AI, Product 5 min read

Risk AI in action: How risk teams are building AI agents for real-world impact

Teams in fraud, credit, and compliance have long relied on AI-powered models to score credit, detect fraud, and assess risk patterns. But we’ve reached a turning point: AI is no longer just about making predictions. With the rise of Generative AI (GenAI)—powered by Large Language Models (LLMs)—risk teams now have the ability to rethink, rebuild, and optimize financial products with more flexibility, speed, and intelligence than ever before.

Yet, to truly harness the full potential of AI in all its forms, teams need the right tools to operationalize it effectively. In this first installment of Risk AI in Action, we explore how Taktile’s Agentic AI Workbench is enabling organizations to scale AI-driven decision-making—minimizing risk, unlocking new opportunities, and, most importantly, turning AI into real business value.

Key takeaways

- Turning AI from hype into a competitive advantage: To unlock true value in high-stakes risk environments, AI must be adaptable, context-aware, and fully auditable—precisely tailored to your organization’s unique products, customers, and processes.

- The Agentic AI Workbench for risk teams: Taktile’s Decision Platform offers a centralized workbench where credit, compliance, and fraud teams can safely experiment with AI, monitor performance in real-time, and seamlessly integrate diverse ML/AI capabilities into a controlled environment.

- Tailored AI Agents drive efficiency and growth: A key strength of the AI Workbench is its ability to empower teams to build and deploy 'Risk AI Agents'. Leveraging Taktile’s built-in AI Node, teams can create custom AI Agents that autonomously execute risk-based actions—such as adjusting credit limits—boosting operational efficiency, enhancing accuracy, and unlocking new growth opportunities.

From AI hype to real-world impact

Without the right tools and infrastructure, AI simply remains an experiment rather than a competitive advantage. To be truly effective in high-stakes risk environments, AI should be:

1. Customizable & accurate – AI tools must be highly tailored, as financial institutions differ significantly in their strategies, target customer segments, and internal processes. The only way to ensure AI aligns seamlessly is through precise customization.

2. Context-aware & embedded – Decisions you make throughout a customer's lifecycle rely heavily on non-public information. To ensure accuracy, you need to integrate high-quality data from internal systems and external vendors while keeping decisions connected to your broader risk infrastructure.

3. Controlled & auditable – AI-driven decisions must be well-tested, transparent, traceable, and compliant to build trust and accountability.

The need for teams to access customizable, embedded, and well-controlled AI in financial services led us to launch a suite of capabilities that transforms Taktile’s Decision Platform into an Agentic AI Workbench.

The Agentic AI Workbench

An AI Workbench is more than a platform—it’s a mission control center providing:

- A centralized environment for safe experimentation, allowing teams to test AI-powered risk models, iterate with confidence, and refine models before deployment.

- The ability to combine multiple AI capabilities, such as document parsing and risk scoring, into a single workflow.

- A secure deployment framework, with built-in A/B testing, real-time monitoring, and oversight to ensure AI remains explainable and auditable, for example:

But what truly sets the AI Workbench apart is its ability to deploy AI Agents—autonomous systems that don’t just analyze risk but take action in real time.

What is an AI Agent?

An AI Agent is a system that makes decisions and takes actions on its own, adapting to different situations. For example, it can raise alerts for human investigators or temporarily freeze a credit card if it detects suspicious activity. Unlike traditional AI models that simply provide predictions for fixed processes, AI Agents break down complex tasks, choose the right tools for each step, and act independently based on the specific scenario.

In our experience, effective agents often combine multiple components:

- Large language models to interpret information and reason.

- Logic and instructions to ensure outputs are structured and respect key guardrails.

- Connectivity to risk information, internal systems, and third-party data vendors.

