Company 3 min read

Taktile raises $54M to enable risk experts to take control of AI adoption for decision-making in financial services

In 2022, we raised our Series A with a mission to transform how financial service providers automate decision-making. Since then, Taktile has become the decision platform of choice for the world’s most innovative fintechs, banks, and insurance companies.

Today, I couldn’t be more proud to announce that we have raised a further $54 million in a Series B funding round, to continue empowering teams at fintech companies and financial institutions to optimize their risk management strategies across the entire customer lifecycle. The round was led by Balderton Capital, with participation from existing investors Index Ventures, Tiger Global, Y Combinator, Prosus Ventures, Visionaries Club as well as Larry Summers, former US Secretary of the Treasury, bringing Taktile’s total funding to date to $79 million.

In 2024, we quadrupled our customer base and grew over 3.5x in ARR. Our customer base spans 24 markets, encompassing sophisticated fintech companies such as Mercury, Kueski, and Zilch, as well as some of the world's largest financial institutions, including Allianz and Rakuten Bank.

We have been recognized as a category leader by G2, a leading user review platform, for three consecutive quarters, most recently earning over 12 accolades in its Winter 2025 report. Reflecting our impact once implemented within an organization, we have also gained industry recognition. At the 2024 Banking Tech Awards USA, hosted by FinTech Futures, we won the “Tech of the Future – Decision Making” award.

Our decision platform is already delivering hundreds of millions of risk decisions every month and the additional funds will be used to accelerate this momentum further as Taktile is equipping business teams with the necessary tools and controls to build transparent AI-powered risk decisions.

In high-stakes industries, AI adoption must be guided by experts with deep, risk domain expertise.

While AI has been broadly adopted for use cases such as chatbots in customer support and real-time personalization in marketing, mainstream automation for high-stakes decisions is just about to break through in 2025. The main difference in applying AI to risk decisions in financial services, such as credit underwriting, account opening, or transaction monitoring, is that errors are extremely costly. Wrong decisions can result in costly loan defaults, fraud losses, preventing good customers from accessing services, or compliance fines by regulators. Only last October TD Bank agreed to pay $3.1 billion to resolve allegations claiming it failed to implement adequate controls to detect and prevent money laundering as regulators across the globe become more concerned with transaction-level controls.

In financial services and other regulated industries, the stakes are high, and every decision matters. Established institutions face intense pressure as AI-driven fintech startups rapidly innovate, challenging their market share and margins. However, many enterprises struggle to adopt AI at scale. The main hurdles? A shortage of highly skilled engineers to develop and maintain AI systems, plus the need for greater precision—since even the most advanced LLMs today can only handle specific aspects of complex problems, rather than providing fully reliable solutions. As Goldman Sachs CEO David Solomon put it: “95% of an S1 filing can be completed by AI in just a few minutes.” However, he continues, “The last 5% now matters because the rest is now a commodity”.

