GenAI, AI 5 min read

GenAI applications in risk management: 10 real-world examples from industry frontrunners

A practical guide for risk and innovation leaders exploring how to apply Generative AI across credit, fraud, compliance, and operations.

In executive suites and transformation teams across financial services, one question is building in urgency: How can we thoughtfully apply Generative AI (GenI) to risk management?

This isn’t just a technology trend—it’s a strategic shift in how decisions are made. Across credit underwriting, fraud prevention, and compliance, risk teams are under growing pressure to make faster, smarter, and more adaptive decisions. They’re expected to catch emerging threats sooner, tailor policies to ever-more nuanced customer segments, and operate with greater efficiency and transparency—all at scale.

AI, and particularly GenAI, offers a promising path forward. When integrated into modern decision infrastructure, it enhances how teams reason about risk, reduces operational friction, and unlocks new ways to deliver value. But with so much noise in the market, it can be challenging to know where to start.

This guide aims to provide clarity. We’ll explore three high-impact areas where GenAI is already making a measurable difference and walk through ten real-world applications where leading risk teams are seeing results today.

Where does GenAI help in risk management?

Across institutions, we see three distinct areas where GenAI is already adding meaningful value. Each represents a high-leverage opportunity to rethink how decisions are made, managed, and operationalized.

1. Supercharging your business-critical decisions

Large language models (LLMs) can significantly improve core decision-making processes. By synthesizing vast and diverse datasets—including structured financial records and unstructured information like customer communications and market news—AI provides nuanced insights that augment human-designed policies. This enables risk teams to detect subtle patterns, adapt swiftly to changing conditions, and incorporate a broader range of data without adding complexity.

For instance, in credit risk assessment, GenAI can identify early signs of borrower risk by analyzing online behaviors and transaction histories, offering context beyond traditional credit scores. In fraud detection, GenAI models can evaluate the plausibility of data inputs (e.g., income vs. occupation) to flag suspicious patterns often missed by rule-based systems.

2. Supercharging your analysts

GenAI is also transforming the role of the risk analyst by making advanced decision-making capabilities more accessible. Where once technical barriers limited experimentation, GenAI now enables analysts to design, test, and iterate on strategies without writing code or relying on engineering teams.

For example, GenAI can suggest improvements to existing logic, identify edge cases, and support rapid A/B testing to refine risk management strategies. In addition, analysts can integrate and assess new data sources—structured or unstructured—without the overhead of manual preprocessing or technical validation.

Together, these capabilities shift risk strategy from static and reactive to dynamic and iterative. Analysts can now move from hypothesis to implementation quickly, improving decision precision and supporting a culture of continuous optimization.

3. Supercharging your operational teams

GenAI can also automate manual, error-prone workflows such as document parsing, data matching, and case triage from customer onboarding to transaction monitoring. This automation not only reduces the risk of human error but also allows operations teams to scale efficiently and focus their efforts on higher-value tasks.

Examples include:

- Document processing: GenAI can extract and interpret information from various document types, streamlining processes like loan applications and compliance checks.

- Alert prioritization: In anti-money laundering (AML) efforts, GenAI can filter and rank alerts, enabling investigators to concentrate on high-risk transactions and reducing noise.

- Conversational AI agents: AI-powered chatbots and voice assistants can handle routine customer interactions, such as payment scheduling and information updates, freeing up human agents for more complex inquiries.

The value of GenAI for financial institutions

When used thoughtfully, GenAI in risk management does more than improve technology—it drives meaningful change across three key areas of value:

1. Enhanced decision quality

GenAI brings new dimensions of precision and adaptability to credit, fraud, and compliance strategies. Decisions become more consistent, context-aware, and aligned with evolving business goals.

2. Significant cost savings

By reducing the volume of manual work, AI lowers operational costs. It also reduces dependency on engineering resources—freeing them to focus on more strategic initiatives.

3. Improved customer experience

Faster decisions, fewer false positives, and less friction translate directly into better customer outcomes. Whether it’s instant credit decisions or streamlined onboarding, GenAI helps you meet rising expectations.

10 real-world GenAI applications that are delivering impact in risk management

Across the financial industry, GenAI is moving from experimentation to execution. Below, we highlight how leading teams at fintechs and banks are embedding GenAI into critical decision workflows—driving measurable gains in accuracy, efficiency, and customer experience.

