Latest Articles

-

AI, GenAI, Fraud 5 min read

How LLMs are becoming investigative partners in fintech fraud detection

Peter Tegelaar (AI & Data Science Expert) explores how LLMs are reshaping fraud detection in fintech—balancing automation with expert oversight

-

B2B, Fraud 5 min read

Four key takeaways on emerging fraud and scam threats in small business banking & lending

SMBs face growing fraud risks with fewer protections than consumers—Jason Mikula shares expert insights on emerging threats and how to combat them

-

AI, GenAI, Data 8 min read

From credit scoring to GenAI: How modern credit decisioning has evolved—and what’s next

Romain Mazoué (Younited) explores the evolution of credit decisioning and uncovers how GenAI is shaping the future of customer-centric lending

-

B2B, Case Study 4 min read

Empowered teams, immediate results: How Zippi replaced legacy systems and cut risk logic deployment time by 67%

Learn how Zippi reduced risk logic deployment time by 67%, doubled experimentation, and scaled real-time decisions on Taktile.

-

Company 2 min read

Taktile remains Category Leader in G2’s Winter 2025 Report

Taktile earns top recognition in G2’s Winter 2025 Report, excelling in usability, implementation, and results—empowering teams to innovate and succeed

-

B2B, Case Study 5 min read

Build or buy? How Credix saved hundreds of hours by prioritizing IP over infrastructure

Discover how Credix scaled underwriting, reduced decision times by 95%, and unlocked weekly iteration cycles with Taktile

-

Data, Lending 5 min read

Credit Builders: What you need to know about this popular fintech category

Discover the evolution of credit-building products in fintech, from secured cards to innovative "crebit" models. Learn the benefits, risks, and future trends.

-

Company 2 min read

Taktile welcomes Stephen Brandes as VP of Sales to drive global growth

Taktile is proud to announce the appointment of Stephen Brendes as VP of Sales

-

B2C, B2B, Fintech 4 min read

Spotlight on Latin America: Top 50 Brazilian fintech disruptors to watch

Explore Brazil’s fintech transformation and discover the Top 50 disruptors driving innovation in payments, credit, and financial inclusion today

-

AI, Product 3 min read

Decisioning reimagined: AI Copilot unlocks new possibilities for risk teams

Discover Taktile's GenAI Copilot: A tool that empowers you to create and refine complex decision logic with unmatched speed and precision

-

Data, Fraud, Lending 4 min read

Key insights from Expert Talks with Jason Mikula: “Keeping up with the changing data landscape”

Explore key insights from our "Expert Talks" EP01 with Jason Mikula on how leaders are navigating a rapidly changing data landscape

-

B2B, Case Study 3 min read

How Breakout Finance cut underwriting time by up to 95% with Taktile

Discover how Breakout Finance streamlined B2B underwriting with Taktile, reducing underwriting time by up to 95%—boosting loan capacity, accuracy, and speed

-

B2C, Case Study 3 min read

How Zilch accelerated growth and halved costs with Taktile

Learn how Zilch accelerated growth, halved underwriting costs, and empowered its teams to innovate faster by switching to Taktile

-

Data, Fraud, Lending 4 min read

How to accelerate your ROI when integrating new third-party data sources

Learn 3 essential steps to accelerate your Return on Investment (ROI) of new third-party data integrations while driving smarter, faster risk decisions

-

Data, Fraud 5 min read

Data-driven fintech: Revolutionizing customer onboarding with AI and third-party data

Discover how AI and third-party data transform fintech onboarding, enabling faster, smarter, and more secure growth

-

Data, Fraud, Lending 4 min read

Rebalacing risk & reward: The role of third-party data

Discover how third-party data helps product and risk teams rebalance risk and reward to drive smarter decisions and unlock growth

-

Company 3 min read

Taktile remains category leader in G2’s Fall 2024 Report for Decision Management Platforms

Taktile continues to lead the way, being recognized again as a category leader in G2’s Fall 2024 report for Decision Management Platforms

-

Fraud, Transaction Monitoring 5 min read

Preventing account takeovers: The power of transaction monitoring systems

Explore the rise of account takeover fraud, why traditional defenses fall short, and how transaction monitoring can safeguard your customers and business