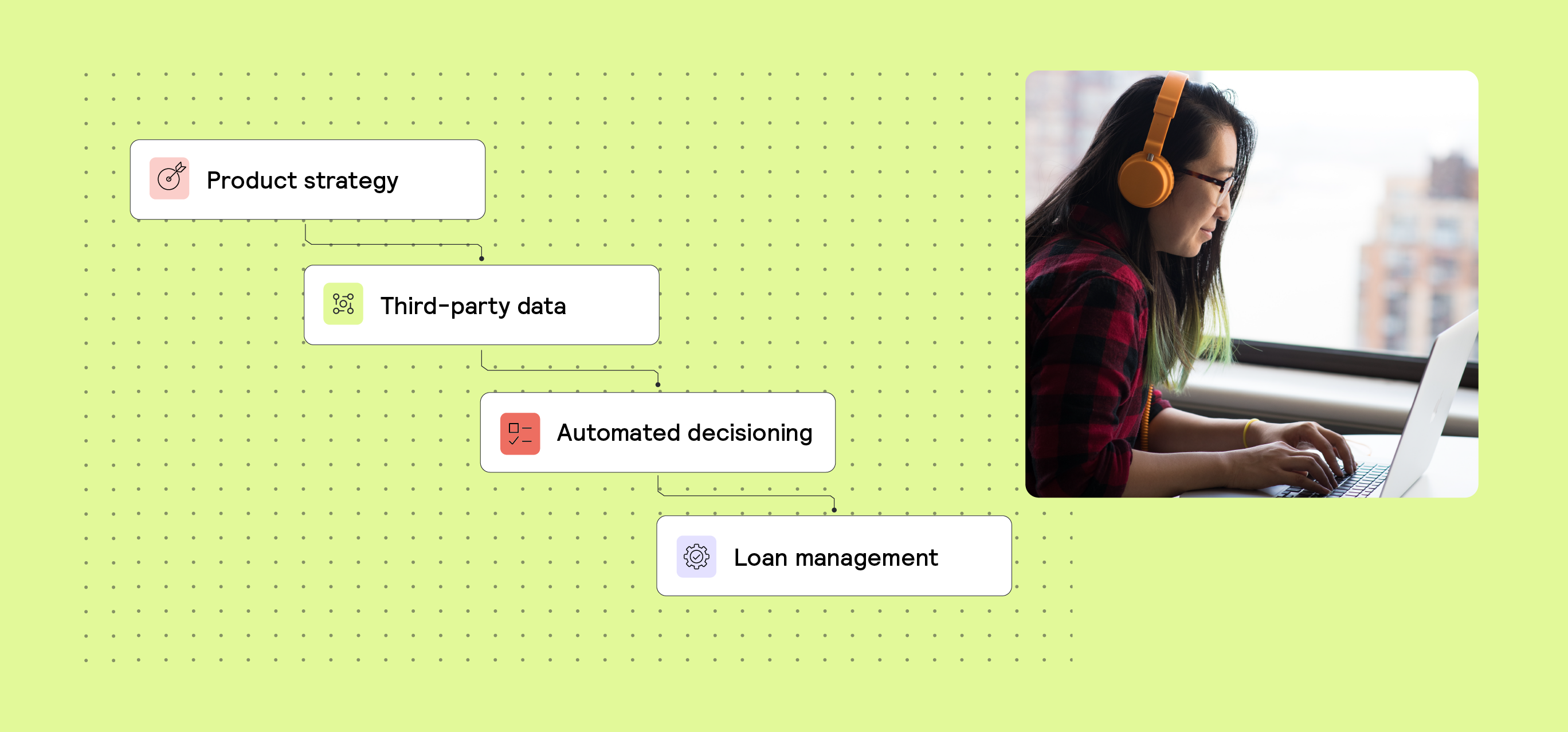

Taktile closes this gap by equipping risk teams and their engineering counterparts with a shared platform to build, manage and optimize complex AI-powered workflows and agents that are governed by rules and embedded into business logic. Transforming AI from just an experiment to something that delivers genuine business value.

From day one of our journey, I believed that millions of lives could be improved by enabling organizations to make optimal decisions for their customers. By keeping experienced risk experts in control, we make it possible for even the most regulated businesses in financial services to fully adopt AI into high-stakes workflows.

As explained by Rob Moffat, General Partner at Balderton Capital, “The best investments for VCs are when your reaction to the company is “of course - why doesn’t this happen already?”. It is crazy that businesses use a plethora of separate tools for different decisions across their business when it is the same customer and data. It is also crazy that a lot of decisions are coded in-house from scratch. Taktile’s integrated decision platform allows businesses to take one consistent view of the customer and easily build, iterate, and test complex decision logic. This has won them some of the most sophisticated fintechs as happy clients and is now allowing them to expand into banks and insurers.”

Moving AI adoption in financial services beyond the hype

Over the past 12 months, Taktile enabled Zilch to reduce its service provider and usage costs by 50% by giving its risk team the tools to build, test, and optimize automated underwriting workflows themselves.

“Taktile’s platform has empowered our teams to take control of our automated underwriting processes, allowing us to build, test, and optimize decisions with unprecedented speed and independence,” said Chanuka Perera, Head of Credit Risk at Zilch. “This shift has not only streamlined our operations but has also resulted in significant cost savings, freeing up resources for further innovation.”

In addition, Taktile helped Zippi make its decision-making process more efficient by enabling 67% faster policy logic deployment, doubling experimentation across fraud, credit, and portfolio workflows, and ensuring real-time, scalable decision-making without performance bottlenecks. This has allowed Zippi to scale its operations more effectively and process significantly more applications with the same resources. The platform has also reduced Breakout Finance’s underwriting time by 95%, enabling its risk team to handle 3-5x more applications and scale rapidly.

Pieter Viljoen, CDO at Allianz Partners, said: “It was clear that we needed a partner who fully understood the nuances of decision-making in various use cases and industries, the challenges that come with off-the-shelf AI models, and who could provide the required infrastructure to deploy LLMs in mission-critical workflows. We met Taktile just at the right time.”