Rapidly evolve automated decision strategies at the

pace your business requires.

Unblock your domain experts to iterate quickly on business logic with the safety and control that financial institutions require.

Discover Taktile

Trusted by financial institutions worldwide.

Design, test, and deploy automated decision

strategies in minutes with helpful AI along the way.

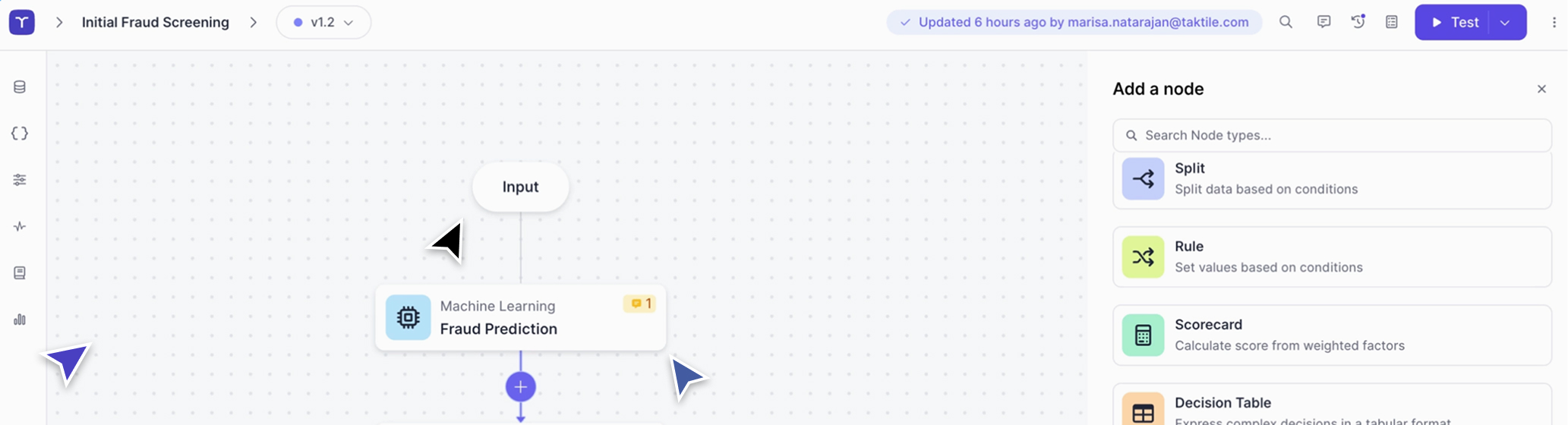

Build decision logic visually using pre-built 'nodes' that empower you to move fast without writing code.

