Credit decisions without limits.

Shape your underwriting, portfolio monitoring, and collections strategies with AI-driven insights and real-time data. Optimize decisions, reduce risk, and approve more of the right customers—without relying on engineers.

Discover Taktile

Join the risk management professionals worldwide who love using Taktile.

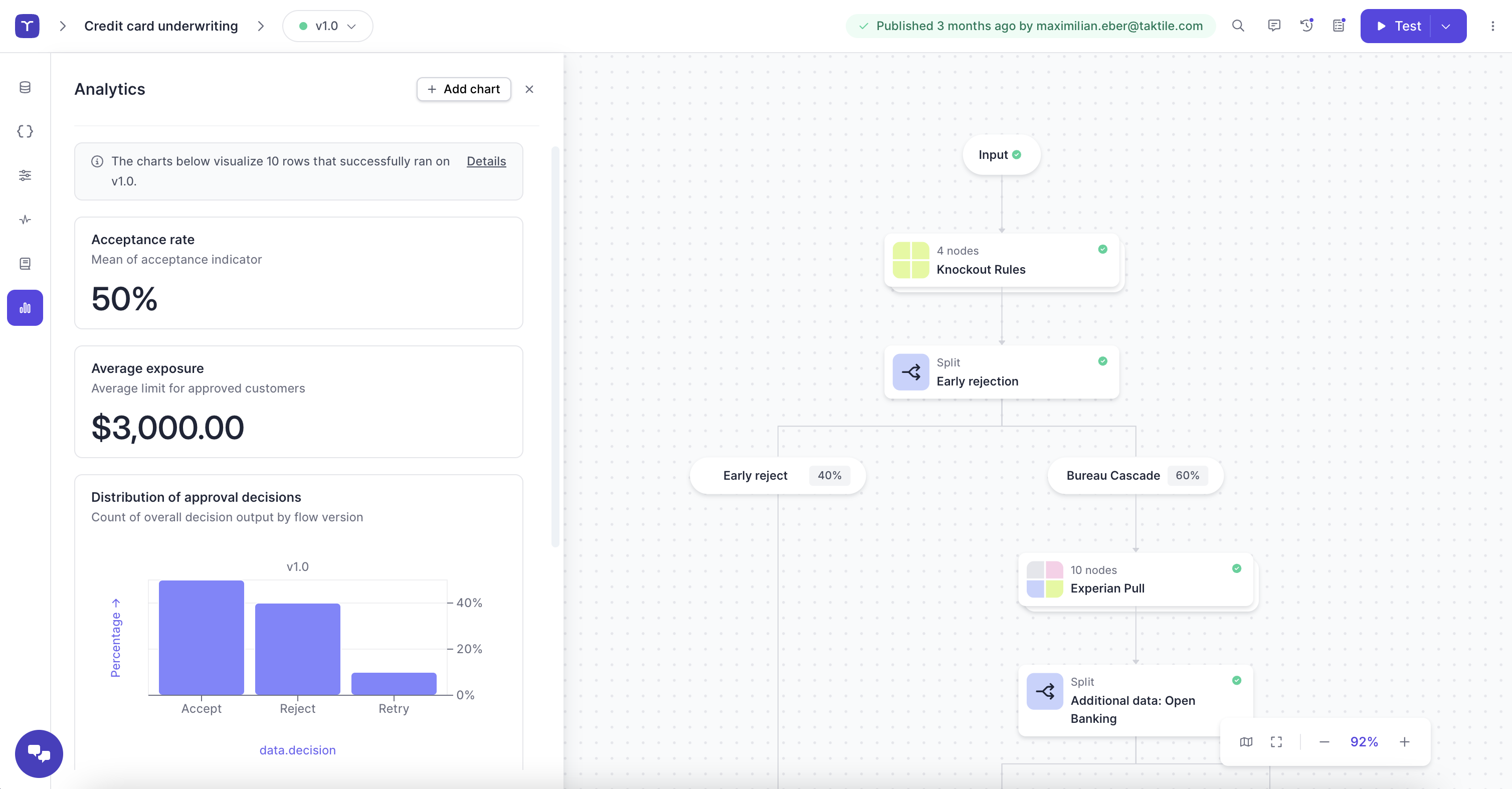

Your credit strategy should move as fast as your business. Stop waiting on engineers to tweak decision logic—design, test, and deploy changes across underwriting, monitoring, and collections in minutes on Taktile's low-code platform.