Enhancing decision quality:

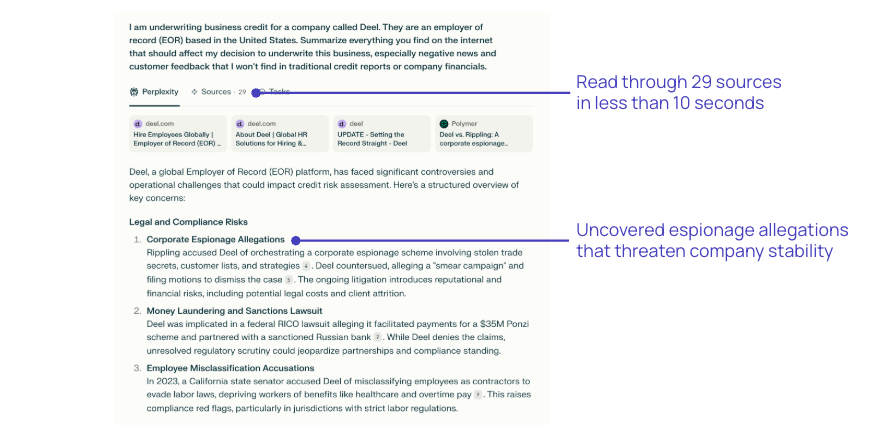

1. Credit underwriting: Online risk signal detection

GenAI models can scan and summarize publicly available online information—such as news articles, websites, or press releases—to help surface risk signals related to a borrower or business. This capability can add an additional layer of context to credit assessments, supplementing traditional financial and bureau data.

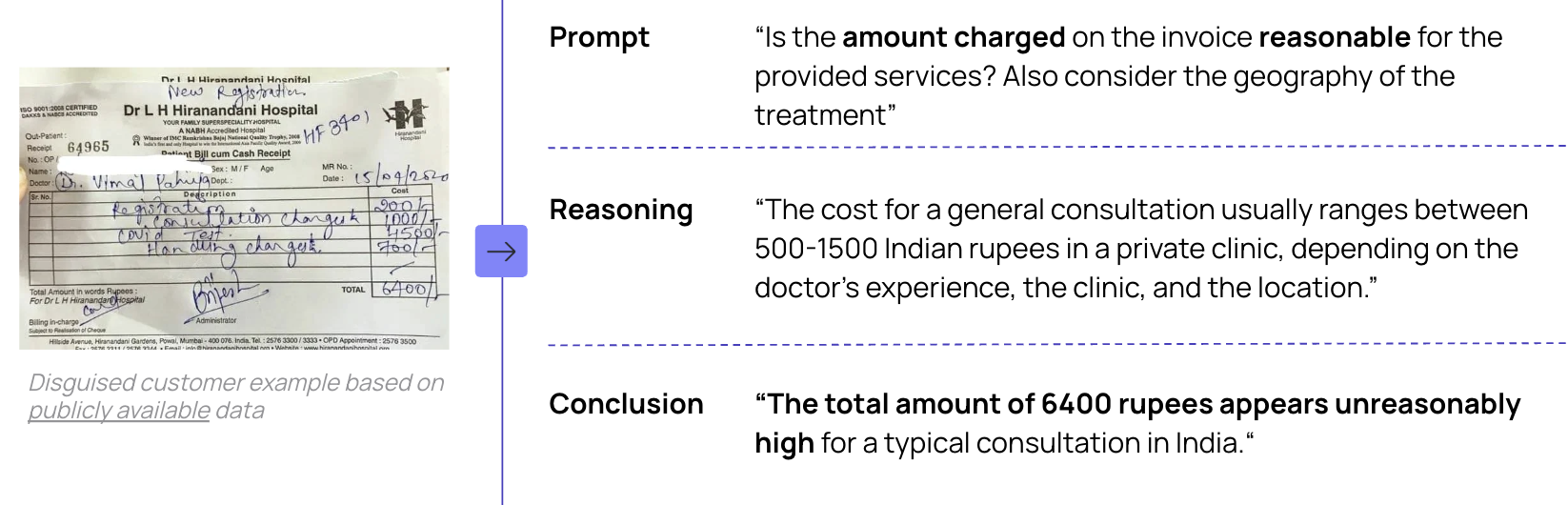

2. Fraud prevention: Plausibility checks via LLMs

LLMs can assess whether individual data points appear logically consistent when considered together—such as whether a reported income aligns with a given occupation, or whether the cost of a transaction matches the described service. This form of plausibility checking can complement existing fraud detection methods by highlighting unusual patterns that may not be captured by static rules.