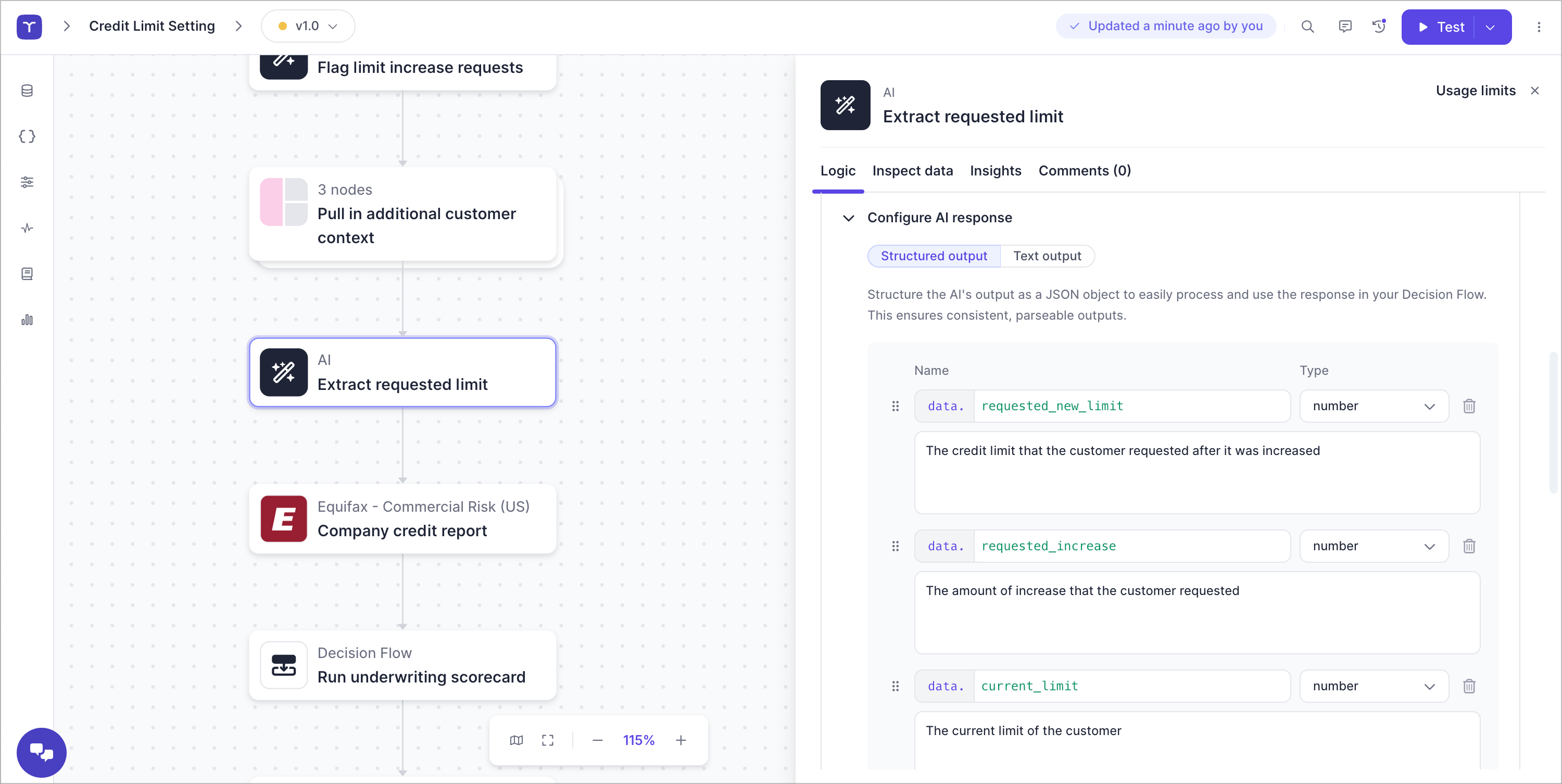

The ability to build and deploy agents on Taktile's AI Workbench is made possible by the AI Node. This built-in capability serves as the link between AI models and real-world decision-making, enabling risk teams to integrate advanced model intelligence into their workflows.

The AI Node connects with all parts of the Taktile Platform, enabling AI Agents to access platform data, interact with external and internal systems, and leverage scorecards and machine learning models. Unlike third-party LLM providers, Taktile hosts models within its own secure infrastructure, keeping all data secure and preventing any third party from accessing it.

The value of building your own ‘Risk AI Agents’

In risk management, the real value of AI isn’t in individual models, predictions, or point solutions—it’s in how you combine and apply them within your product and customer workflows. Simply integrating standalone AI models or using off-the-shelf AI Agents without customization rarely works because processes, data structures, and preferences differ so much across organizations.

The real advantage lies in building a Risk AI Agent tailored to your needs—where you can harness the best AI tools for your product and segment while automating repetitive, manual tasks to free up your team. Everyone has access to LLMs. The key is structuring and shaping AI-powered decisions to fit your business and function.

Example use case: AI-powered credit limit adjustments

As an example, consider an AI Agent that automates credit limit adjustments. Today, this process is often manual and typically involves these steps:

Step 1: The customer requests a credit limit increase through various channels, such as in-app chat, support tickets, email, or Slack.

Step 2: The financial institution manually reviews the request, interpreting unstructured customer messages to decide whether to approve the increase.

