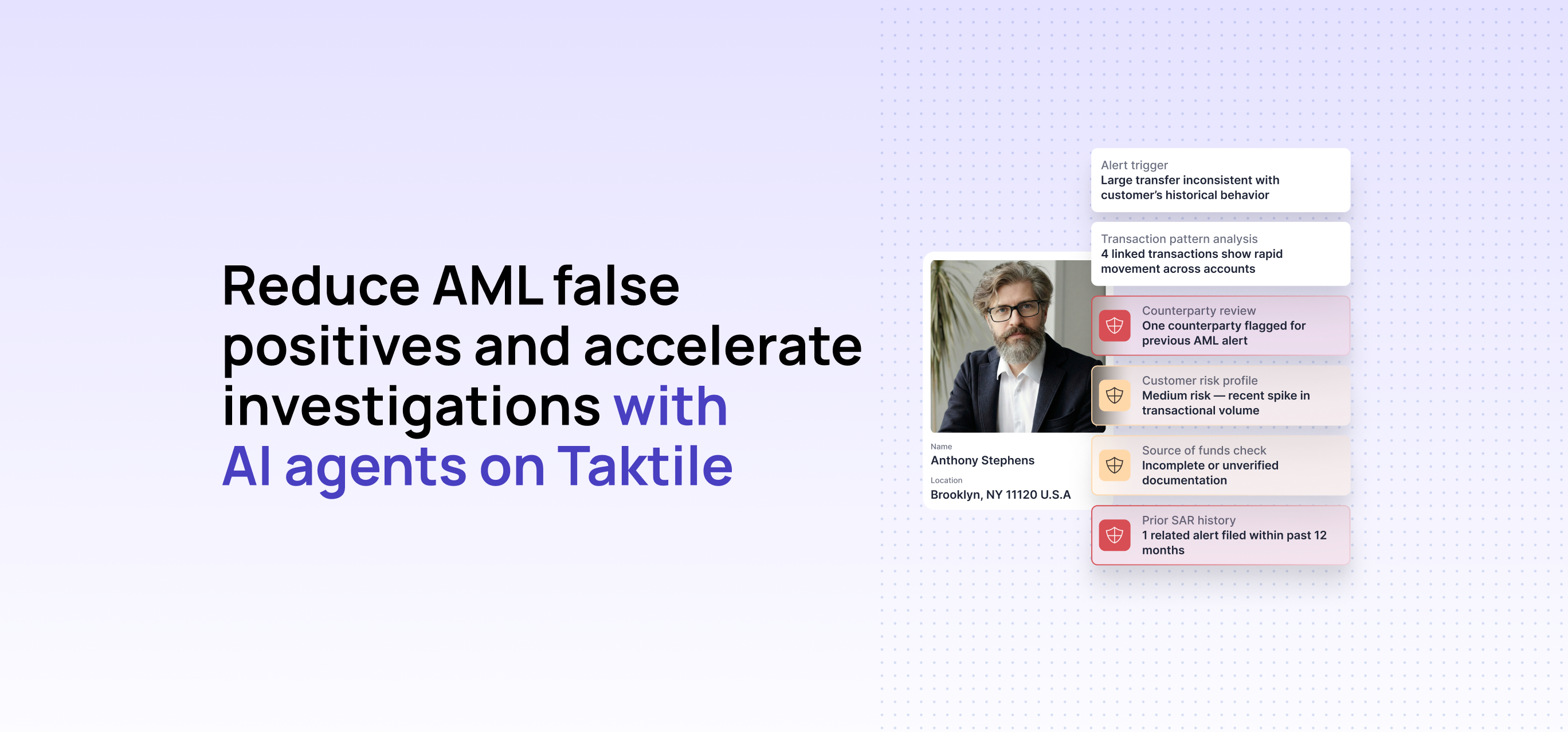

How teams use Taktile’s Agentic AML Solution to reduce false positives and streamline investigations

Discover how Taktile’s Agentic AML solution helps teams close cases faster while keeping every decision compliant and audit-ready.

From insight to intelligence

Explore Taktile's hands-on frameworks, operator stories, and practical AI insights for financial services.

Discover how Taktile’s Agentic AML solution helps teams close cases faster while keeping every decision compliant and audit-ready.

Ricardo Barbosa is Taktile’s latest Senior Account Executive in Brazil, helping financial institutions across LATAM transform their highest-stakes decisions with AI.

Financial services leader Yuliya Kazakevich breaks down AI for risk and compliance teams—and how to supercharge business and customer success with AI upskilling.

