Press Release, Data 2 min read

Taktile launches global Data Marketplace to enable data-driven decisions for lenders

Key takeaways

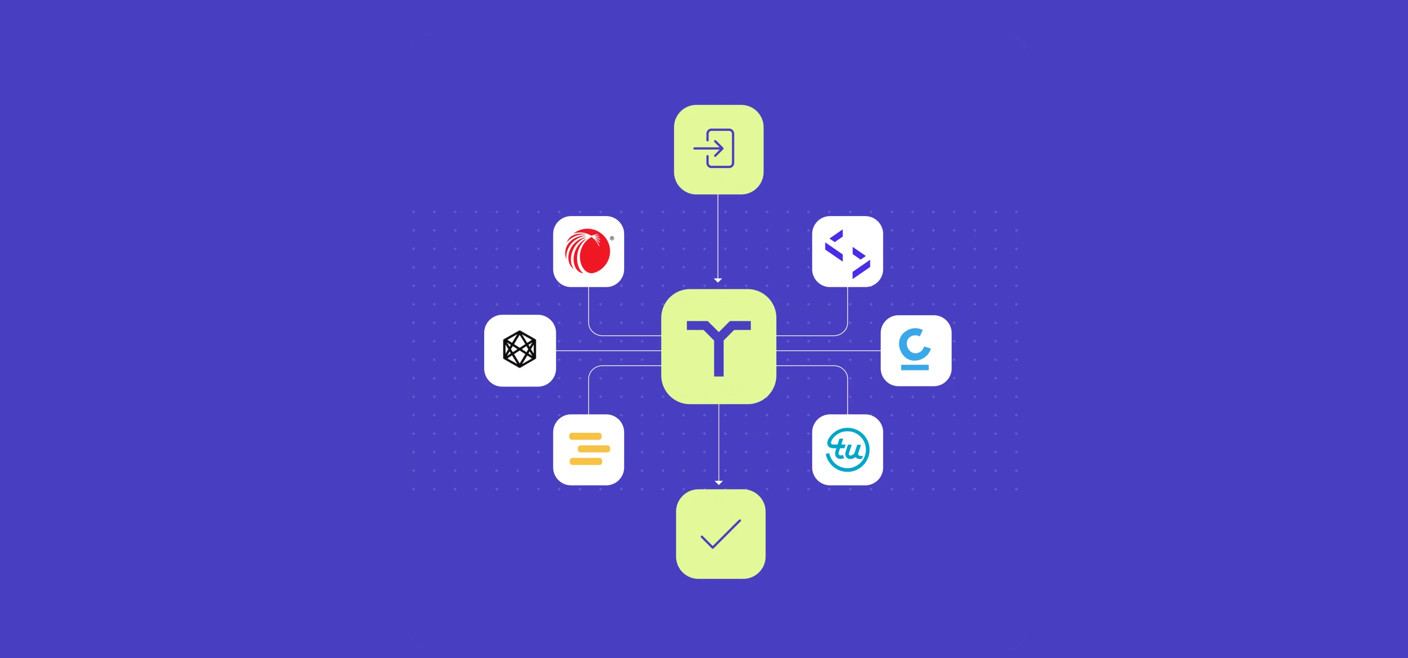

- Taktile partners with Codat, CRS, and others to provide easy access to traditional credit, identity, fraud, open banking, accounting and alternative data.

- On Taktile’s low-code platform, financial institutions can easily add new data sources in minutes through using pre-built integrations.

- At a time when profitability is top of mind for banks and fintechs, simplifying data integrations empowers lenders to increase acceptance rates, lower default rates, and offer competitive risk-based pricing.

Taktile's Data Marketplace revolutionizes data-driven decision-making

Taktile, the leading automated decision platform, has launched its Data Marketplace to revolutionize how fintechs and banks harness data to make decisions.

The Taktile Data Marketplace is a one-stop ecosystem of leading data providers that enables customers to easily access a global collection of traditional credit, identity, fraud, accounting, open banking, and alternative data sources. By leveraging these data sources, Taktile customers can refine their automated credit policies to better identify the right customers and make smarter, more accurate decisions - ultimately supporting profitable growth.

Possible data integrations include: Codat, CRS, NovaCredit, Boniversum, credolab, LexisNexis, Experian, Transunion, Equifax, Creditreform and Belvo.

As CEO and Co-Founder of Taktile, Maik Taro Wehmeyer, puts it:

“Identifying the right data sources for your customer segment has never been more important, but building data integrations in-house is often painful, time-consuming, and resource-intensive. Our Data Marketplace makes it easy for risk experts to experiment with various data sources so they can focus on improving their decision accuracy rather than on building integrations.”

How financial institutions can leverage Taktile's Data Marketplace to make high-stakes decisions more easily

On Taktile’s low-code platform, fintechs and banks can easily add new data sources from around the world in minutes through using Taktile’s pre-built integrations, which support both B2B and B2C use cases. In addition, Taktile already offers functionality today that enables customers to easily connect to any modern third-party API. As a result, users are not constrained by the current offering of off-the-shelf integrations.

The obtained data is well-structured and organized, making it easy to glean aggregate insights, build custom metrics, and identify the right KPIs that take decision accuracy to the next level. Users can also simulate decision outcomes before setting new decision strategies live, empowering them to make informed decisions based on real evidence not speculation.

At a time when profitability is top of mind for fintechs and financial institutions, simplifying data integrations is a powerful advantage. Through rapid experimentation, Taktile customers can uncover the best data sources for their target population and ultimately increase acceptance rates, lower default rates, and offer competitive risk-based pricing–all without requiring any engineering resources.

According to Philip Low, Head of Partnerships at Codat:

“In a challenging market, it is lenders' ability to harness data to build the most comprehensive view of their borrowers that gives them the edge. Now that Codat’s universal API is part of Taktile’s Data Marketplace, Taktile customers can incorporate data from any major accounting, open banking or commerce system into their decision engine in a few simple steps. In other words, obtaining that edge just got a lot simpler."

The launch of the Data Marketplace reflects Taktile's commitment to innovation and its ongoing efforts to provide customers with the tools they need to succeed in today's rapidly changing business environment. As part of this commitment, Taktile will rapidly add new global data partners every month and expects to triple the number of providers by the end of the year.