Real-time credit data, ready when you are.

Instantly connect to internal and third-party data sources to enhance credit approvals, detect emerging risk signals, and fine-tune collections strategies in real-time.

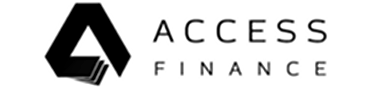

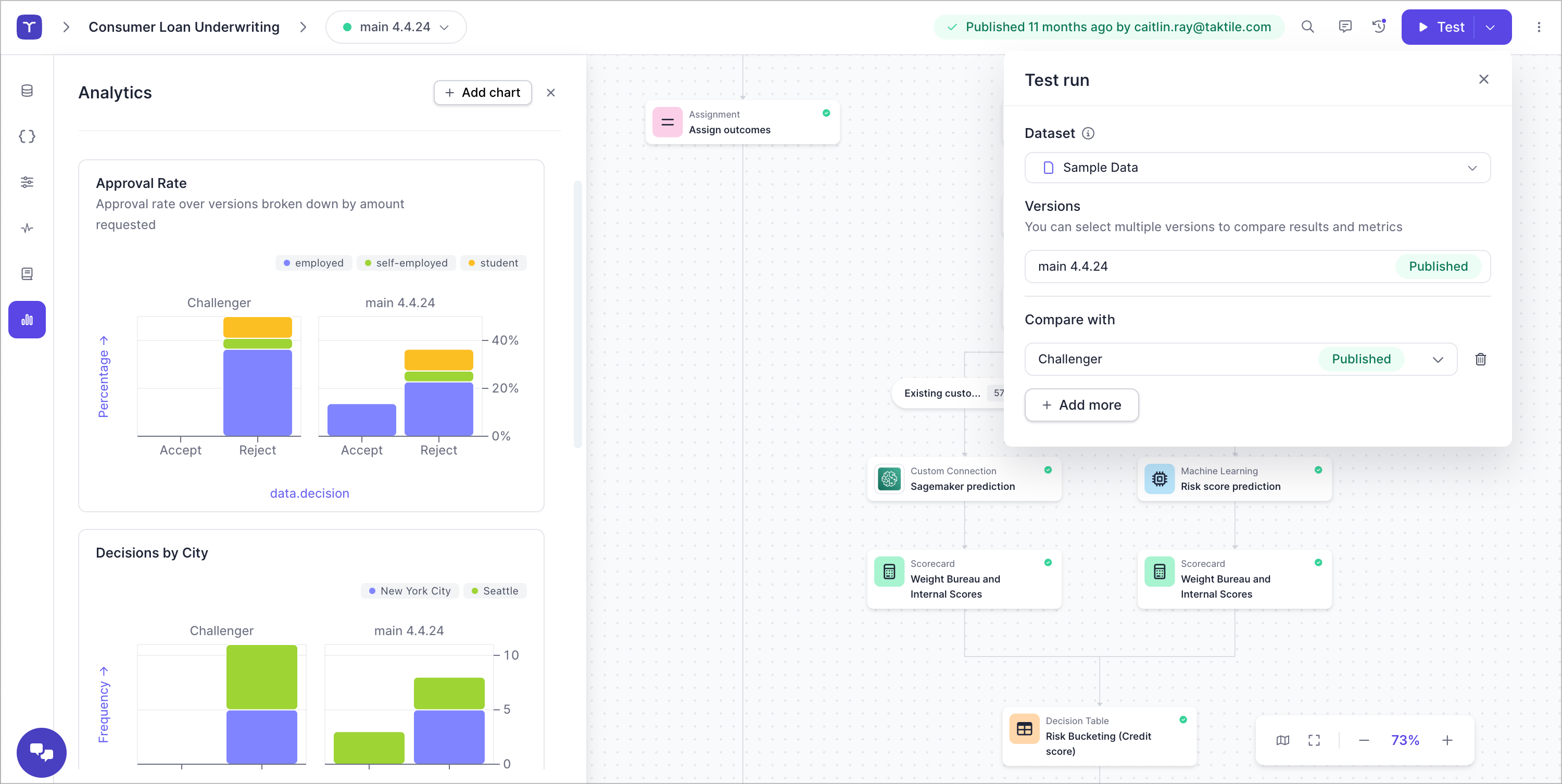

Refine, adapt, and outperform.