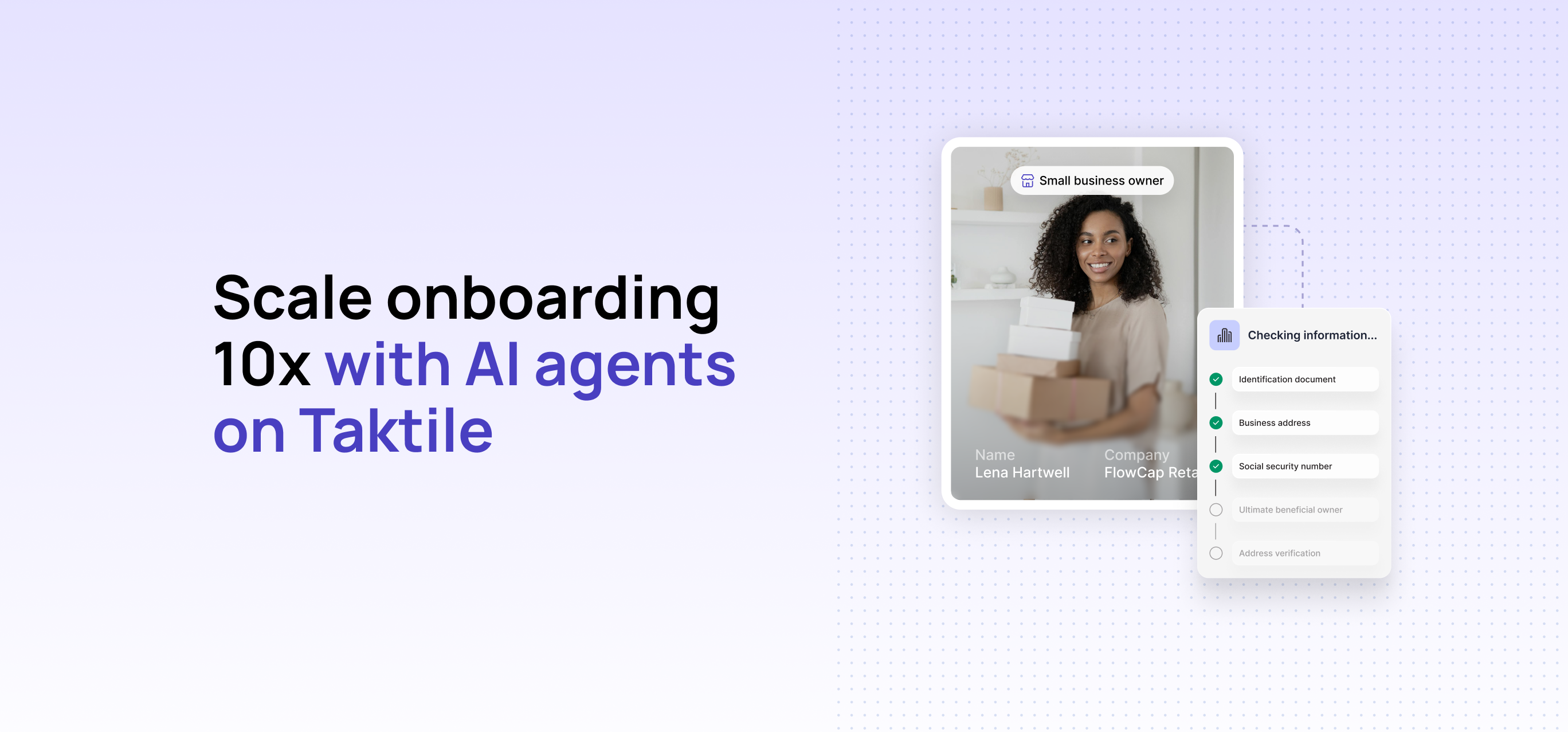

Leading banks and fintechs are scaling their onboarding capacity with Taktile's AI agents. Discover how it works.

Risk expert Alexandra Lynn Hollombe explains where AI is adding value in critical decision-making—and why risk management remains fundamentally human.

Dustin Eaton, Principal of Fraud & AML at Taktile, provides a step-by-step guide to implementing model risk management for AI-driven AML systems.

Learn how Finom cut false positives by 75% and accelerated rule updates by 99% with Taktile's Agentic Decision Platform, effectively staying ahead of financial crime.

Taktile’s Dustin Eaton explains why AML teams must now apply model risk management standards to AI systems and breaks down the regulation behind this new mandate.

In an interview with Taktile’s Maximilian Eber, Baishi Wu, Director of Product Management at Chime, shares how his team uses AI to power its credit strategy.

Taktile’s sixth consecutive G2 Category Leader badge comes as mid-market and enterprise banks accelerate adoption of the agentic decision platform.

Access OpenSanctions' screening, PEP, and watchlist data in Taktile to make faster, more confident compliance and fraud decisions for your business.

Taktile customers can now use Mifundo’s verified cross-border credit data to make faster and more consistent, compliant lending decisions for borrowers.

Rhino + Jetty cut manual claims work by 50% by embedding agentic AI through Taktile.

Discover Brazil’s Top 25 innovators of 2025: institutions reshaping financial services across fraud prevention, payroll lending, and embedded finance.

Discover how AML teams can build smarter transaction monitoring systems for stronger compliance, reduced false positives, faster prevention, and scalable protection.

Monzo’s Head of Product explains why risk isn’t a constraint but a core design principle in fintech. Practical insights for scalable, resilient product strategy.

After 50 years of fragmented AML tooling, financial institutions face an inflection point: moving from siloed point solutions to unified, horizontal decision-making.

Qwist Managing Director, Matt Colebourne, explores how open banking data fuels smarter, more inclusive finance.

Taktile welcomes Mario De Lecce as VP of Partnerships, Financial Institutions to grow relationships, deepen partner engagement, and drive joint GTM strategies.

Isaac reduced delinquencies by 11% with smarter collections—boosting revenue, cutting policy deployment time by 99%, and enabling rapid experimentation.

With this reseller partnership, Taktile customers can connect to Equifax data faster than ever and unlock data-driven growth at scale.

Camunda customers can now integrate Taktile to add advanced decision-making and automation across every stage of the customer lifecycle.

Taktile welcomes Sven Zeidler as Director of Finance to build scalable financial strategies, strengthen forecasting, and drive long-term growth.

Taktile and Prism Data partner to unlock real-time cash flow underwriting for lenders, leading to expanded credit access, higher approvals, and data-driven growth.