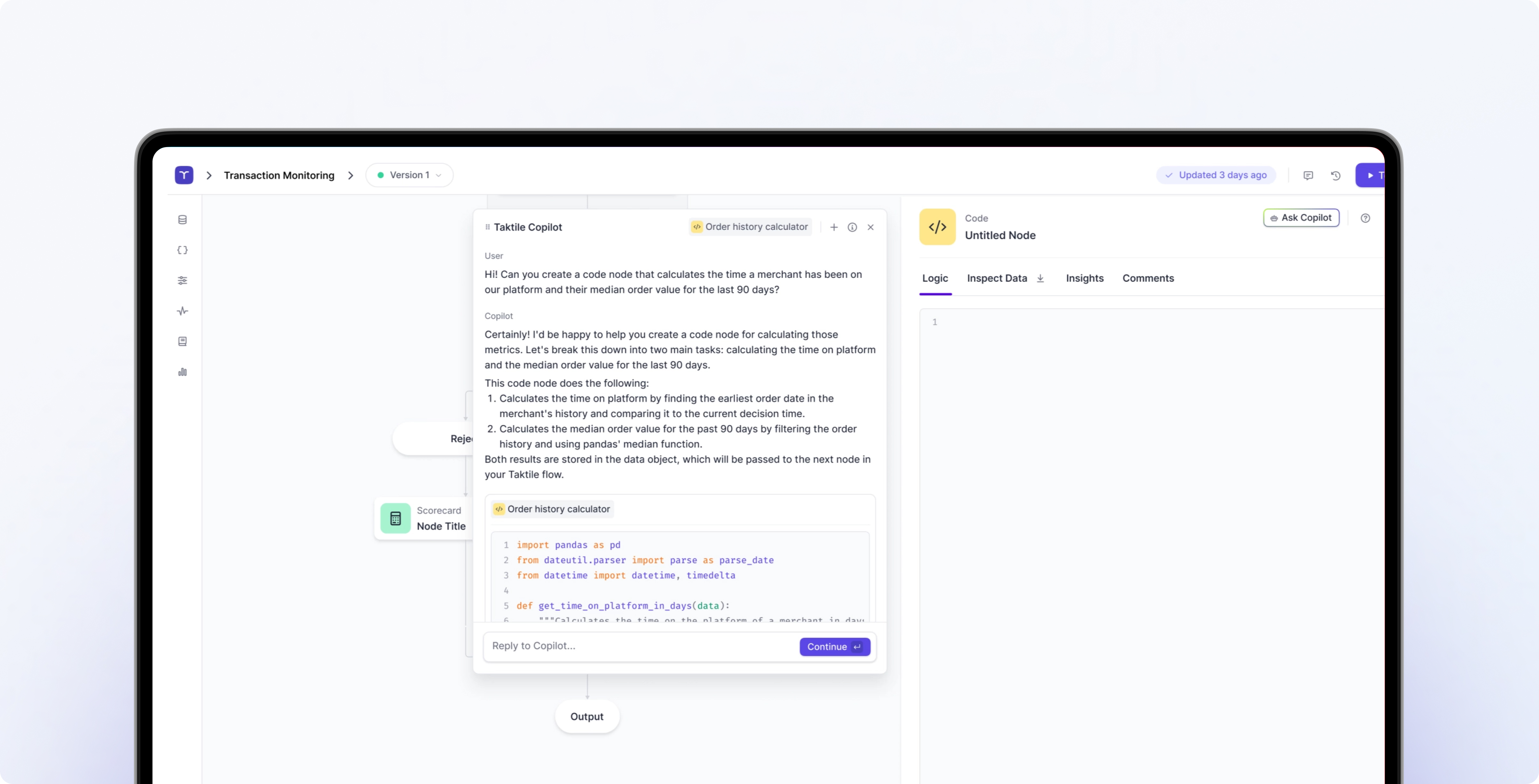

Leverage AI to generate Python, giving you

low-code speed with full code-level flexibility.

