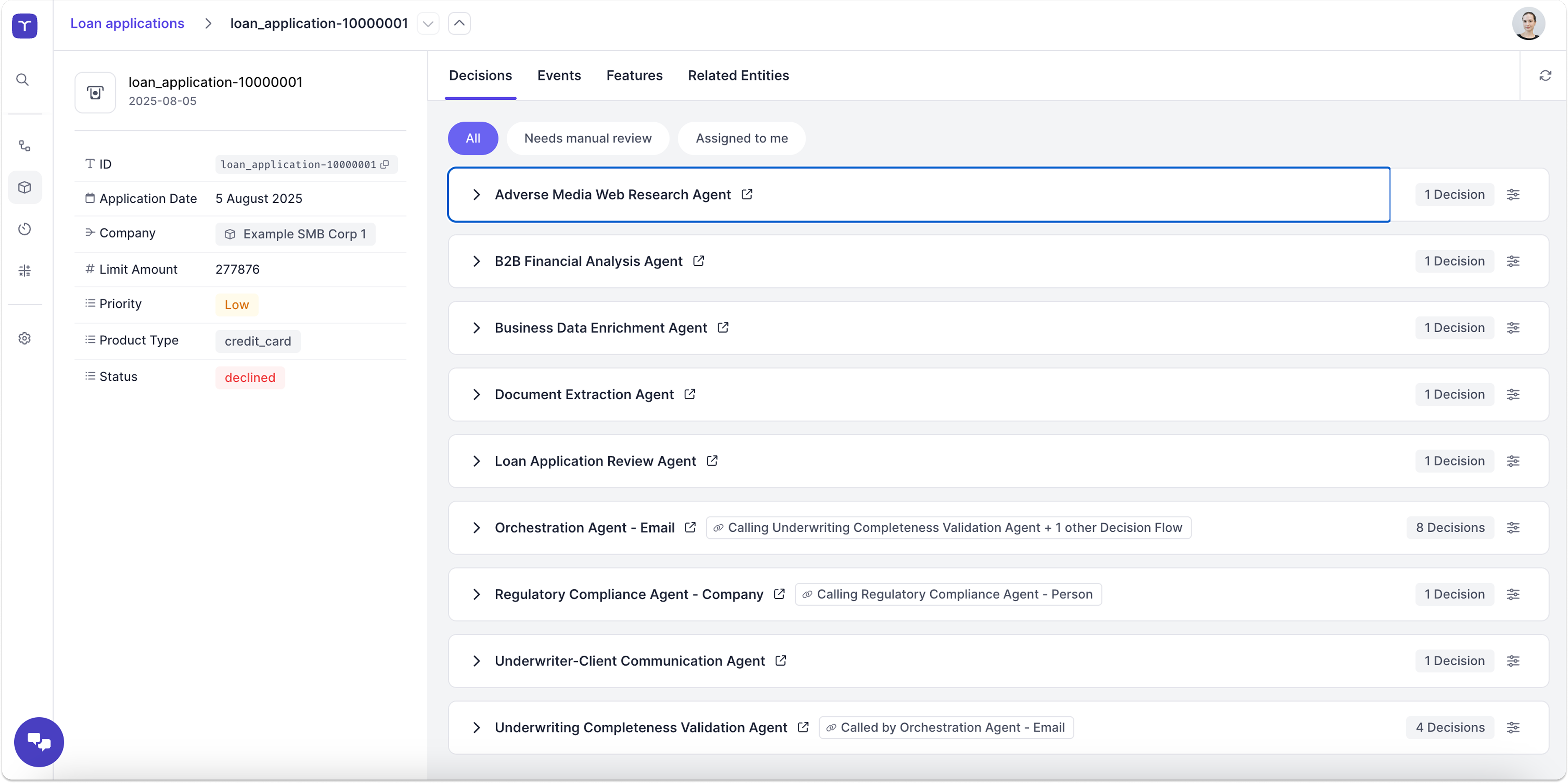

Taktile’s customizable AI agents bring this concept directly into financial services. Each one specializes in a core underwriting task, such as:

- Document parsing: Extracting data from PDFs and turning it into structured, decision-ready inputs.

- Web verification: Checking business websites, validating models, and flagging potential risks.

- Financial analysis: Reviewing statements, assessing risk, suggesting pricing, and generating summaries.

By running these agents in parallel, lenders can achieve both efficiency and precision: loan files that once sat idle for weeks can now be processed 5x faster – with standardized, regulator-ready accuracy built in.