Taktile named a G2 Fall 2025 Category Leader for results, ease of use, and fast implementation, enabling risk teams in financial services to innovate with confidence.

Taktile welcomes Kiana Davari as VP of People to onboard exceptional talent and foster a culture of collaboration and growth.

Meet the future of SMB credit underwriting. Taktile's fully customizable AI Agents deliver scalable automation, customizable logic, and regulator-ready accuracy.

Taktile and MANTL partner to help banks and credit unions automate underwriting, drive loan growth, and increase operational efficiency with less technical support.

Former PayPal Chief Risk Officer, Jill Sheckman, shares how AI transforms risk from control to growth, enabling real-time underwriting and hyper-personalized banking.

Learn how the EU AI Act will reshape credit underwriting and insurance, and what risk leaders need to know to stay compliant and competitive.

Peter Tegelaar shares practical frameworks to move stalled AI pilots in fraud, credit, and AML into full production, tackling the challenges many teams face today.

Max sits down with Henrique Lopes, Head of AI at Nubank, to talk about what it really takes to put AI into production in a highly regulated environment.

From experimentation to regulation, Ai4 2025 revealed how businesses are navigating AI innovation, risk, and trust in financial services.

Share and explore forward-thinking ideas, exclusive insights, and industry opportunities worth knowing about with the launch of Taktile's community newsletter.

Taktile welcomes Dustin Eaton as Principal of Fraud & AML to help financial institutions build systems for compliance, growth, and scalable customer protection.

Taktile ranks #181 on the 2025 Inc. 5000 list of America’s fastest-growing companies, recognized for innovation and growth in fintech decision-making.

Meet the 2025 Top Voices in Risk - honoring risk leaders transforming financial services with AI, inclusive credit and next-gen risk strategies.

Discover how FairPlay and Taktile empower lenders to meet compliance and expand credit access through smart, inclusive decision-making.

Explore how Capchase scales its KYB strategy with speed and precision with Taktile's AI-powered Decision Platform.

Taktile recognized in G2’s Summer 2025 Report for excellence in results, ease of use, and implementation - equipping risk teams to innovate with speed and confidence.

Taktile is excited to welcome Greg Adamietz as Director of Sales.

Taktile has been recognized by the WEF as a member of its Global Innovators Community to collaborate with global technology leaders.

Know someone who’s shaping how we think about risk management? Nominate them for Top Voices in Risk ’25.

See how leading financial institutions are using GenAI to transform risk management across credit, fraud, compliance, and operations—with 10 real-world examples.

Accelerate real-time risk decisions by combining Tecton’s feature platform with Taktile’s low-code logic for faster, smarter credit and fraud outcomes.

Taktile is proud to announce the appointment of Alex Zieger as VP of Finance.