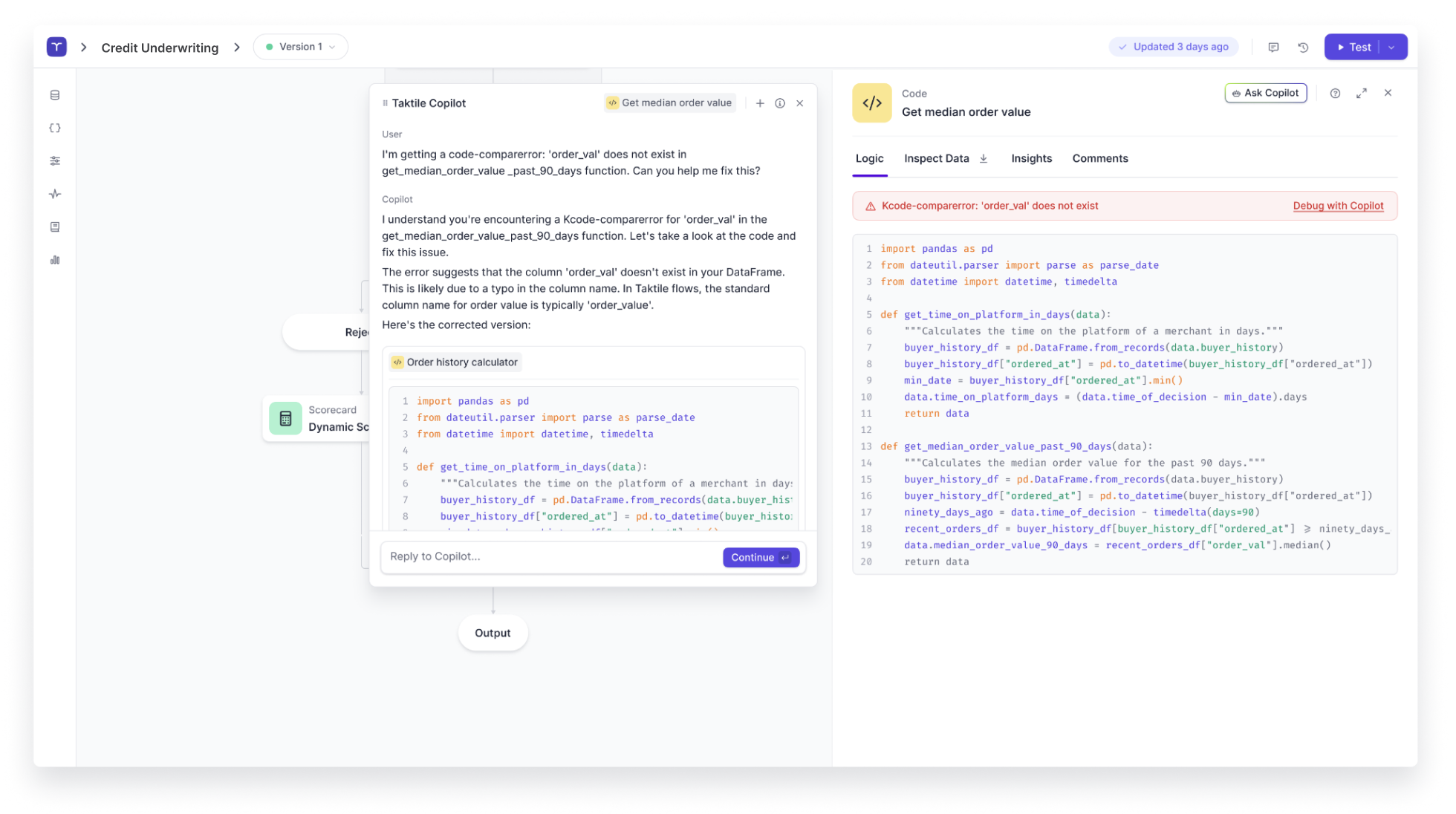

3. Credit underwriting: Policy optimization with AI Assistance

GenAI ‘copilots’ can support risk functions to optimize credit policies by helping them write complex code, debug logic, and test rules. Powered by LLMs, these copilots interpret policy structures and outcomes to provide contextual guidance—accelerating iteration without increasing engineering dependency.

Reducing costs:

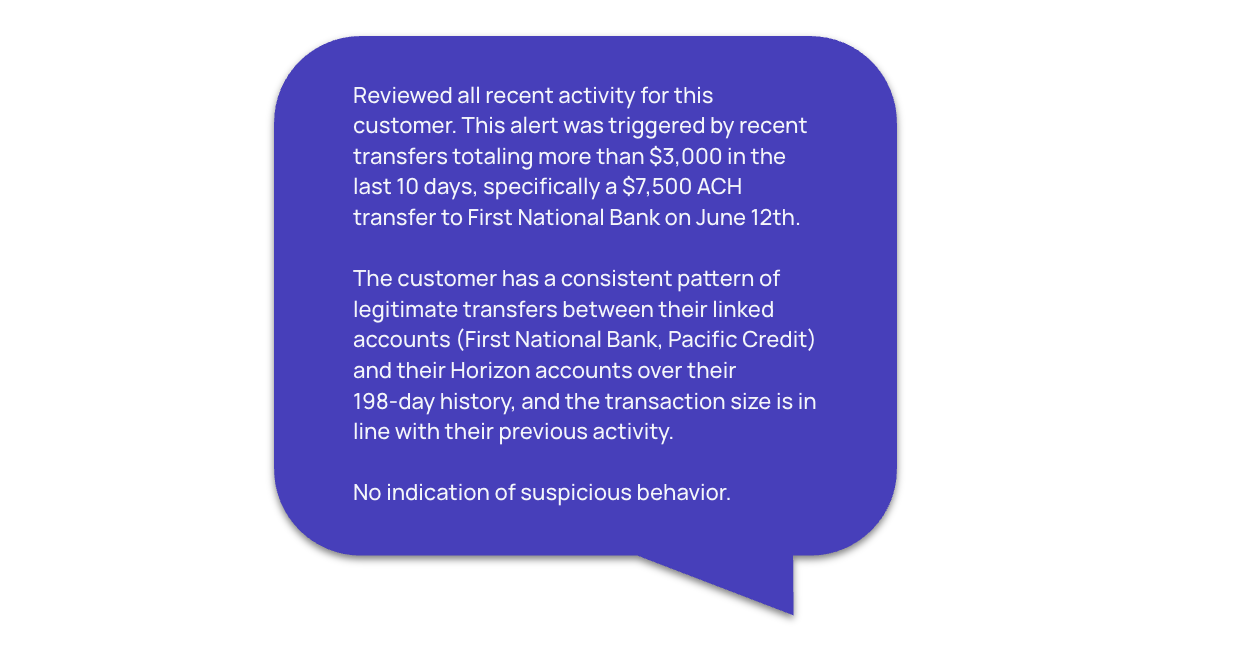

4. AML: AI-powered transaction monitoring investigation

In AML and compliance workflows, GenAI assistants can compile and summarize relevant case details—such as counterparties, patterns, and historical context—to support faster and more informed alert investigations. This enables teams to assess potential risk more efficiently, without changing existing monitoring standards.

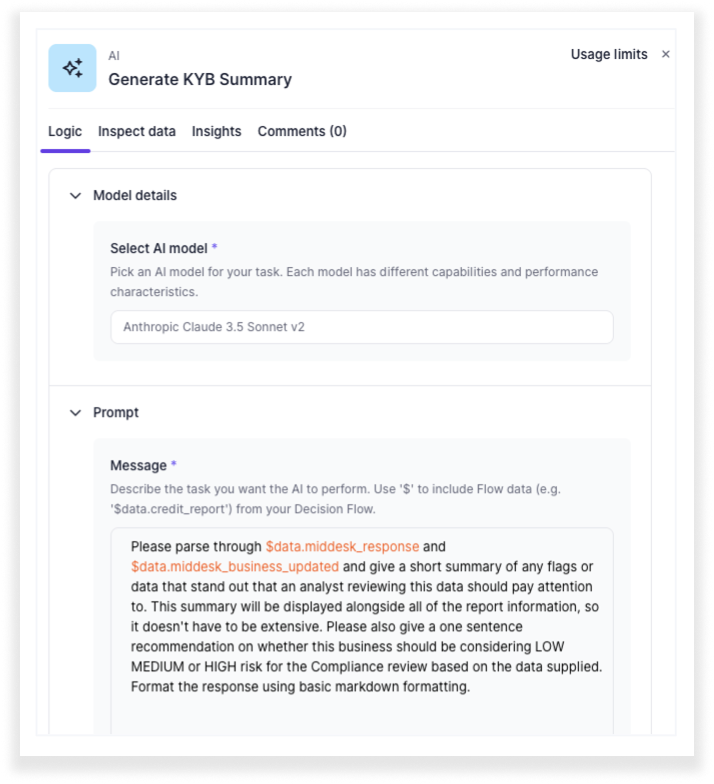

5. KYB: AI-powered triage of KYB alerts

AI assistants can also be used to review KYB alerts, generate clear case summaries, and recommend actions to speed up manual decision-making. For low-risk or routine cases, AI assistants can auto-resolve alerts entirely—freeing up teams to focus on complex investigations while improving overall efficiency and consistency.

6. Collections: Conversational AI Agents

Conversational AI agents have the power to transform how collections teams manage repayments by automating outreach across voice and chat channels—at scale and with a personal touch.

These AI-powered agents can handle routine repayment interactions autonomously, allowing teams to redirect their focus to complex cases and higher-value work. Credix, a fintech that helps SMBs access credit in emerging markets, adopted this approach by deploying two custom agents, “Bruna” and “Bruno,” which now fully automate its collections workflow.