Customizable blueprints: The Taktile advantage

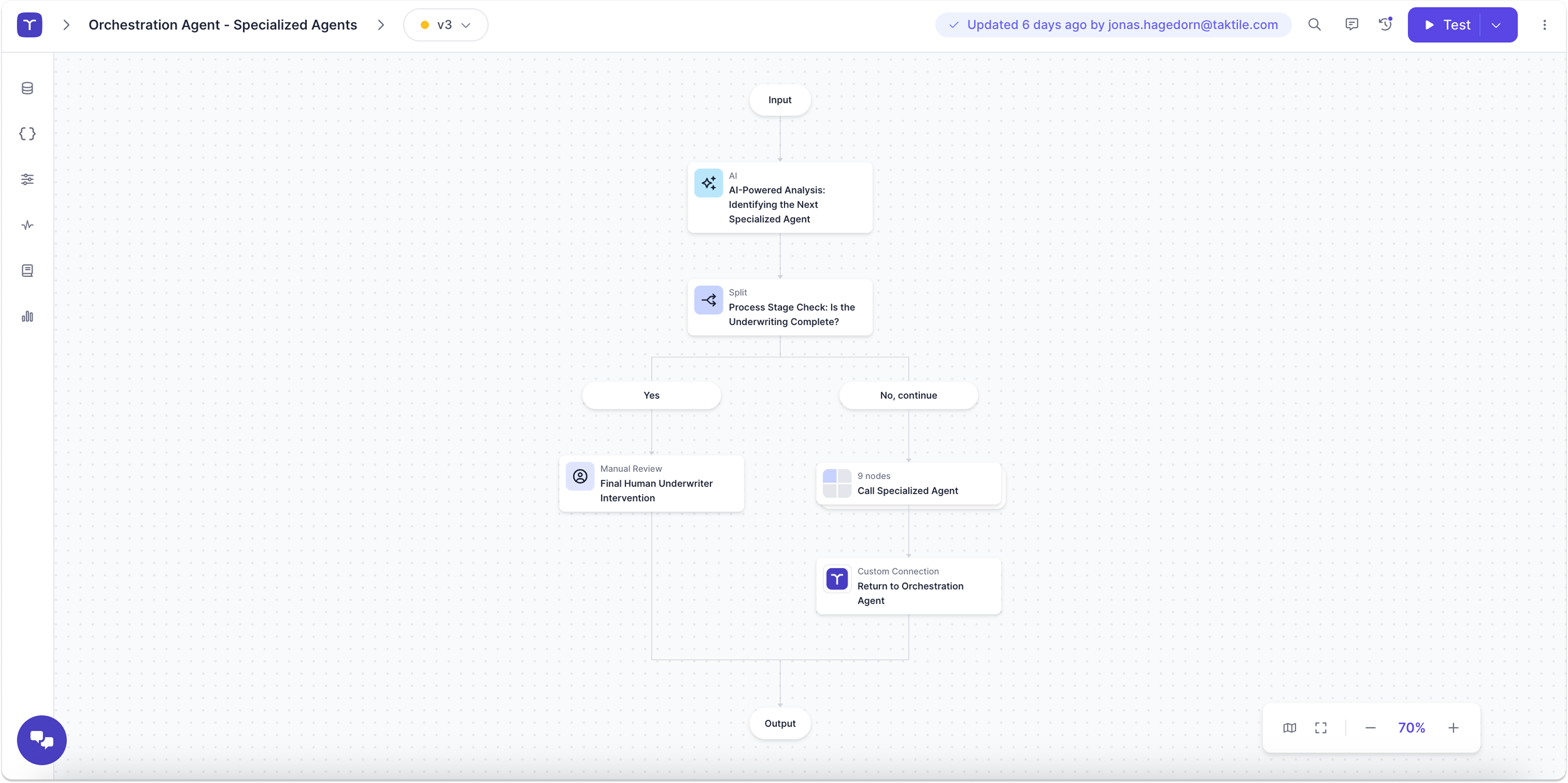

Most AI tools today get stuck as experiments in underwriting, but Taktile’s agents are different. They’re built as fully customizable blueprints that adapt instantly to your strategy.

- Need to add a new data source? Plug it in via Taktile’s Data Marketplace.

- Want to adjust underwriting logic? Test the change, see the impact instantly, and push it live without engineering support.

- Require human oversight? Blend AI workflows with rules-based steps and insert expert review where it matters most.

This isn’t AI in a sandbox. It’s AI in production, under your control, evolving as quickly as your business.

Scaling SMB lending capacity without extra headcount

For small business lenders, the impact is immediate and transformative:

- 5x more loans processed without hiring additional staff.

- Weeks to deploy, not months – accelerating time-to-value.

- Standardized and consistent assessments, reducing human error and bias.

- Transparency and control baked in, ensuring compliance and regulator confidence.

The result? Faster access to credit for SMBs, empowered underwriters freed from repetitive work, and growth that scales sustainably without scaling headcount.

The future of SMB credit underwriting: Automated and in your control

AI isn’t here to replace underwriters. It’s here to eliminate the bottlenecks that prevent them from doing their best work. With Taktile AI Agents, financial institutions can scale responsibly, maintain accuracy and oversight, and focus human expertise where it matters most: making strategic risk decisions.

This is the future of underwriting: automated, accurate, customizable — and entirely in your control.

Discover how to build your AI Agent workforce

AI agents in credit underwriting: Frequently Asked Questions (FAQs)

Q: What are AI agents in credit underwriting?

A: Taktile AI agents are customizable workflows that automate specific underwriting tasks like document parsing, financial analysis, and business verification. They act as a digital workforce alongside human underwriters.

Q: How do AI agents help SMB lending?

A: By automating repetitive reviews, AI agents enable lenders to process 5x more SMB loans without adding headcount, speeding up approvals and reducing bottlenecks.

Q: Can AI agents be customized for my institution’s underwriting strategy?

A: Yes. Each AI Agent is a fully customizable blueprint. Institutions can adapt them instantly, integrate third-party data sources via Taktile’s marketplace, and deploy changes live in minutes.

Q: How fast can AI agents be deployed in production?

A: Unlike typical AI pilots that stall in the experimentation stage, Taktile AI agents are production-ready and deployable in weeks, delivering immediate value without engineering support.