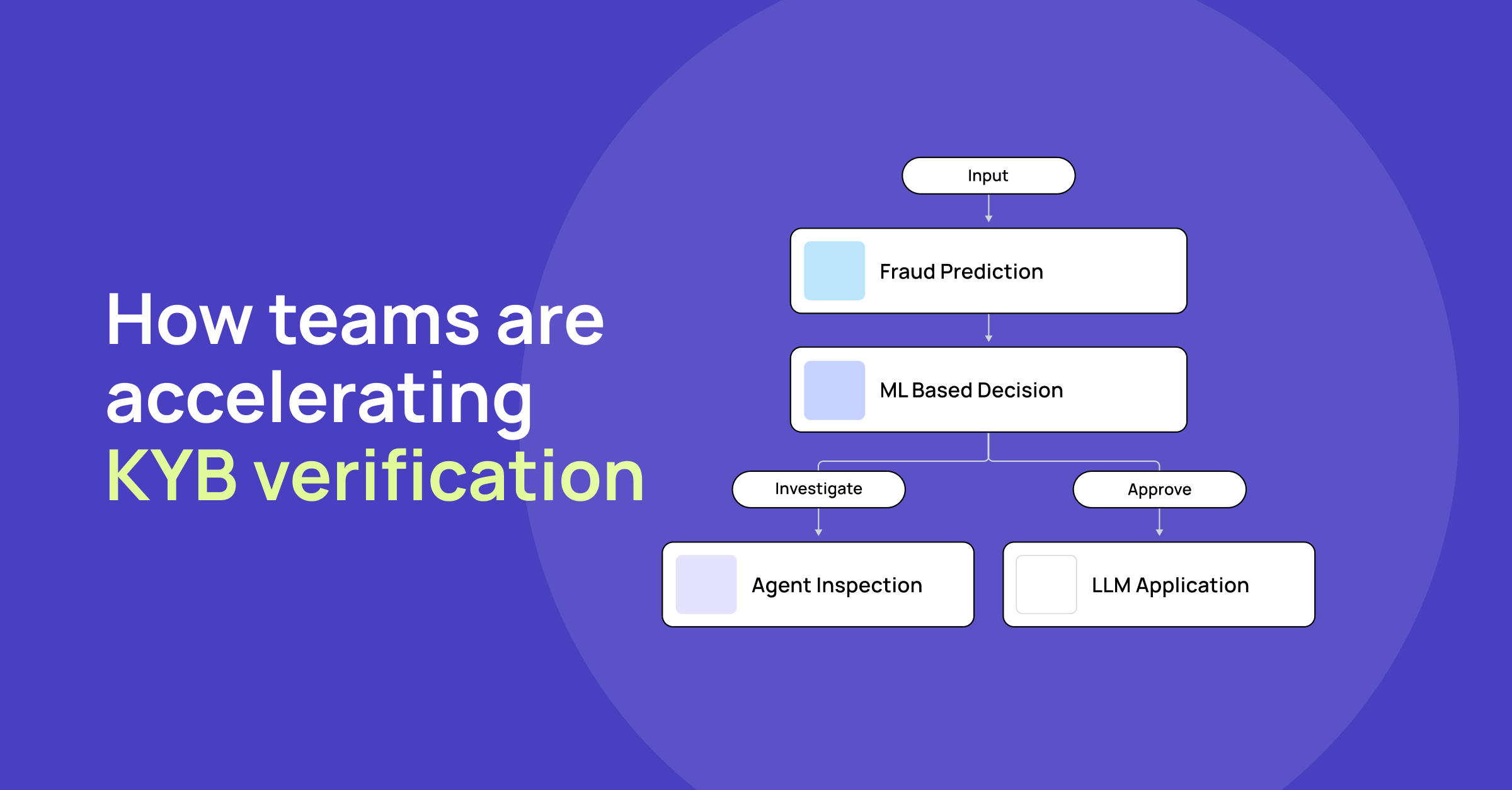

Learn how modern fintechs verify business identities fast—without sacrificing security or compliance.

Taktile earns top recognition in G2’s Spring 2025 Report, excelling in usability, implementation, and results—empowering teams to innovate and succeed.

Discover how Pleo undertakes smarter financial crime detection across the customer lifecycle on Taktile’s AI-driven fraud solution.

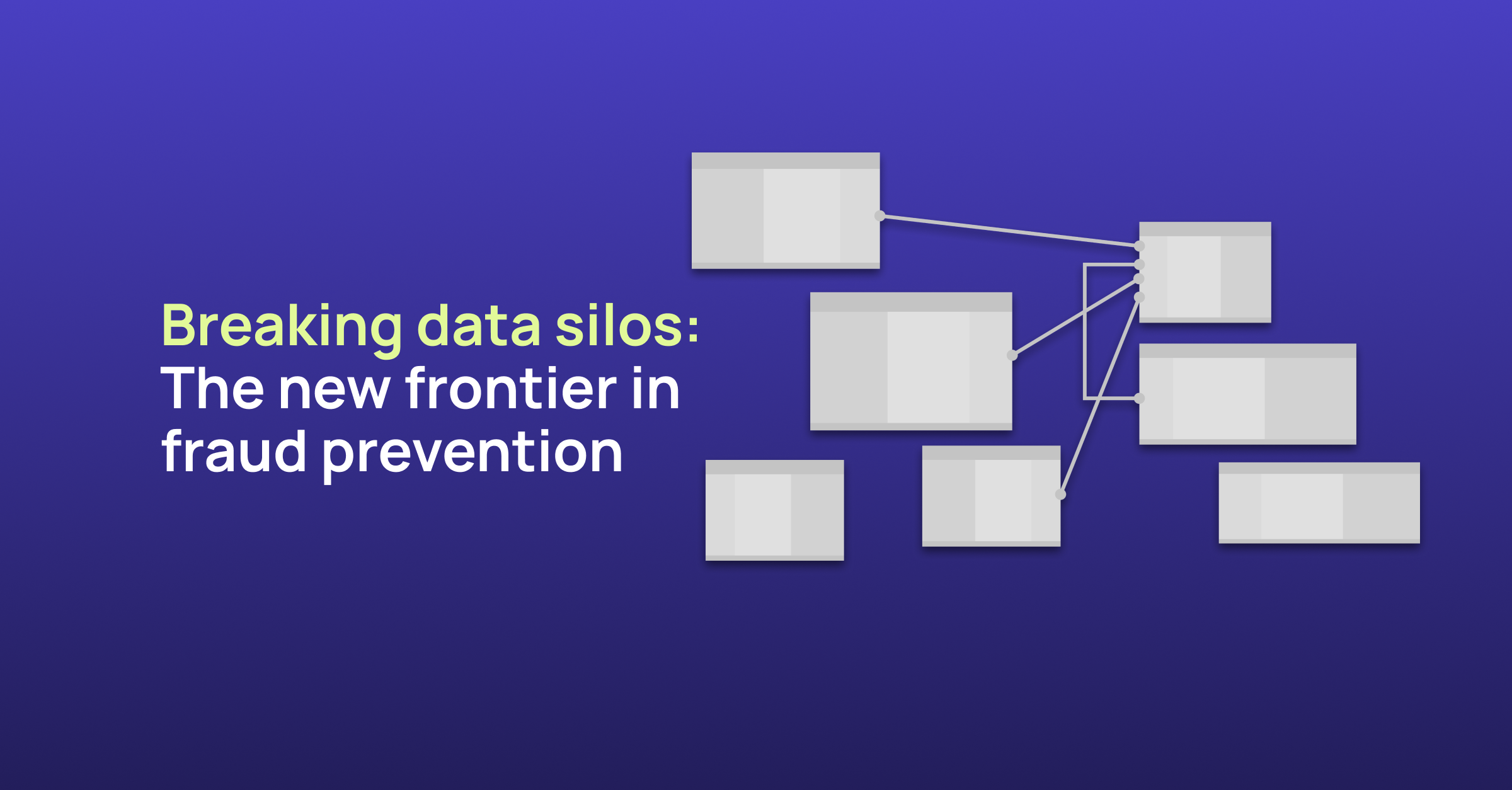

Discover the new frontier in fraud prevention on Taktile: Real-time pattern detection across use cases, teams, and systems.