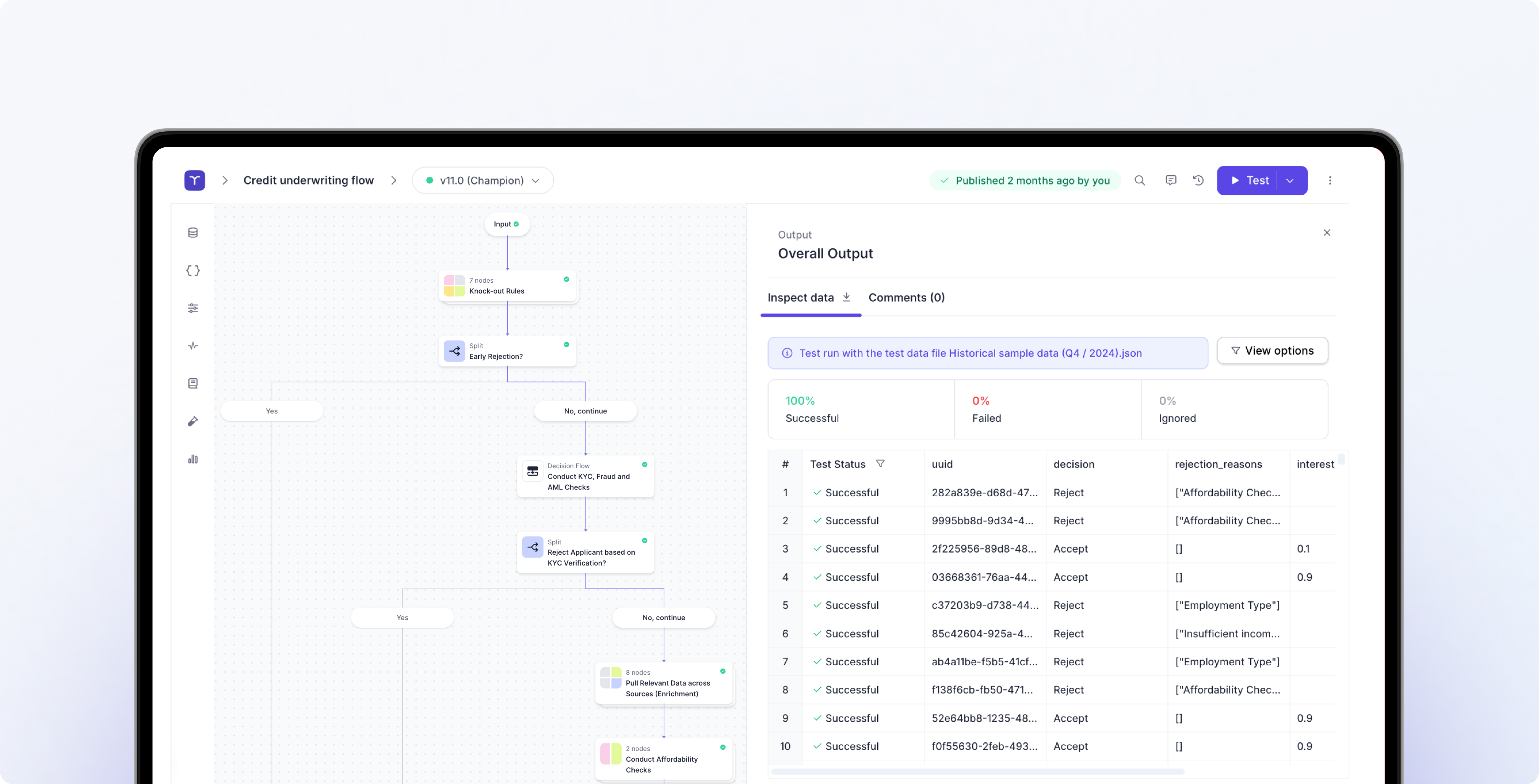

Run tests in seconds and see expected outputs immediately to validate changes before deploying.

Improve your decisions with

embedded access to third-party data.