As explained by Maxim Piessen, Co-founder of Credix, “In just a few months, Bruno now resolves 80% of repayment cases on its own. That’s freed our team to concentrate on strategic growth and deeper client engagement—while we continue scaling fast.”

Discover Credix's collections agent in action

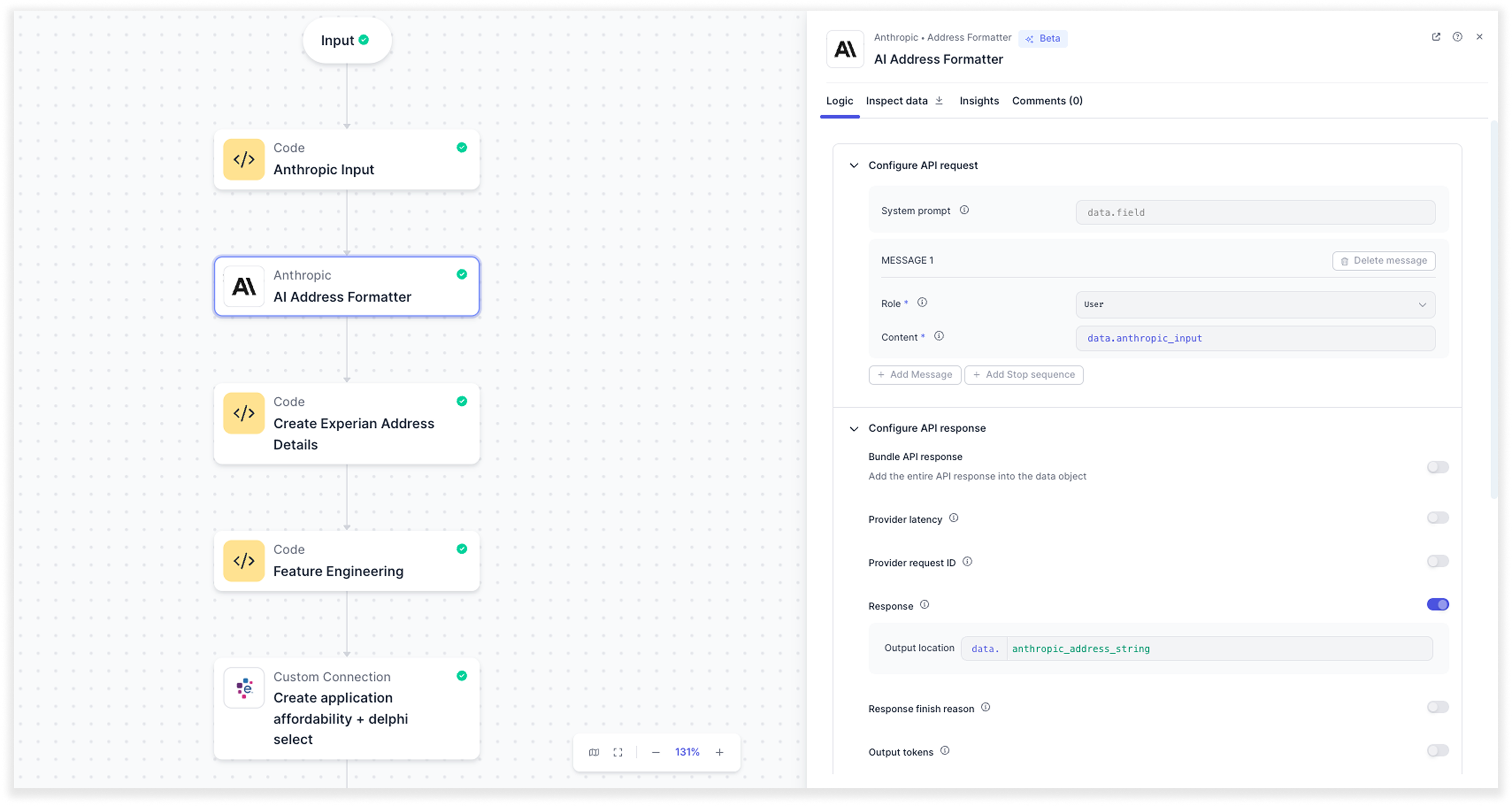

7. KYC: AI-driven address matching to support KYC

Generative AI can help onboarding teams standardize addresses submitted in varying formats by parsing, interpreting, and reformatting them into a consistent structure. This reduces false flags during KYC checks, improves data quality, and minimizes the need for manual intervention on formatting-related issues.

