Discover Taktile

Fraud adapts fast.

Now you can too.

Give your team a unified view of risk signals and the clarity to act and refine strategies at speed, with agentic AI enhancing operations where it counts.

Trusted by leading financial institutions worldwide.

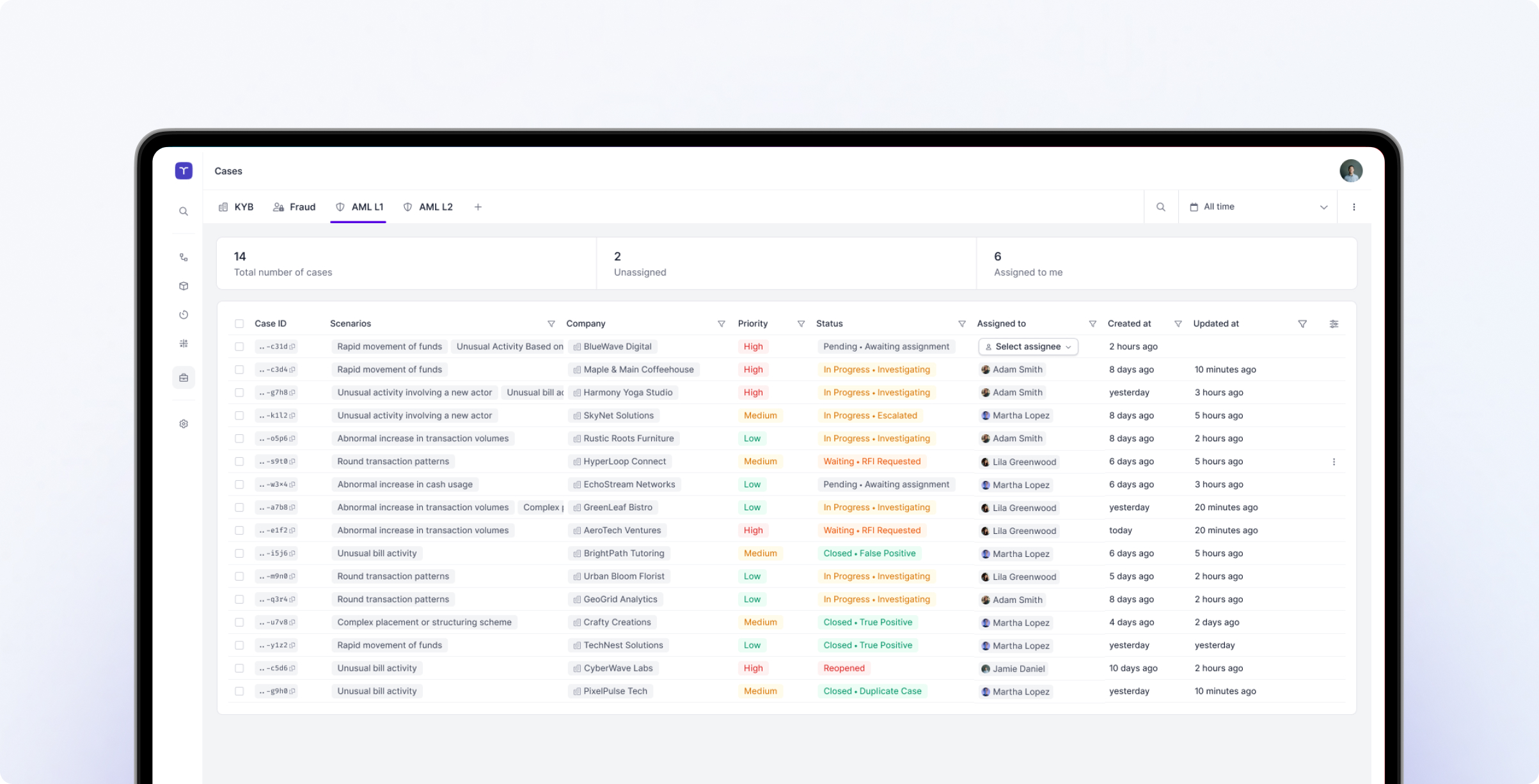

Taktile centralizes the signals that shape your fraud and monitoring strategy, giving teams a complete view of each customer and how their risk evolves. With agentic AI assisting in investigation tasks, you can minimize manual effort and run integrated case management directly within your workflow.