Step 3: If approved, the financial institution processes and applies the new credit limit.

How would this process look if executed via a Risk AI Agent?

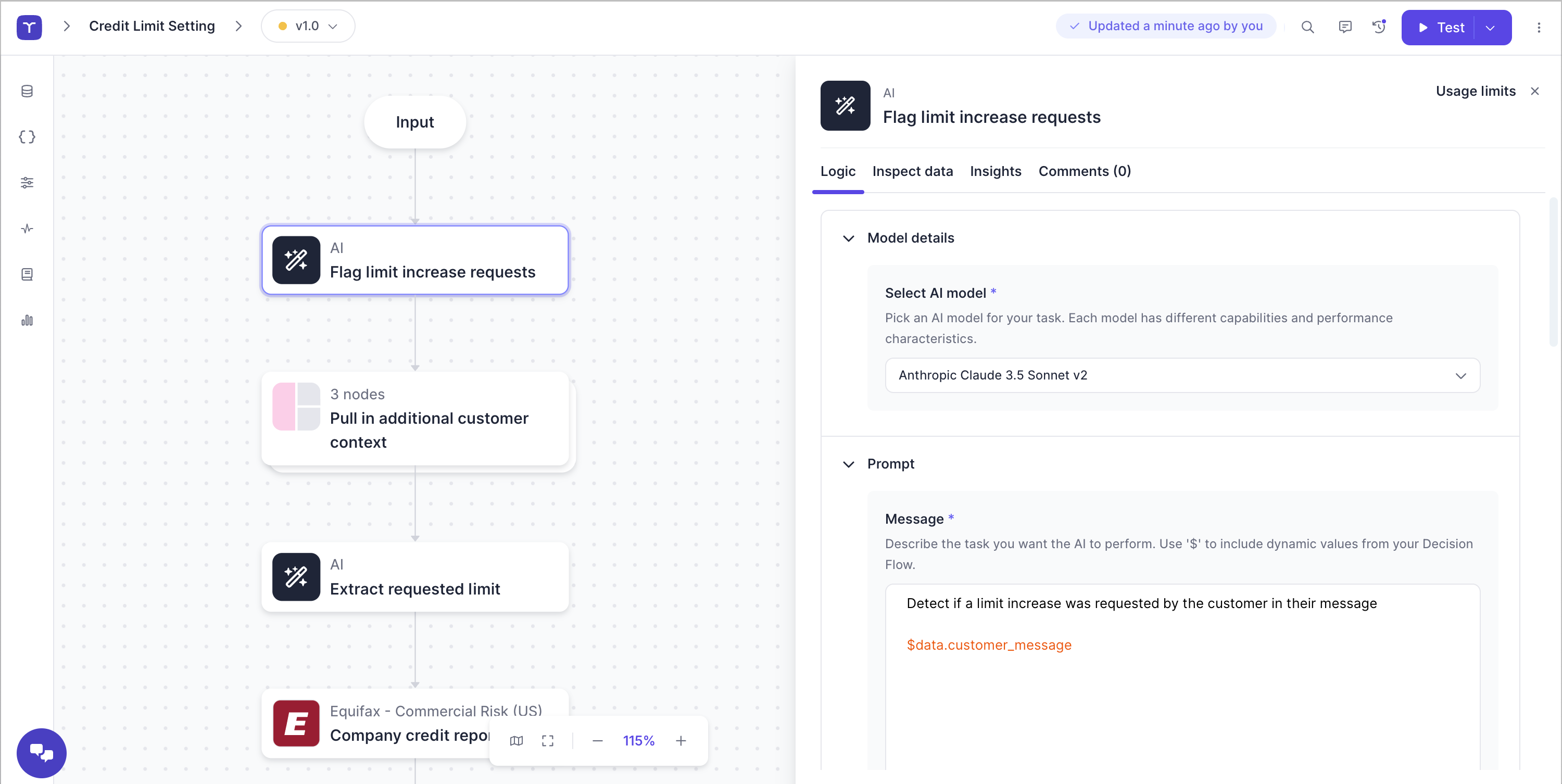

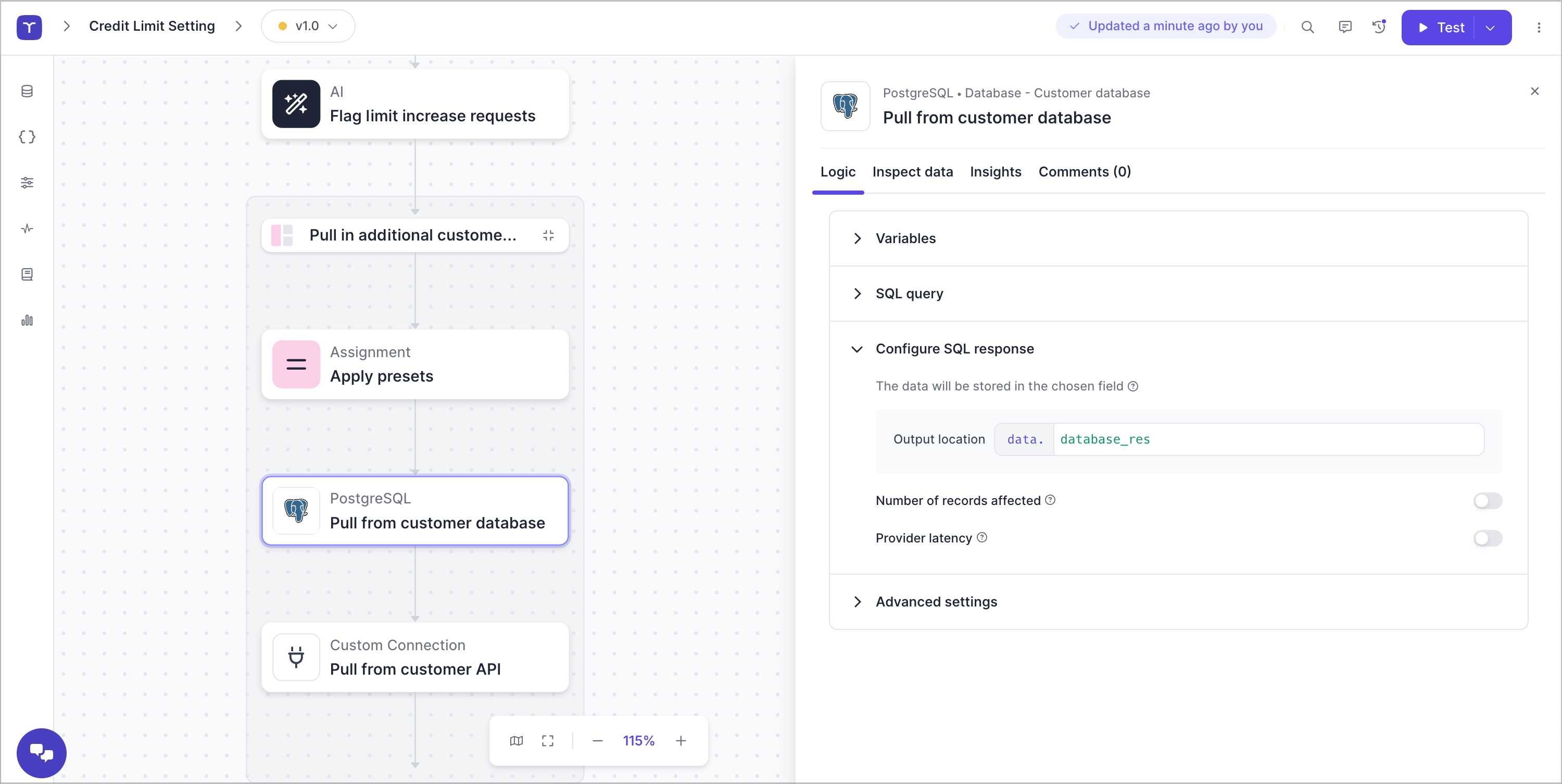

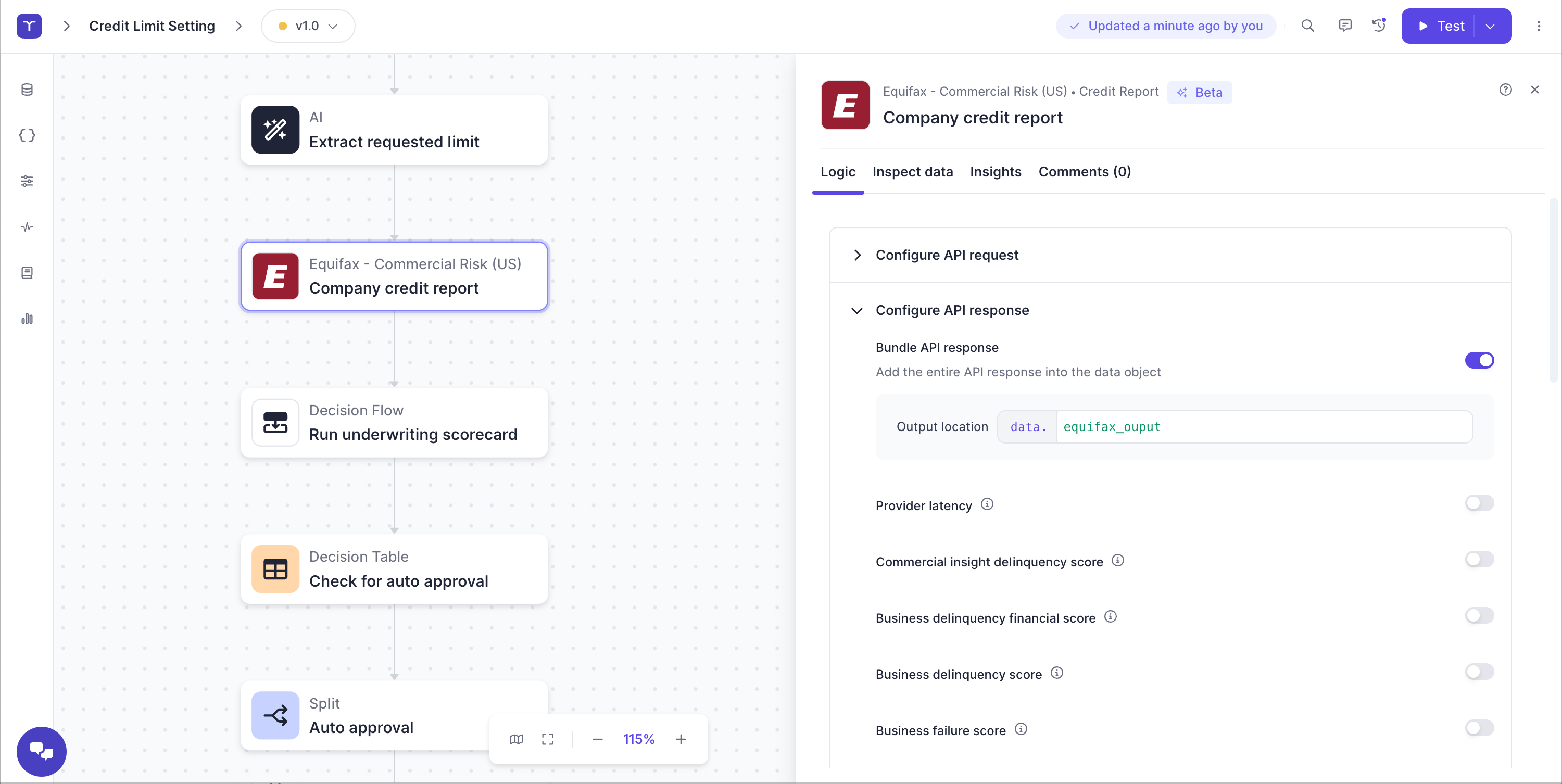

On Taktile’s Decision Platform, teams can build a custom Risk AI Agent using modular building blocks that leverage multiple LLMs within a structured workflow. These blocks work together to automate key tasks, including:

1. Identifying limit increase requests

2. Pulling customer context

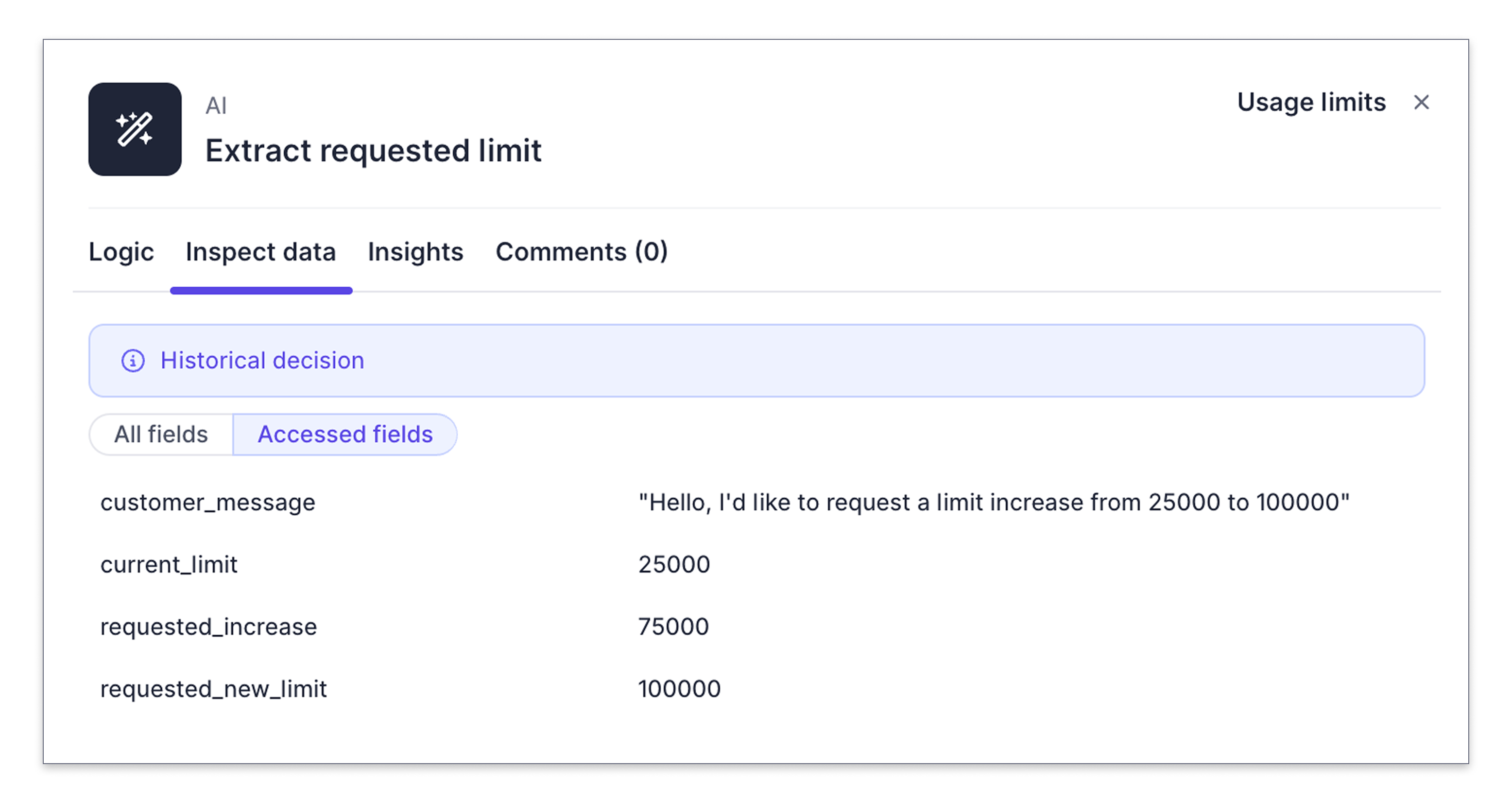

3. Extracting the requested limit amount

4. Running rescoring checks

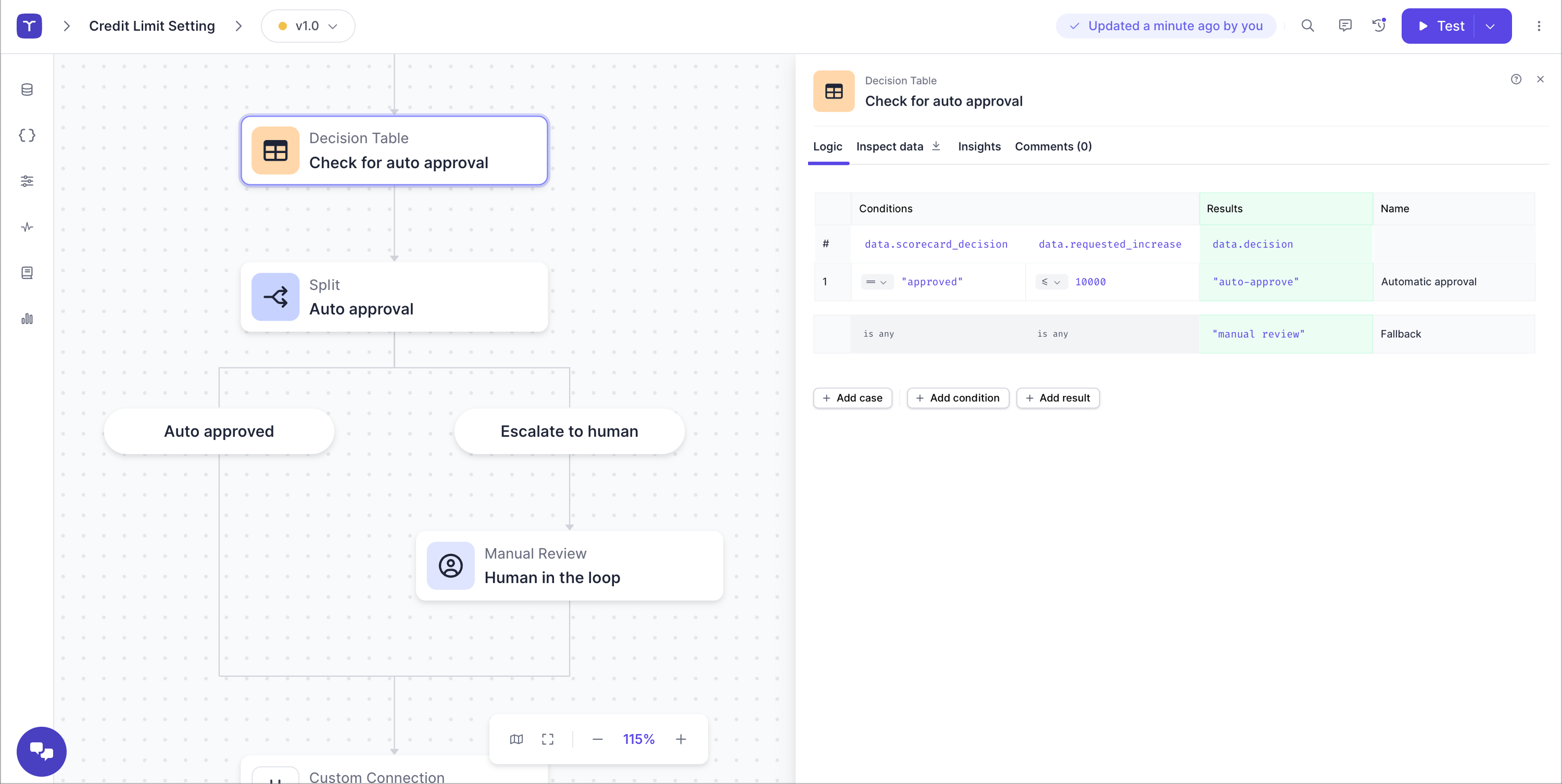

5. Applying bucketing logic to determine whether the request needs manual review

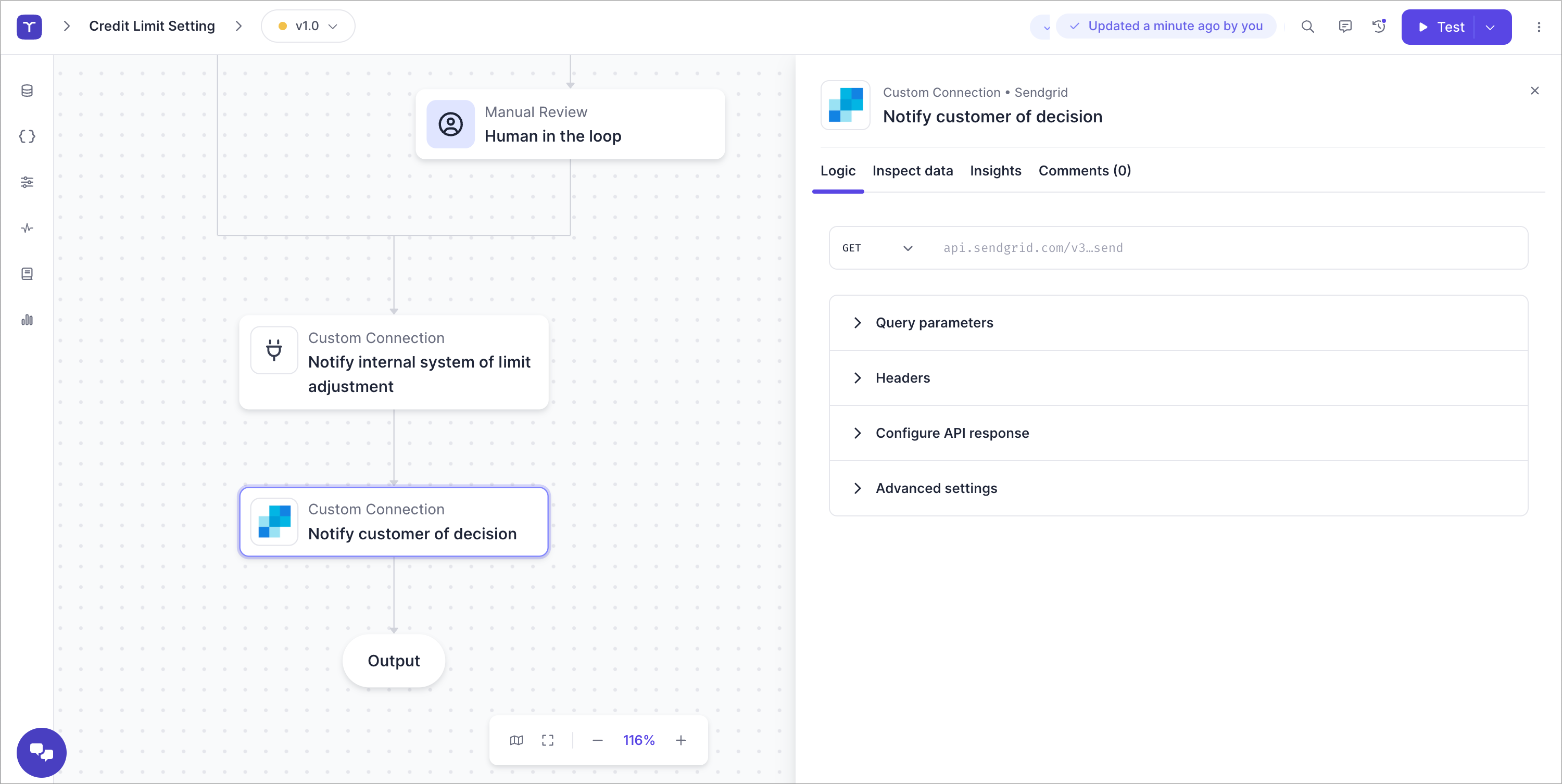

6. Applying the new limit to internal systems of record and notifying the customer of the decision

Recently, forward-thinking B2B fintech Credix deployed a custom Risk AI Agent on Taktile to streamline their credit limit adjustments. As a result, Credix reduced manual intervention time by over 95%, cutting decision times from hours to seconds and eliminating 50–100 manual reviews per day. As Maxim Piessen, Co-Founder and CTO, explains:

"Using Taktile’s AI Node, we’ve built an AI Agent that streamlines our limit increase requests end-to-end. When a customer submits a request in Slack, an LLM automatically interprets their intent and extracts key details. The agent then evaluates the request using our decision-making logic, factoring in rescoring checks and risk thresholds. Finally, the agent responds directly in Slack with a natural-language decision—either approving the request or flagging it for manual review. This automation saves our team valuable time while ensuring consistent, controlled decision-making.”