Snowflake

Snowflake  ThomsonReuters

ThomsonReuters  Socure

Socure  Slack

Slack  Dun & Bradstreet

Dun & Bradstreet  CRIF

CRIF  MongoDB

MongoDB  Fingerprint

Fingerprint  Opensanctions

Opensanctions  OpenAI

OpenAI  Equifax

Equifax  Creditsafe

Creditsafe  BigQuery

BigQuery  LexisNexis

LexisNexis  Experian

Experian  TransUnion

TransUnion  Plaid

Plaid  Baselayer

Baselayer  Middesk

Middesk  Anthropic

Anthropic  Codat

Codat  Snowflake

Snowflake  ThomsonReuters

ThomsonReuters  Socure

Socure  Slack

Slack  Dun & Bradstreet

Dun & Bradstreet  CRIF

CRIF  MongoDB

MongoDB  Fingerprint

Fingerprint  Opensanctions

Opensanctions  OpenAI

OpenAI  Equifax

Equifax  Creditsafe

Creditsafe  BigQuery

BigQuery  LexisNexis

LexisNexis  Experian

Experian  TransUnion

TransUnion  Plaid

Plaid  Baselayer

Baselayer  Middesk

Middesk  Anthropic

Anthropic  Codat

Codat  Snowflake

Snowflake  ThomsonReuters

ThomsonReuters  Socure

Socure  Slack

Slack  Dun & Bradstreet

Dun & Bradstreet  CRIF

CRIF  MongoDB

MongoDB  Fingerprint

Fingerprint  Opensanctions

Opensanctions  OpenAI

OpenAI  Equifax

Equifax  Creditsafe

Creditsafe  BigQuery

BigQuery  LexisNexis

LexisNexis  Experian

Experian  TransUnion

TransUnion  Plaid

Plaid  Baselayer

Baselayer  Middesk

Middesk  Anthropic

Anthropic  Codat

Codat  Snowflake

Snowflake  ThomsonReuters

ThomsonReuters  Socure

Socure  Slack

Slack  Dun & Bradstreet

Dun & Bradstreet  CRIF

CRIF  MongoDB

MongoDB  Fingerprint

Fingerprint  Opensanctions

Opensanctions  OpenAI

OpenAI  Equifax

Equifax  Creditsafe

Creditsafe  BigQuery

BigQuery  LexisNexis

LexisNexis  Experian

Experian  TransUnion

TransUnion  Plaid

Plaid  Baselayer

Baselayer  Middesk

Middesk  Anthropic

Anthropic  Codat

Codat  Snowflake

Snowflake  ThomsonReuters

ThomsonReuters  Socure

Socure  Slack

Slack  Dun & Bradstreet

Dun & Bradstreet  CRIF

CRIF  MongoDB

MongoDB  Fingerprint

Fingerprint  Opensanctions

Opensanctions  OpenAI

OpenAI  Equifax

Equifax  Creditsafe

Creditsafe  BigQuery

BigQuery  LexisNexis

LexisNexis  Experian

Experian  TransUnion

TransUnion  Plaid

Plaid  Baselayer

Baselayer  Middesk

Middesk  Anthropic

Anthropic  Codat

Codat  Middesk

Middesk  Baselayer

Baselayer  Dun & Bradstreet

Dun & Bradstreet  Opensanctions

Opensanctions  LexisNexis

LexisNexis  TransUnion

TransUnion  Anthropic

Anthropic  Fingerprint

Fingerprint  Creditsafe

Creditsafe  BigQuery

BigQuery  ThomsonReuters

ThomsonReuters  Experian

Experian  MongoDB

MongoDB  Codat

Codat  Socure

Socure  CRIF

CRIF  Slack

Slack  Snowflake

Snowflake  Plaid

Plaid  OpenAI

OpenAI  Equifax

Equifax  Middesk

Middesk  Baselayer

Baselayer  Dun & Bradstreet

Dun & Bradstreet  Opensanctions

Opensanctions  LexisNexis

LexisNexis  TransUnion

TransUnion  Anthropic

Anthropic  Fingerprint

Fingerprint  Creditsafe

Creditsafe  BigQuery

BigQuery  ThomsonReuters

ThomsonReuters  Experian

Experian  MongoDB

MongoDB  Codat

Codat  Socure

Socure  CRIF

CRIF  Slack

Slack  Snowflake

Snowflake  Plaid

Plaid  OpenAI

OpenAI  Equifax

Equifax  Middesk

Middesk  Baselayer

Baselayer  Dun & Bradstreet

Dun & Bradstreet  Opensanctions

Opensanctions  LexisNexis

LexisNexis  TransUnion

TransUnion  Anthropic

Anthropic  Fingerprint

Fingerprint  Creditsafe

Creditsafe  BigQuery

BigQuery  ThomsonReuters

ThomsonReuters  Experian

Experian  MongoDB

MongoDB  Codat