Taktile partners with Prior Labs to provide teams across risk, fraud, and compliance access to TabPFN - a breakthrough model for tabular tasks.

Taktile continues on its growth trajectory, empowering risk teams to enhance and optimize their risk management strategies throughout the customer lifecycle.

Learn how to turn AI into a competitive advantage by building and deploying AI Agents tailored to your product and customer.

Peter Tegelaar (AI & Data Science Expert) explores how LLMs are reshaping fraud detection in fintech—balancing automation with expert oversight.

SMBs face growing fraud risks with fewer protections than consumers—Jason Mikula shares expert insights on emerging threats and how to combat them.

Romain Mazoué (Younited) explores the evolution of credit decision-making and uncovers how GenAI is shaping the future of customer-centric lending.

Learn how Zippi reduced risk logic deployment time by 67%, doubled experimentation, and scaled real-time decisions on Taktile.

Taktile earns top recognition in G2’s Winter 2025 Report, excelling in usability, implementation, and results—empowering teams to innovate and succeed.

Discover how Credix scaled underwriting, reduced decision times by 95%, and unlocked weekly iteration cycles with Taktile.

Discover the evolution of credit-building products in fintech, from secured cards to innovative "crebit" models. Learn the benefits, risks, and future trends.

Explore Brazil’s fintech transformation and discover the Top 50 disruptors driving innovation in payments, credit, and financial inclusion today.

Discover Taktile's GenAI Copilot: A tool that empowers you to create and refine complex decision logic with unmatched speed and precision.

Explore key insights from our "Expert Talks" EP01 with Jason Mikula on how leaders are navigating a rapidly changing data landscape.

Discover how Breakout Finance streamlined B2B underwriting with Taktile, reducing underwriting time by up to 95%—boosting loan capacity, accuracy, and speed.

Learn how Zilch accelerated growth, halved underwriting costs, and empowered its teams to innovate faster by switching to Taktile.

Learn 3 essential steps to accelerate your Return on Investment (ROI) of new third-party data integrations while driving smarter, faster risk decisions.

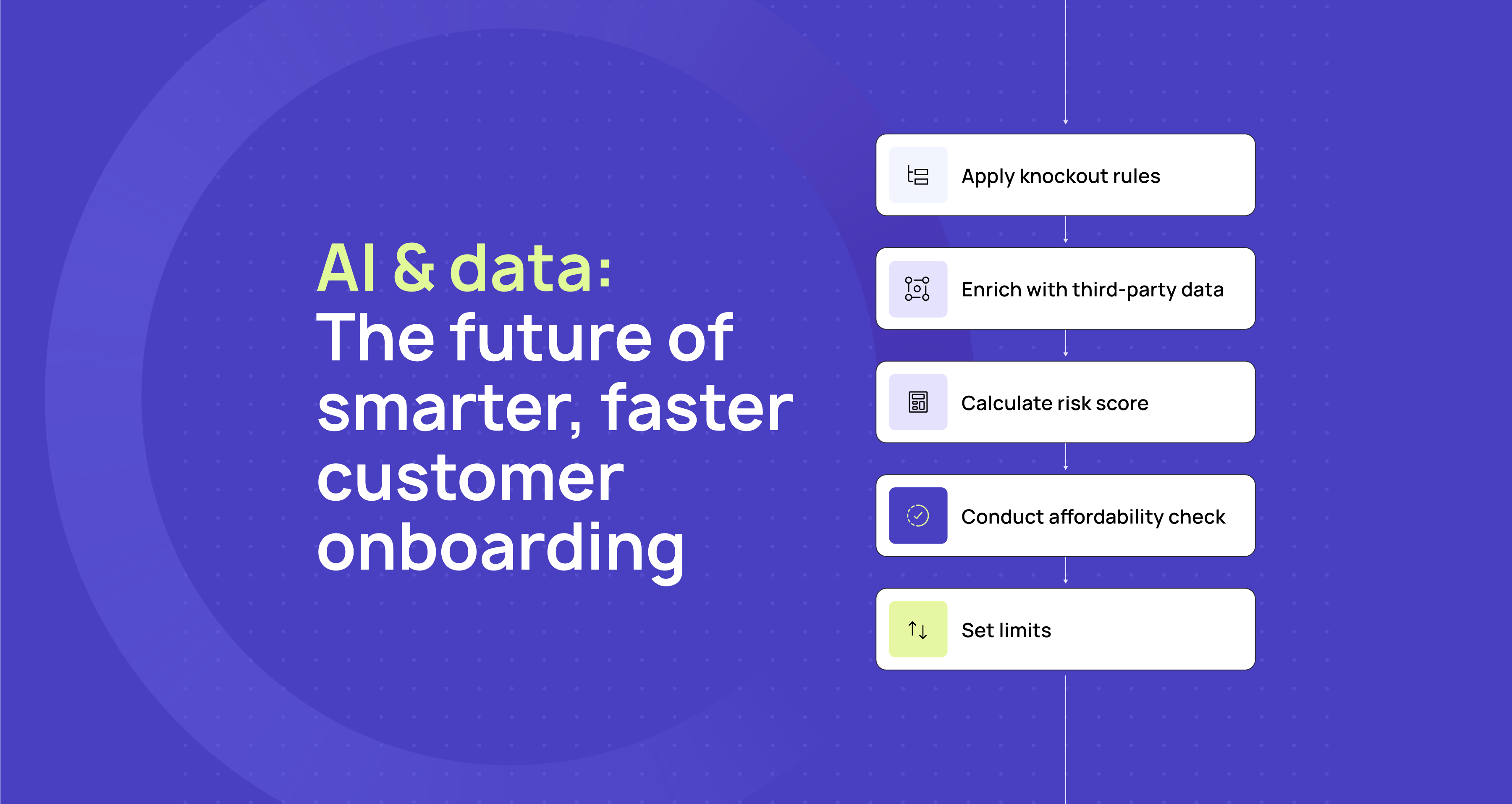

Discover how AI and third-party data transform fintech onboarding, enabling faster, smarter, and more secure growth.