The future of risk management with AI Agents

AI Agents aren’t just automating tasks—they’re expanding how much risk teams can do. By making decisions faster, more accurate, and adaptable, they reduce risk exposure, catch more fraud, and unlock new growth opportunities. For risk teams, the shift isn’t about replacing humans—it’s about scaling smarter, working faster, and staying ahead of emerging risks.

Recommended additional reading

- How LLMs are becoming investigative partners in fintech fraud detection

- From credit scoring to GenAI: How modern credit decision-making has evolved—and what’s next

- Decision-making reimagined: AI Copilot unlocks new possibilities for risk teams

- AI without the hype: Getting true value from LLMs without getting distracted

Frequently Asked Questions (FAQs)

Q: How does agentic AI work in financial services?

A: Agents are AI systems that don’t just predict risk but can take real-time actions, such as adjusting credit limits or flagging suspicious activity. Unlike traditional ML models, AI Agents combine LLMs, logic, and data integrations to make smarter, automated decisions.

Q: How can AI Agents improve fraud detection and compliance?

A: AI Agents enhance fraud detection by analyzing real-time behavioral signals and external data, while also automating compliance checks. This can reduce false positives and manual reviews, giving risk and compliance teams more efficiency and accuracy.

Q: What role does Generative AI play in risk management?

A: Generative AI (GenAI) enables risk teams to interpret unstructured data faster and more accurately, automate decisions, and build explainable, auditable models. With tools such as Taktile’s AI Workbench, GenAI becomes practical and safe for critical decisions.

Q: Why do financial institutions need customizable AI decision strategies?

A: Every institution has unique processes and customer segments. Off-the-shelf AI often falls short, but customizable AI decision strategies help teams tailor agents for credit risk, fraud detection, or onboarding.

Q: How does agentic AI in risk management create business value?

A: By automating manual tasks and improving decision accuracy, agentic AI can help reduce losses, speed up customer experiences, and unlock new growth opportunities. For example, AI-powered credit limit adjustments can cut review times from hours to seconds. Talk to our team about building your own AI Agents with Taktile.