Codat  Socure

Socure  CRIF

CRIF  Slack

Slack  Snowflake

Snowflake  Plaid

Plaid  OpenAI

OpenAI  Equifax

Equifax  Middesk

Middesk  Baselayer

Baselayer  Dun & Bradstreet

Dun & Bradstreet  Opensanctions

Opensanctions  LexisNexis

LexisNexis  TransUnion

TransUnion  Anthropic

Anthropic  Fingerprint

Fingerprint  Creditsafe

Creditsafe  BigQuery

BigQuery  ThomsonReuters

ThomsonReuters  Experian

Experian  MongoDB

MongoDB  Codat

Codat  Socure

Socure  CRIF

CRIF  Slack

Slack  Snowflake

Snowflake  Plaid

Plaid  OpenAI

OpenAI  Equifax

Equifax  Middesk

Middesk  Baselayer

Baselayer  Dun & Bradstreet

Dun & Bradstreet  Opensanctions

Opensanctions  LexisNexis

LexisNexis  TransUnion

TransUnion  Anthropic

Anthropic  Fingerprint

Fingerprint  Creditsafe

Creditsafe  BigQuery

BigQuery  ThomsonReuters

ThomsonReuters  Experian

Experian  MongoDB

MongoDB  Codat

Codat  Socure

Socure  CRIF

CRIF  Slack

Slack  Snowflake

Snowflake  Plaid

Plaid  OpenAI

OpenAI  Equifax

Equifax  OpenAI

OpenAI  BigQuery

BigQuery  Snowflake

Snowflake  Socure

Socure  TransUnion

TransUnion  MongoDB

MongoDB  Experian

Experian  Baselayer

Baselayer  Slack

Slack  Dun & Bradstreet

Dun & Bradstreet  LexisNexis

LexisNexis  Fingerprint

Fingerprint  Equifax

Equifax  Plaid

Plaid  Creditsafe

Creditsafe  Codat

Codat  ThomsonReuters

ThomsonReuters  Anthropic

Anthropic  Middesk

Middesk  CRIF

CRIF  Opensanctions

Opensanctions  OpenAI

OpenAI  BigQuery

BigQuery  Snowflake

Snowflake  Socure

Socure  TransUnion

TransUnion  MongoDB

MongoDB  Experian

Experian  Baselayer

Baselayer  Slack

Slack  Dun & Bradstreet

Dun & Bradstreet  LexisNexis

LexisNexis  Fingerprint

Fingerprint  Equifax

Equifax  Plaid

Plaid  Creditsafe

Creditsafe  Codat

Codat  ThomsonReuters

ThomsonReuters  Anthropic

Anthropic  Middesk

Middesk  CRIF

CRIF  Opensanctions

Opensanctions  OpenAI

OpenAI  BigQuery

BigQuery  Snowflake

Snowflake  Socure

Socure  TransUnion

TransUnion  MongoDB

MongoDB  Experian

Experian  Baselayer

Baselayer  Slack

Slack  Dun & Bradstreet

Dun & Bradstreet  LexisNexis

LexisNexis  Fingerprint

Fingerprint  Equifax

Equifax  Plaid

Plaid  Creditsafe

Creditsafe  Codat

Codat  ThomsonReuters

ThomsonReuters  Anthropic

Anthropic  Middesk

Middesk  CRIF

CRIF  Opensanctions

Opensanctions  OpenAI

OpenAI  BigQuery

BigQuery  Snowflake

Snowflake  Socure

Socure  TransUnion

TransUnion  MongoDB

MongoDB  Experian

Experian  Baselayer

Baselayer  Slack

Slack  Dun & Bradstreet

Dun & Bradstreet  LexisNexis

LexisNexis  Fingerprint

Fingerprint  Equifax

Equifax  Plaid

Plaid  Creditsafe

Creditsafe  Codat

Codat  ThomsonReuters

ThomsonReuters  Anthropic

Anthropic  Middesk

Middesk  CRIF

CRIF  Opensanctions

Opensanctions  OpenAI

OpenAI  BigQuery

BigQuery  Snowflake

Snowflake  Socure

Socure  TransUnion

TransUnion  MongoDB

MongoDB  Experian

Experian  Baselayer

Baselayer  Slack

Slack  Dun & Bradstreet

Dun & Bradstreet  LexisNexis

LexisNexis  Fingerprint

Fingerprint  Equifax

Equifax  Plaid

Plaid  Creditsafe

Creditsafe  Codat

Codat  ThomsonReuters

ThomsonReuters  Anthropic

Anthropic  Middesk

Middesk  CRIF

CRIF  Opensanctions

Opensanctions Analyze and refine decision strategies with

built-in experimentation and AI-driven analytics.

Model how changes to your logic will perform

using real or historical data before going live.