-

Company 2 min read

Taktile appoints Jason Mikula as Head of Industry Strategy for Banking & Fintech

Taktile is proud to announce the appointment of Jason Mikula as Head of Industry Strategy for Banking and Fintech

-

Data, Fraud, Lending 8 min read

Better data, better decisions: Risk assessment in the open finance era

Learn how open finance revolutionizes risk assessment practices for sophisticated fintech companies and banks worldwide

-

Fraud, Transaction Monitoring 5 min read

From liability to leadership: Transforming transaction monitoring to combat authorized push payment fraud

Learn how to adapt your transaction monitoring practices to combat the rise of Authorized Push Payment (APP) fraud in real-time payments

-

Data, Lending 3 min read

Taktile and Pave.dev partner to automate SMB credit underwriting

Pave.dev’s cashflow analytics and scores boost SMB lenders’ risk models—now fully integrated into Taktile’s next-gen decision platform

-

Fraud, Transaction Monitoring 8 min read

Battling first-party fraud with transaction monitoring

Learn about the types of first-party fraud companies face today and the key strategies they are employing to counter them effectively

-

Company 2 min read

G2 names Taktile category leader in Decision Management Platforms for summer 2024

Taktile is regonized as a G2 category leader, reflecting our commitment to delivering a holistic decisioning solution that truly empowers our users

-

B2C, Fintech, Lending 5 min read

Taktile & Portage Present: The Top 50 disruptors in US consumer finance

In partnership with Portage, Taktile presents the Top 50 US fintechs disrupting consumer finance and reshaping the industry

-

Fraud, Transaction Monitoring 5 min read

Demystifying deepfake fraud: How the price of technology determines the targets

Learn about the emerging types and costs of deepfake fraud so you can proactively enhance your fraud strategies against these growing risks

-

AI, LLM 5 min read

AI without the hype: Getting true value from LLMs without getting distracted

This guide will help risk teams see through stage-rigged demos, avoid falling for charlatans, and focus on what moves the needle instead

-

Fintech, Lending 4 min read

The lender's dilemma: Risk versus return in 2024

Drawing on our firsthand experiences working with lenders on the front lines, we highlight winning strategies for 2024

-

Fintech, Lending 2 min read

Experts predict the future of lending at Money20/20

Risk & lending experts share insights and strategies shaping the future of the lending industry

-

Data, Lending 3 min read

Taktile and Ocrolus partner to unlock real-time underwriting for small business lenders

Taktile and Ocrolus partner to transform small business lending, leading the race to equip small business lenders with real-time underwriting and data at scale

-

Product, Portfolio Monitoring 3 min read

Taktile launches scheduled Jobs feature for frictionless portfolio monitoring

Discover Jobs: A powerfully simple feature that empowers you to effortlessly set up automated decisions that periodically run over large datasets

-

Company 2 min read

Taktile named high performer and #1 in support by G2 in the decision management platforms category for spring 2024

Taktile named a High Performer and top for customer support in G2’s Spring 2024 report for Decision Management Platforms

-

Data, Lending 2 min read

Taktile’s Plaid integration empowers lenders to unlock new growth opportunities

Learn how Taktile’s Plaid integration empowers lenders to harness the power of open banking data across the lifecycle of underwriting decisions

-

B2B, Case Study 3 min read

How SME lender Silvr grew its signed loan fundings by 8X

Find out how Taktile's Decision Engine helped innovative SME lender Silvr significantly scale its underwriting operations

-

AI, Lending 2 min read

Taktile and Deeploy partner to revolutionize high-risk, AI-driven decision-making

Taktile and Deeploy announced their partnership as part of their combined mission to redefine high-risk decision-making with AI

-

B2B, B2C, Lending 5 min read

Beyond credit scoring: A decision-making framework for profitable lending

Discover the innovative risk assessment frameworks leading lenders are employing to grow more profitably

-

B2B, Fintech, Lending 3 min read

US Spotlight: Top 50 fintech companies transforming business finance & lending in 2023

Taktile and Portage identify the top 50 US fintechs at the forefront of B2B finance and lending innovation in 2023 and uncover key trends driving this growth

-

Lending, Insights 3 min read

Taktile’s State of Lending report reveals how lenders plan to grow more profitably in 2023

Discover how lenders are navigating the path of profitability with Taktile's 2023 State of Lending Report

-

B2B, B2C, Data 4 min read

Unlocking open banking data: Strategies for cash flow-based underwriting

Uncover strategies for cash flow-based underwriting from industry experts Abhinav Swara from Bluevine & Jonathan Gurwitz from Plaid

-

AI, Lending 3 min read

Money20/20 Vegas Panel Recap: ChatGPT can write, but can AI underwrite?