Discover how third-party data helps product and risk teams rebalance risk and reward to drive smarter decisions and unlock growth.

Taktile continues to lead the way, being recognized again as a category leader in G2’s Fall 2024 report for Decision Management Platforms.

Explore the rise of account takeover fraud, why traditional defenses fall short, and how transaction monitoring can safeguard your customers and business.

Learn how open finance revolutionizes risk assessment practices for sophisticated fintech companies and banks worldwide.

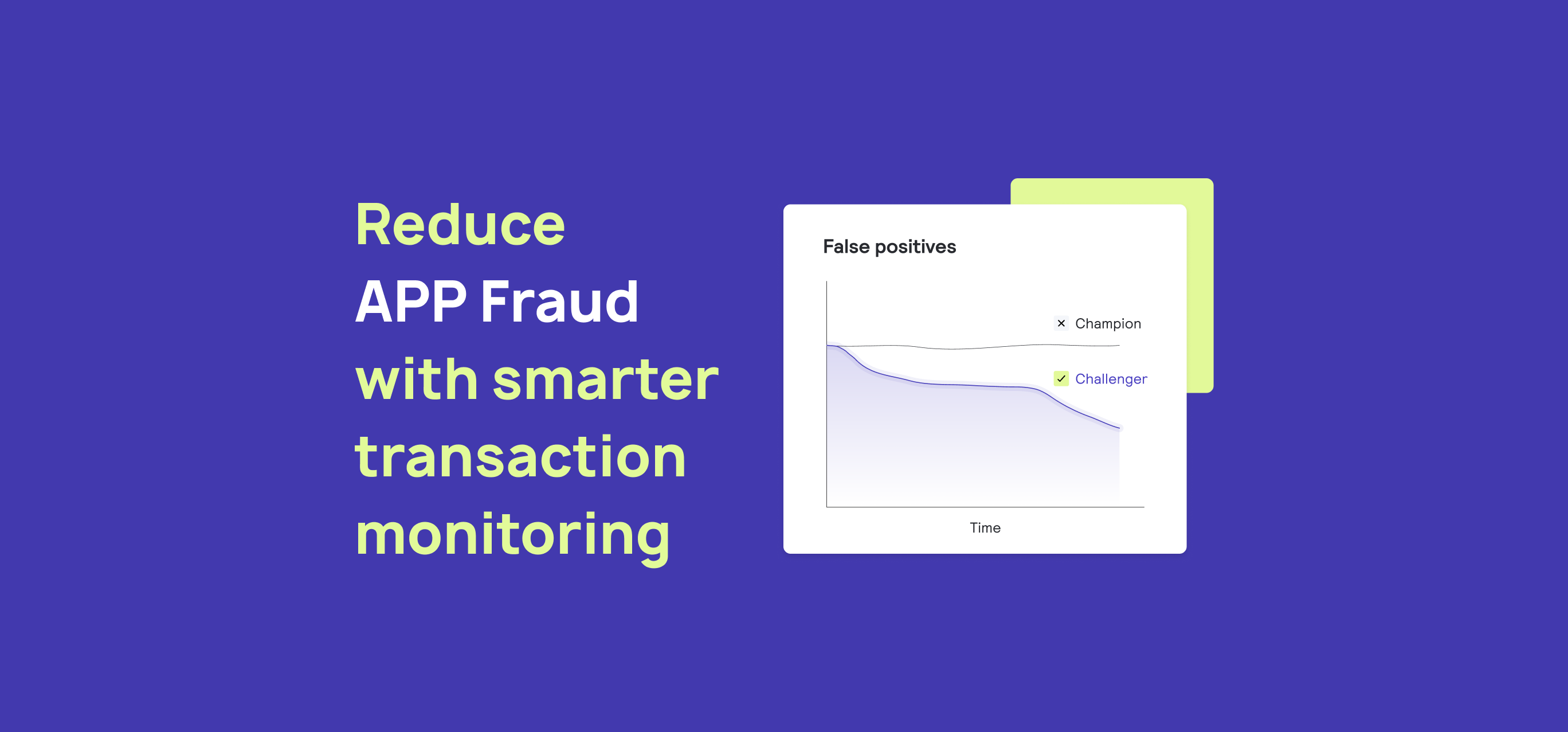

Learn how to adapt your transaction monitoring practices to combat the rise of Authorized Push Payment (APP) fraud in real-time payments.

Pave.dev’s cashflow analytics and scores boost SMB lenders’ risk models—now fully integrated into Taktile’s next-gen decision platform.

Learn about the types of first-party fraud companies face today and the key strategies they are employing to counter them effectively.

Taktile is regonized as a G2 category leader, reflecting our commitment to delivering a holistic decision platform that truly empowers our users.

In partnership with Portage, Taktile presents the Top 50 US fintechs disrupting consumer finance and reshaping the industry.

Learn about the emerging types and costs of deepfake fraud so you can proactively enhance your fraud strategies against these growing risks.