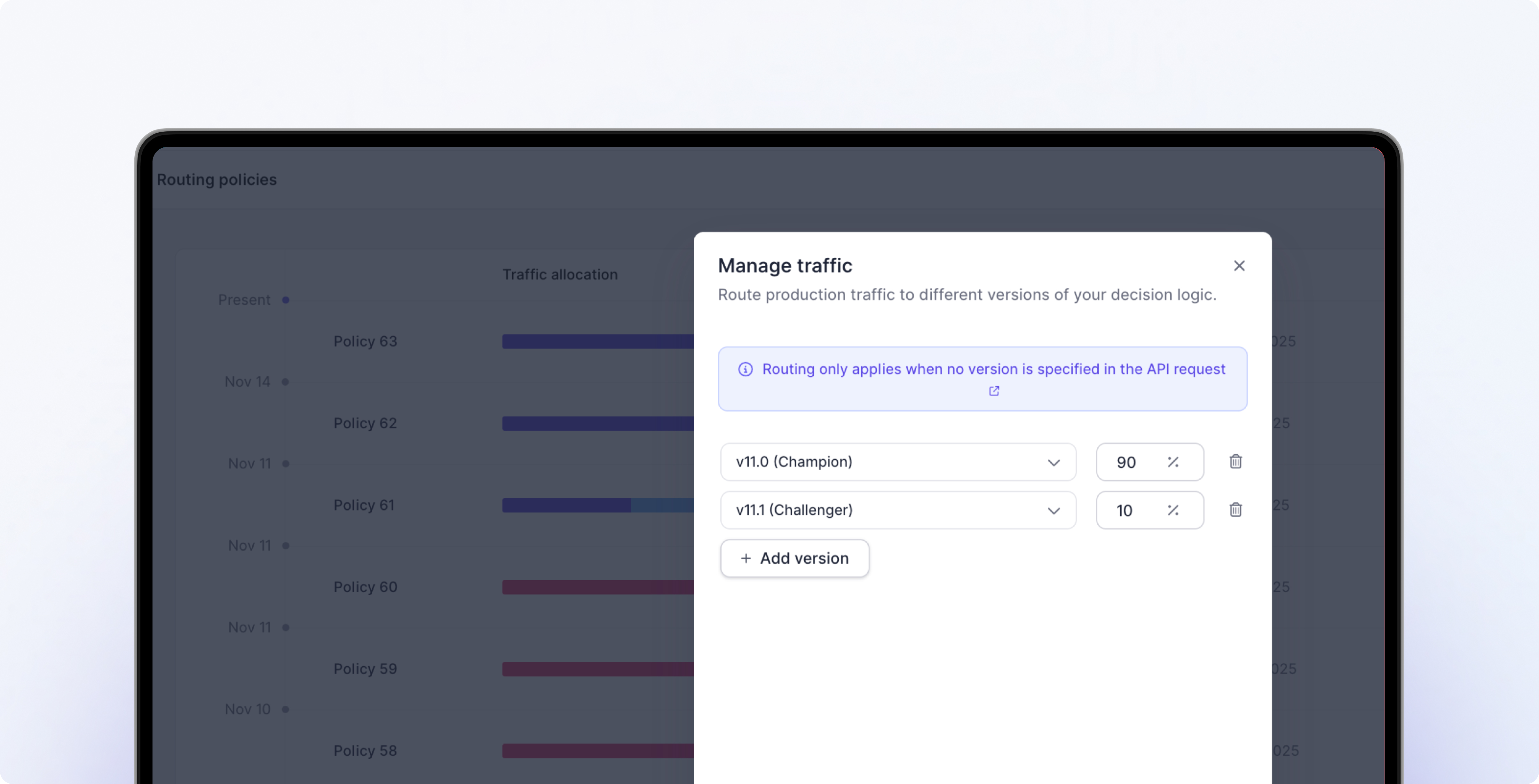

Experiment with multiple versions of a flow in

production to identify the best-performing variant.

Track outcomes and KPIs in real time to understand

performance and guide continuous optimization.

Leading financial institutions innovate faster on Taktile.