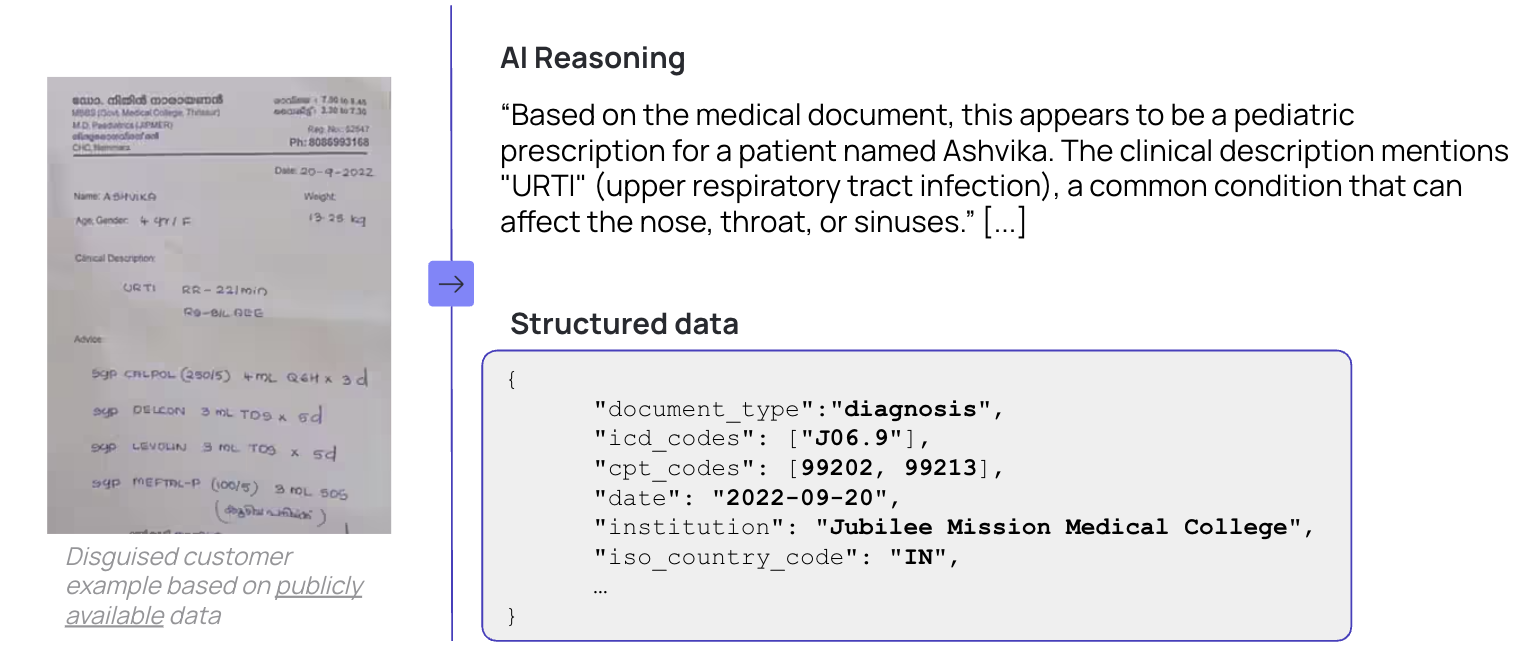

8. Risk management operations: Document Parsing with AI OCR

GenAI combined with OCR technology can extract, interpret, and structure data from unstructured documents such as PDFs, scanned forms, and contracts. This reduces the need for manual data entry and accelerates processes like onboarding, verification, and risk reviews.

Improving user experience:

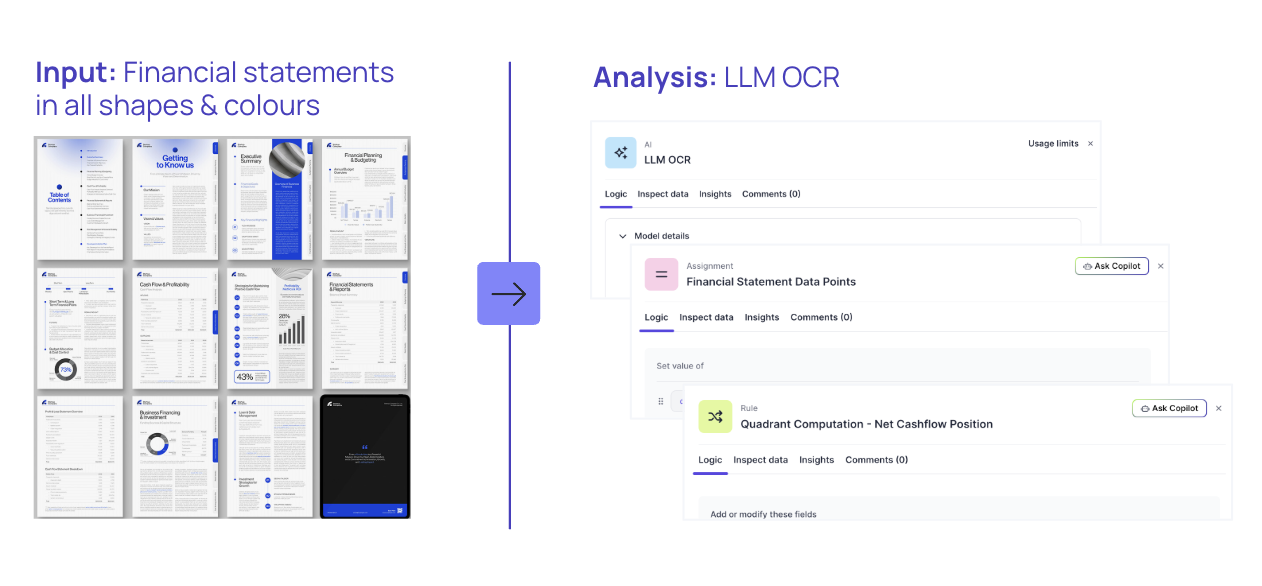

9. Credit underwriting: Document understanding in real-time

GenAI can process uploaded documents—such as financial statements or income proofs—in real time, extracting key data points and analyzing them for relevance to underwriting criteria. This enables faster, lower-friction credit decisions while reducing manual review requirements.