Global financial services organizations stop financial crime on Taktile.

Apply entity-level intelligence to every decision.

Fraud doesn't happen in isolation. Analyze risk at the entity level to detect patterns across transactions, accounts, and behaviors. Run A/B tests, backtest models, and refine fraud rules in real time.

Enrich your fraud strategy with real-time data.

No delays, no complexity.

Instantly integrate AI, ML models, and third-party fraud data to monitor and stop fraud faster with fewer false positives.

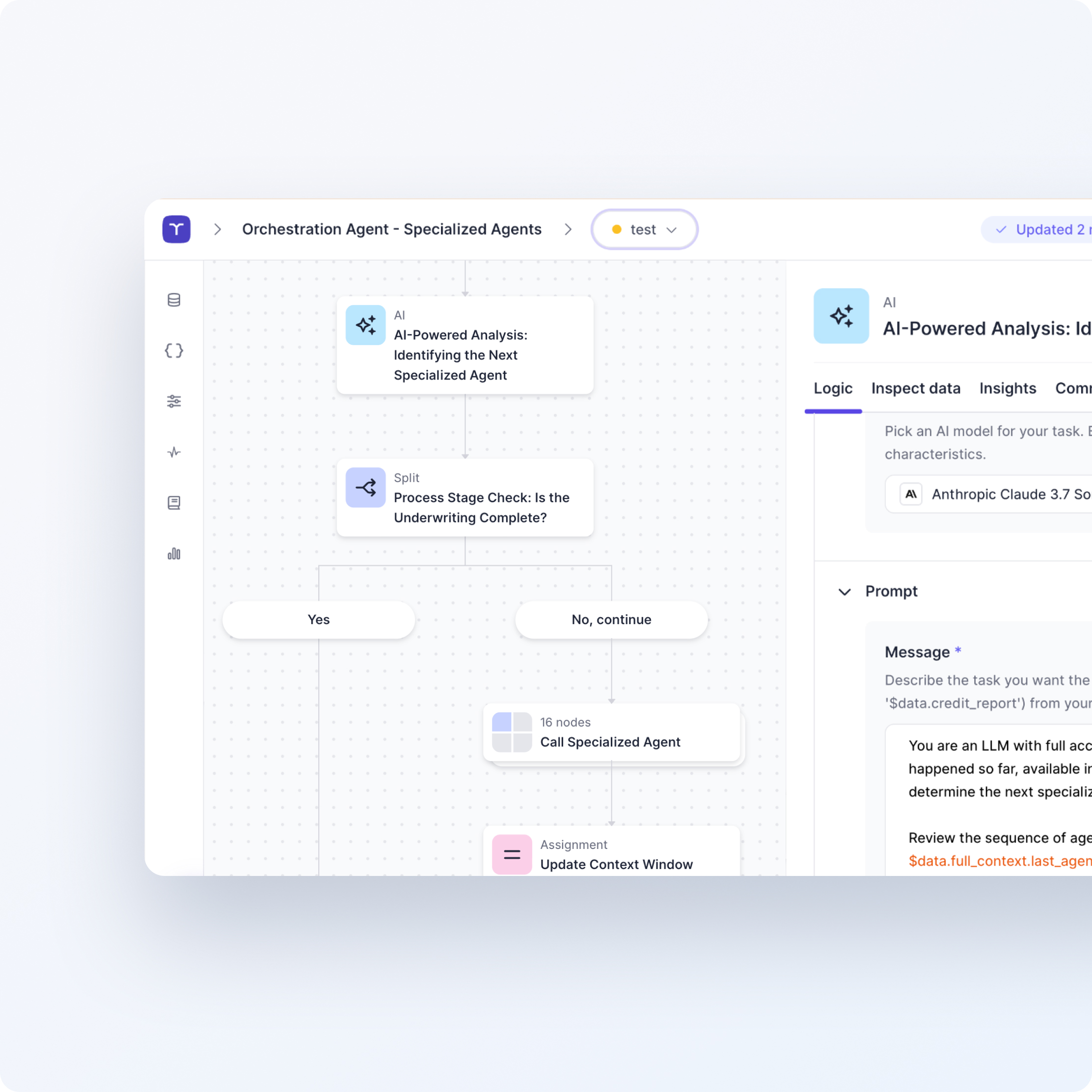

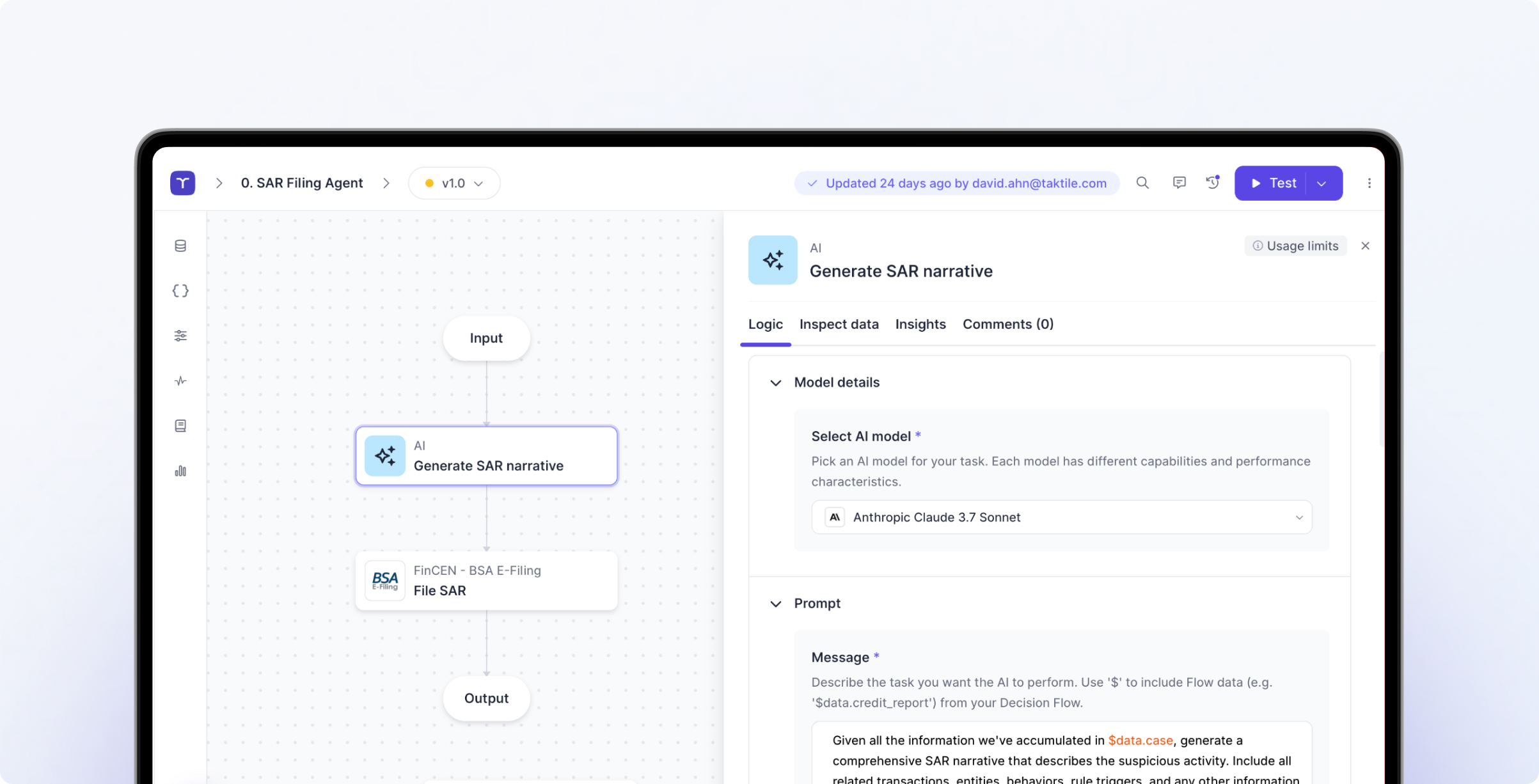

Deploy specialized agents that handle monitoring, screening, and investigation, working together to catch risk faster. No training required, just configure to your workflows and go live.

Investigate and resolve fraud faster with AI assistance.

Review flagged transactions, analyze risk signals, and take action in one interface. Automate escalations, collaborate across teams, and use agentic AI to cut manual steps and surface real-time insights.

Discover the latest insights on AI-driven fraud prevention.

See why financial services organizations trust Taktile to transform their businesses with unmatched safety and control.

Discover Taktile