Empower analysts, engineers, and product managers

to work together on one platform.

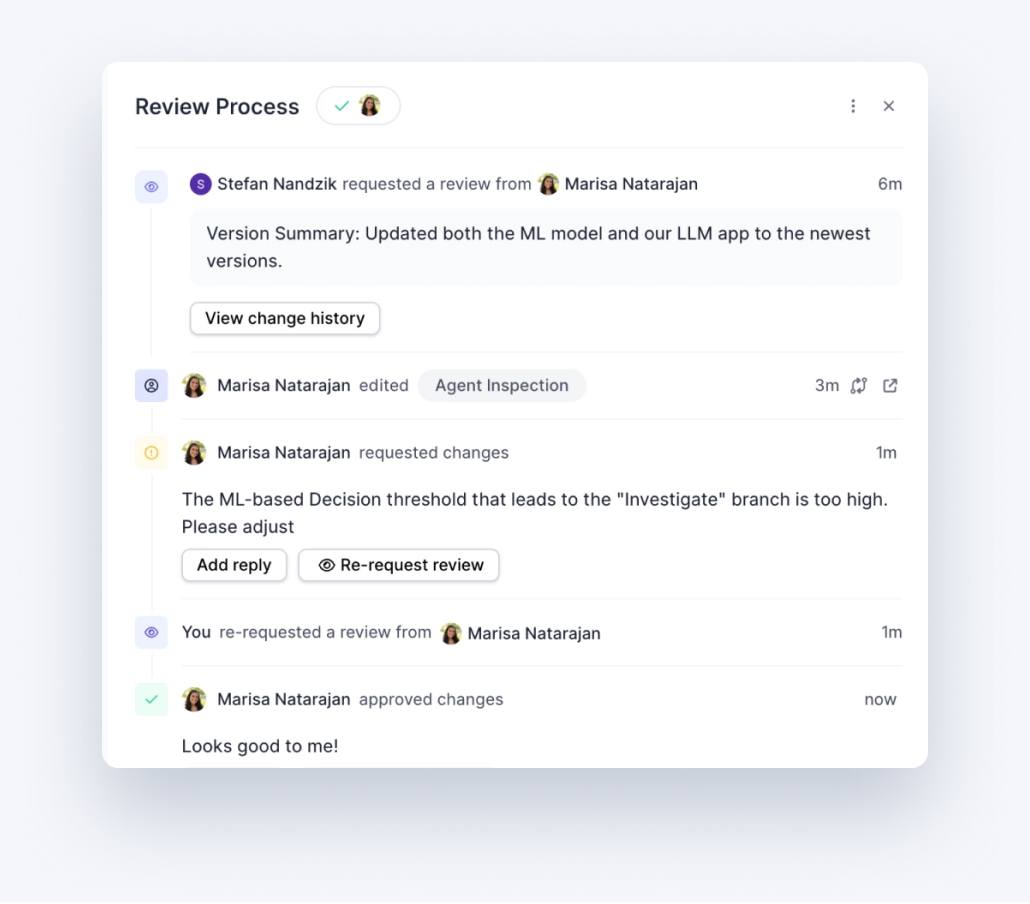

Share insights, tag colleagues, and keep entire team aligned in real time. Teammates can build, edit and refine logic simultaneously. No bottlenecks. No silos.