10. Credit underwriting: Dynamic credit limit adjustments

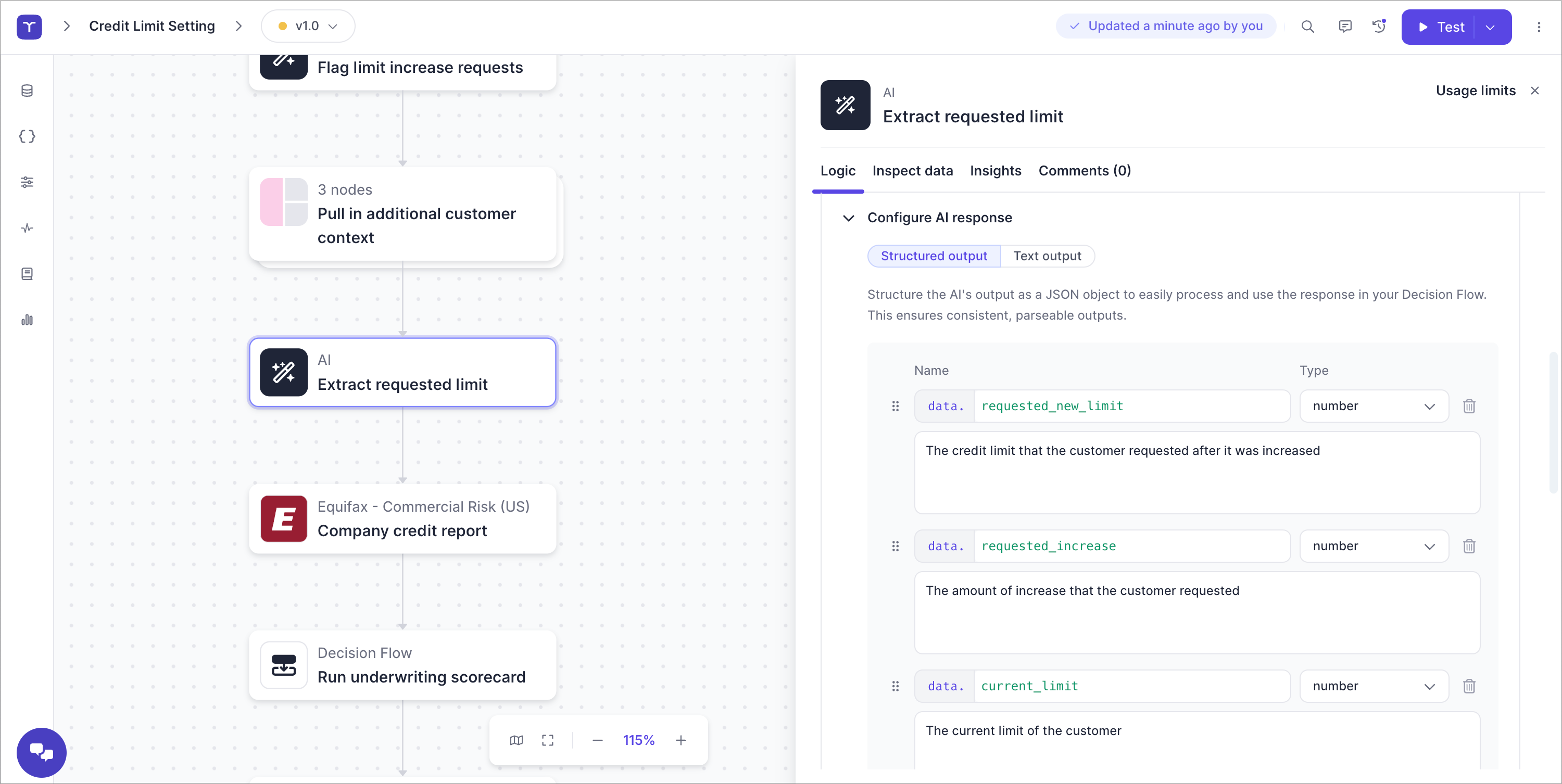

Teams can design custom AI agents that orchestrate multiple LLMs within a structured workflow to automate complex servicing tasks. For example, these agents can identify limit increase requests, retrieve customer context, extract the requested amount, trigger rescoring, apply bucketing logic to determine review needs, and—if approved—update internal systems and notify the customer.

How to get started with GenAI—responsibly and strategically

Adopting GenAI in risk management isn’t about jumping to end-state automation. It’s about laying a foundation that supports iteration, oversight, and scale. The most successful teams start by enabling structured experimentation—so they can move quickly without losing control.

Here are three capabilities to prioritize:

1. Composable infrastructure for data and systems integration

Your solution for leveraging GenAI should be easy to plug into your existing technology stack. This includes connecting to internal systems like data warehouses, CRM platforms, and custom risk models—as well as third-party providers for identity, credit, fraud, or compliance data. A low-code, composable decision platform will enable your teams to orchestrate data flows, policy, and rule logic, as well as AI models without heavy engineering lift. This agility is essential for adapting to new products, markets, or regulatory shifts.

2. Human-AI hybrid strategy design

In risk management, human oversight isn’t optional—it’s foundational. Look for tools that allow AI-driven logic to coexist with rule-based strategies and manual reviews. This makes it possible to automate high-volume, low-variance cases while escalating ambiguous ones to experts. Ideally, you can configure workflows that flexibly route decisions based on context, confidence scores, or operational thresholds—so your teams retain agency over final outcomes.

3. Embedded testing, monitoring, and auditability

Treat every AI-assisted decision as a testable, trackable process. A robust platform should support end-to-end experimentation, including back-testing against historical data, A/B testing in live traffic, and continuous monitoring of key performance indicators. It should also generate audit-ready logs for every decision—so you can demonstrate compliance, debug issues, and explain outcomes to both regulators and internal stakeholders.

The next chapter for risk management: Human expertise, enhanced by GenAI

The core principles of great risk management—sound judgment, accountability, and adaptability—aren’t going away. What’s changing is the toolkit. GenAI offers a powerful way to extend human expertise, streamline complexity, and accelerate decision-making where it matters most.

With the right foundation, risk teams can move faster, respond smarter, and unlock new strategic value—without compromising on control or compliance.

Wherever you are on your AI journey, the opportunity is clear: to build a more agile, intelligent, and resilient risk function for the future.

Discover how risk teams are embracing GenAI on Taktile

Frequently Asked Questions (FAQs)

Q: How is Generative AI being used in financial risk management?

A: Generative AI (GenAI) is transforming credit underwriting, fraud detection, compliance, operations, and more. From automating document parsing to enhancing transaction monitoring, GenAI helps risk teams make faster, more adaptive, and cost-efficient decisions.

Q: What are the benefits of applying GenAI in fraud prevention?

A: GenAI adds reasoning capabilities beyond rules-based systems - flagging inconsistencies in invoices, transactions, and customer data that traditional models miss. This reduces false positives, accelerates investigations, and strengthens fraud prevention in fintech and banking.

Q: Can Generative AI improve compliance and AML processes?

A: Yes. GenAI automates time-consuming tasks like sanctions screening, KYB/KYC checks, and AML case triage. It helps compliance teams reduce noise, focus on high-risk cases, and meet regulatory requirements with greater accuracy and speed.

Q: How does GenAI support credit risk assessment?

A: In credit underwriting, GenAI enriches traditional models by analyzing unstructured data, detecting subtle borrower risk signals, and processing documents in real time. This leads to faster credit decisions and lower customer drop-off rates.

Q: What’s the best way for risk teams to start with Generative AI?

A: The key is structured experimentation: using a decision platform that combines AI with existing risk models, supports low-code testing, and provides monitoring and audit trails. This ensures GenAI enhances decision-making while maintaining compliance and control. Request a demo to discover how Taktile’s AI Decision Platform can enhance your risk decisions.