Make every credit decision better than the last. Run A/B tests, backtest decisions, and continuously refine your credit models to approve more of the right customers, reduce risk exposure, and improve repayment rates.

Credit & risk teams love using Taktile.

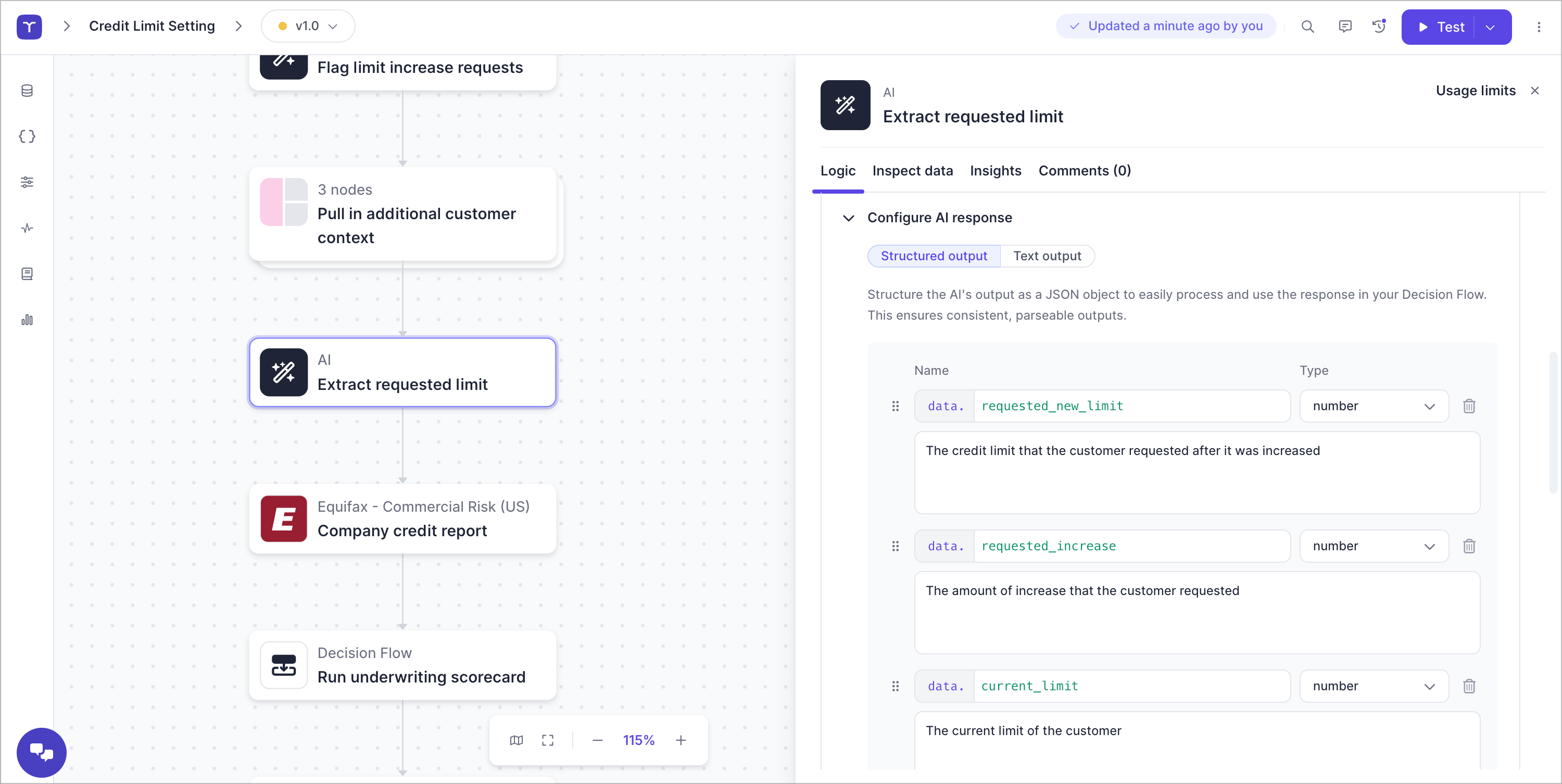

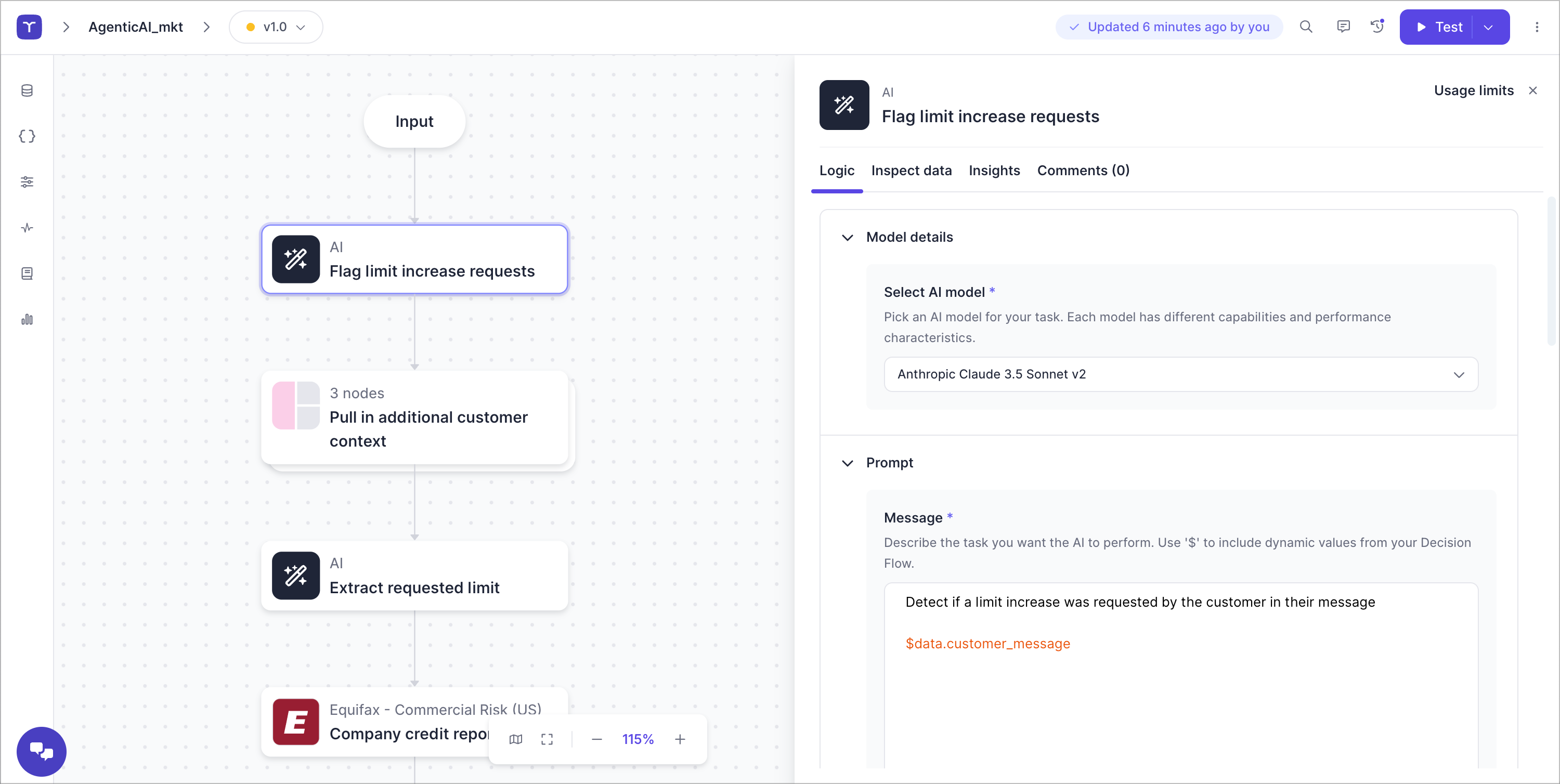

The AI Workbench for Risk

AI-powered decision-making, Copilot intelligence, and AI Agent automation—built for risk teams. Enhance your risk management strategies across the entire lifecycle with AI-driven precision.

Discover the latest insights on real-time credit decision-making

Taktile was recognized as market leader by G2 for three quarters in a row

Optimize your credit risk strategy on Taktile.

Let’s start with a conversation—tell us your needs, get your questions answered, and see firsthand how Taktile can support your goals.

Discover Taktile