Easily collaborate and move from draft to approved with audit-ready traceability, meeting internal governance and regulatory standards.

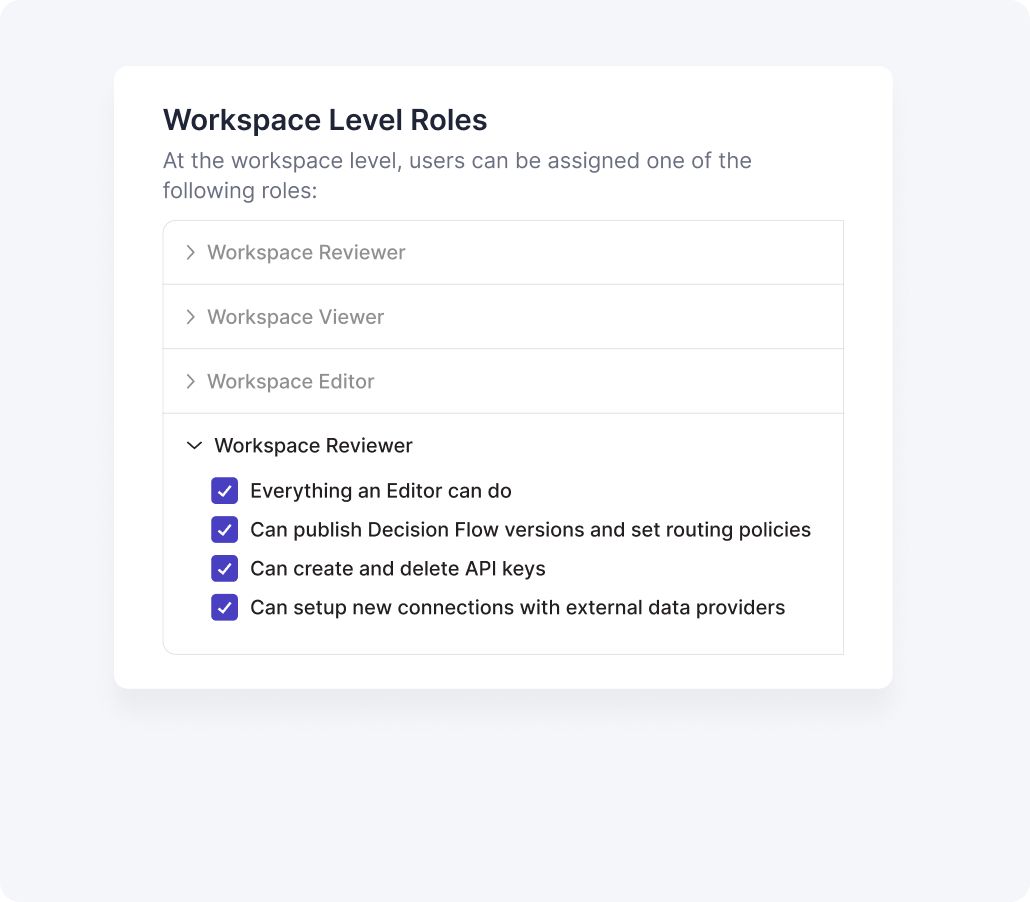

Granular role-based access ensures cross-functional teams collaborate without sacrificing security or compliance.

Everything you need for production-ready AI, powered by Taktile.

See why leading financial institutions trust Taktile to transform their operations with AI.

Discover Taktile