This guide will help risk teams see through stage-rigged demos, avoid falling for charlatans, and focus on what moves the needle instead.

Drawing on our firsthand experiences working with lenders on the front lines, we highlight winning strategies for 2024.

Risk & lending experts share insights and strategies shaping the future of the lending industry.

Taktile and Ocrolus partner to transform small business lending, leading the race to equip small business lenders with real-time underwriting and data at scale.

Discover Jobs: A powerfully simple feature that empowers you to effortlessly set up automated decisions that periodically run over large datasets.

Taktile named a High Performer and top for customer support in G2’s Spring 2024 report for Decision Management Platforms.

Learn how Taktile’s Plaid integration empowers lenders to harness the power of open banking data across the lifecycle of underwriting decisions.

Taktile and Deeploy announced their partnership as part of their combined mission to redefine high-risk decision-making with AI.

Discover the innovative risk assessment frameworks leading lenders are employing to grow more profitably.

Taktile and Portage identify the top 50 US fintechs at the forefront of B2B finance and lending innovation in 2023 and uncover key trends driving this growth.

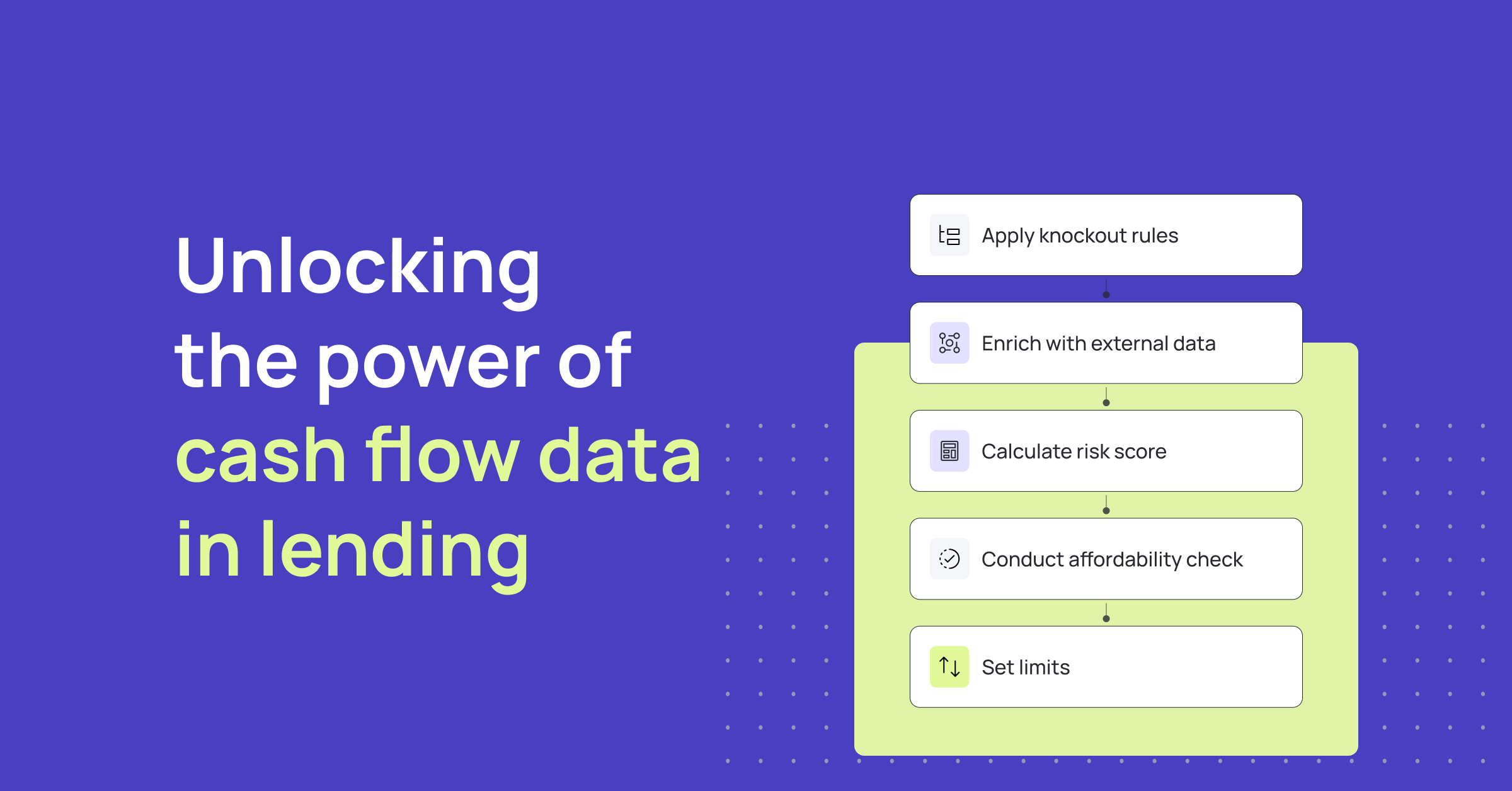

Uncover strategies for cash flow-based underwriting from industry experts Abhinav Swara from Bluevine & Jonathan Gurwitz from Plaid.

This year, ChatGPT captured the world's attention. Learn about the possibilities it presents for underwriters and expand your knowledge of AI trends in lending.

Discover how the EU's upcoming AI Act will affect credit underwriting activities in the future.

Learn how Rhino is reaching its goals and empowering its risk team using Taktlie.