This year, ChatGPT captured the world's attention. Learn about the possibilities it presents for underwriters and expand your knowledge of AI trends in lending

-

AI, Lending 6 min read

The future of credit underwriting under AI regulation: Implications for the EU and beyond

Discover how the EU's upcoming AI Act will affect credit underwriting activities in the future

-

B2C, Case Study 5 min read

The future of risk decisioning: Rhino’s innovative approach to empowering risk teams

Learn how Rhino is reaching its goals and empowering its risk team using Taktlie

-

B2B, Fintech, Lending 3 min read

Taktile-AltFi Webinar Recap: Automation and the future of B2B lending

Discover how B2B decision automation is unlocking new possibilities for lenders

-

B2B, Lending 4 min read

How to save time and money by automating B2B underwriting decisions

Learn how automation can transform your B2B lending operations to make faster, smarter, and safer underwriting decisions at scale

-

B2B, Case Study, Lending 2 min read

Novo leverages Taktile to launch Novo Funding for small businesses

Learn how Novo used Taktile's automated decision engine to launch a small business financing solution

-

Company 2 min read

CNBC recognizes Taktile as one of the world’s top fintechs

Taktile named one of the top 200 fintechs in analysis by CNBC and Statista

-

Decision Engine, Fintech, Lending 4 min read

10 things risk experts look for in a modern decision engine

Learn about the top 10 considerations of risk experts when choosing a decision engine

-

B2B, Fintech 3 min read

Money 20/20 Recap: Bringing B2B SME payments and financing up to speed

Discover why B2B payments lag behind B2C, how it affects credit underwriting, and actionable steps B2B companies can take to close the gap

-

Press Release, Data 2 min read

Taktile launches global Data Marketplace to empower lenders

Taktile launches a data marketplace with an unprecedented coalition of leading data providers to ensure lenders can make the most accurate decisions

-

Lending 8 min read

Beginner’s guide to lending: How to assess credit risk

Learn how to create a credit policy that minimizes your loss rates, optimizes approval rates, and gives you a competitive advantage in your customer segment

-

B2C, Case Study, Lending 2 min read

Growing profitably in 2023: Advice for state-of-the-art lenders

Jitin Bhasin, CEO of rapidly growing healthcare fintech SaveIN, offers advice to other lenders on how to grow profitably

-

B2C, Case Study, Lending 2 min read

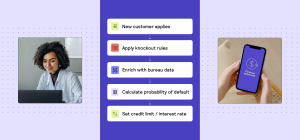

Eliminating guesswork: How Branch uses data to iterate on models

Learn how one of the most popular finance apps in the world uses Taktile to refine their lending models

-

Fintech, Lending 4 min read

How to launch a new lending product quickly

Based on industry best practices, learn the 4 key steps required to launch a modern lending product

-

Fintech 3 min read

2023: Top 5 trends in the next chapter of fintech

As we near the end of the year, we have highlighted five key trends that will bring transformative changes to the fintech sector in 2023

-

Decision Engine, Fintech 4 min read

How new credit decisioning approaches are empowering credit teams

Learn how lenders quickly adapt to market changes, grow loan books profitably, and launch new products fast with data-driven strategies

-

Data, Lending 4 min read

How novel data sources help lenders drive profit growth

Discover how novel data sources optimize the risk selection process from onboarding new customers to underwriting loans

-

Fintech 2 min read

Fintech's second chapter: Turning from growth to profitability

Our founder shares his vision on the future of fintech and how companies can adapt to thrive in the current economic environment

-

Company 3 min read

Taktile raises $20 Million Series A funding round to transform how businesses make decisions

Funds will be used to continue improving the product, adding new integrations, and expanding in the US