Discover how B2B decision automation is unlocking new possibilities for lenders.

Learn how automation can transform your B2B lending operations to make faster, smarter, and safer underwriting decisions at scale.

Taktile named one of the top 200 fintechs in analysis by CNBC and Statista.

Learn how Novo used Taktile's automated decision engine to launch a small business financing solution.

Learn about the top 10 considerations of risk experts when choosing a decision engine.

Discover why B2B payments lag behind B2C, how it affects credit underwriting, and actionable steps B2B companies can take to close the gap.

Discover how lenders are navigating the path of profitability with Taktile's State of Lending Report.

Taktile launches a data marketplace with an unprecedented coalition of leading data providers to ensure lenders can make the most accurate decisions.

Learn how to create a credit policy that minimizes your loss rates, optimizes approval rates, and gives you a competitive advantage in your customer segment.

Jitin Bhasin, CEO of rapidly growing healthcare fintech SaveIN, offers advice to other lenders on how to grow profitably.

Learn how one of the most popular finance apps in the world uses Taktile to refine their lending models.

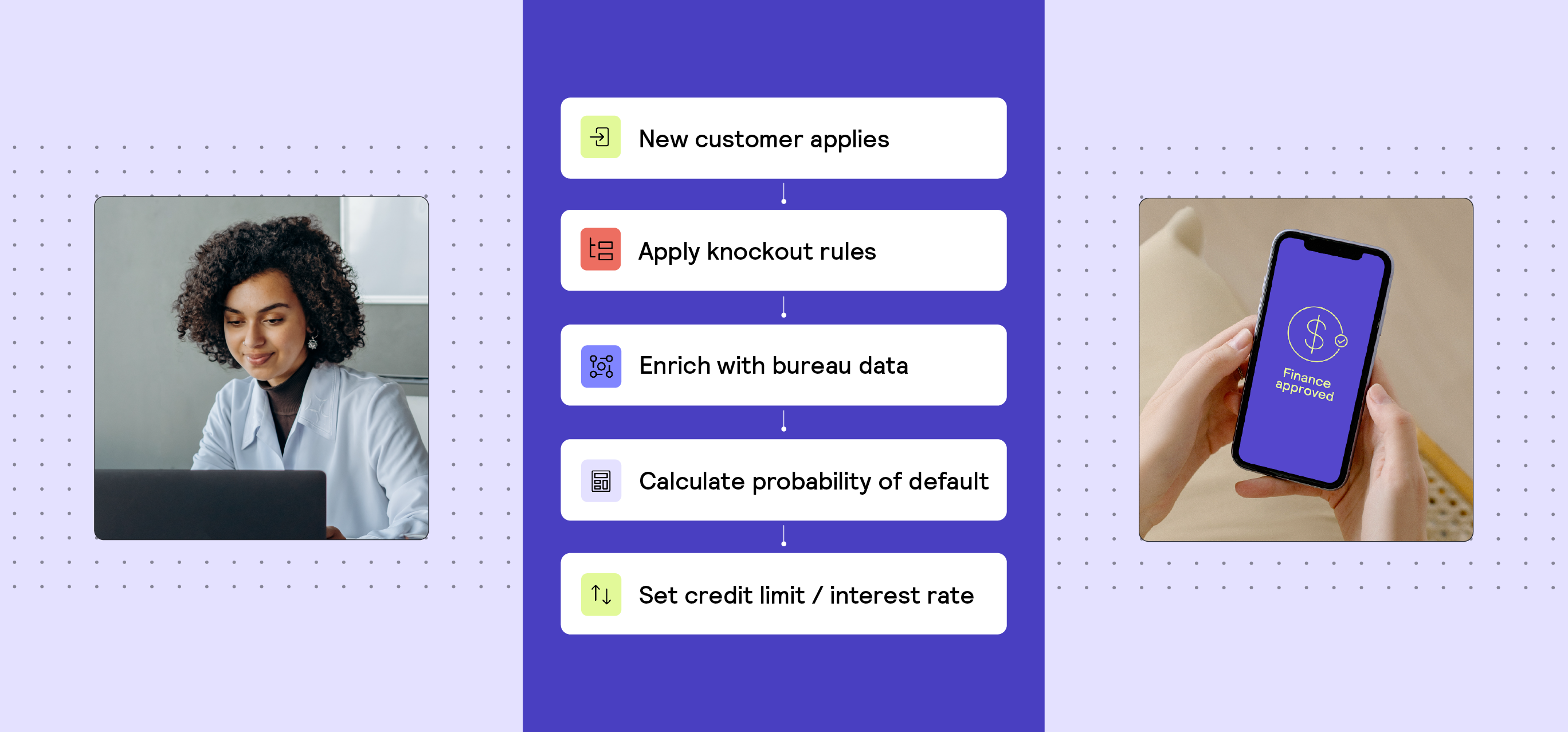

Based on industry best practices, learn the 4 key steps required to launch a modern lending product.

As we near the end of the year, we have highlighted five key trends that will bring transformative changes to the fintech sector in 2023.

Learn how lenders quickly adapt to market changes, grow loan books profitably, and launch new products fast with data-driven strategies.

Discover how novel data sources optimize the risk selection process from onboarding new customers to underwriting loans.

Our founder shares his vision on the future of fintech and how companies can adapt to thrive in the current economic environment.

Funds will be used to continue improving the product, adding new integrations, and expanding in the US.

Try adjusting your search or filter to find what you're looking for.

Ready to see Taktile in action?

Discover Taktile

Discover Taktile