AML software for banks and fintech.

Stay compliant with AML, KYC & KYB regulations using AI-powered monitoring on Taktile. Detect suspicious activity, automate alerts and sanctions screenings, and streamline case management—without slowing operations.

Join the risk management professionals worldwide who love using Taktile.

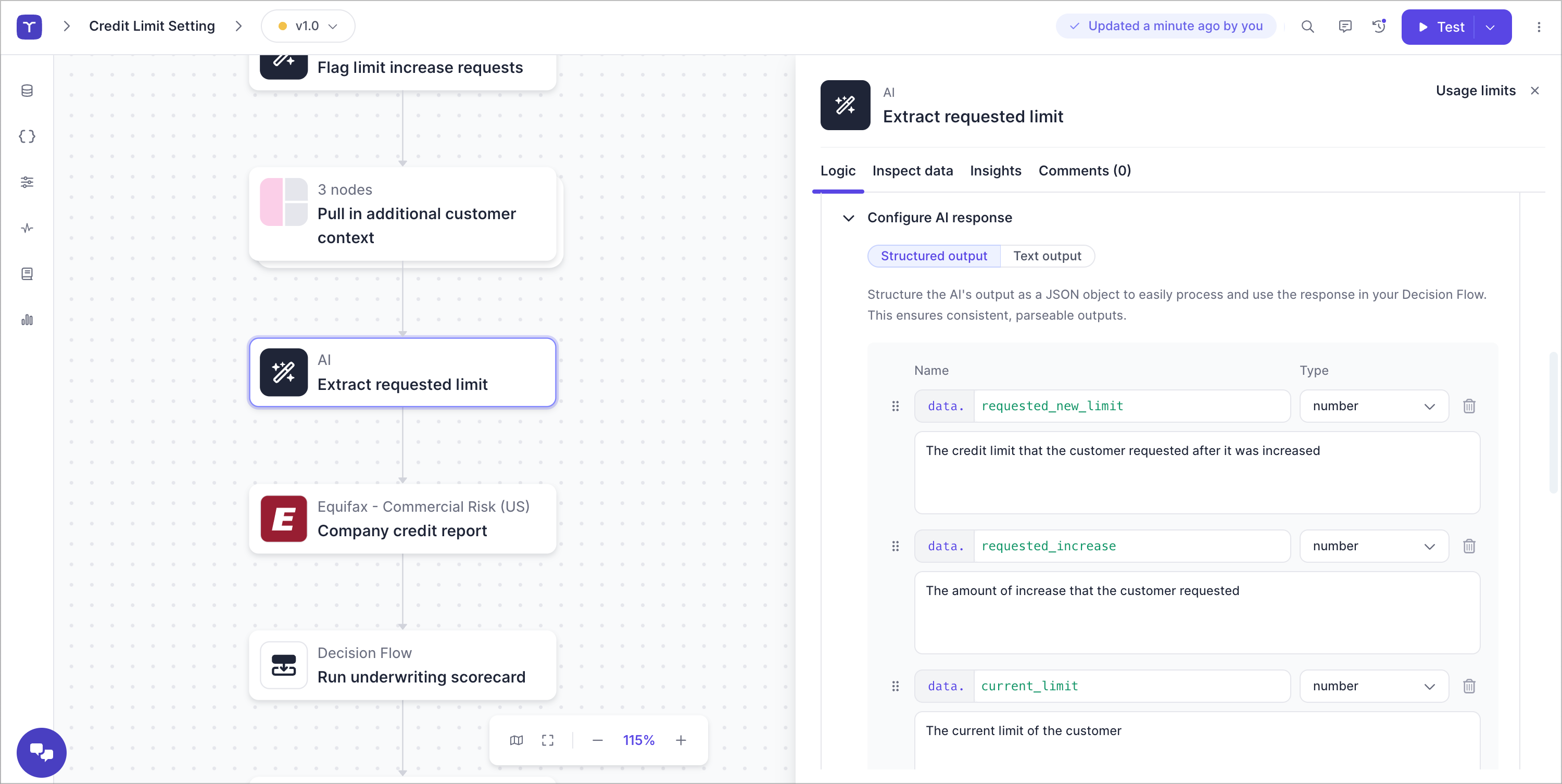

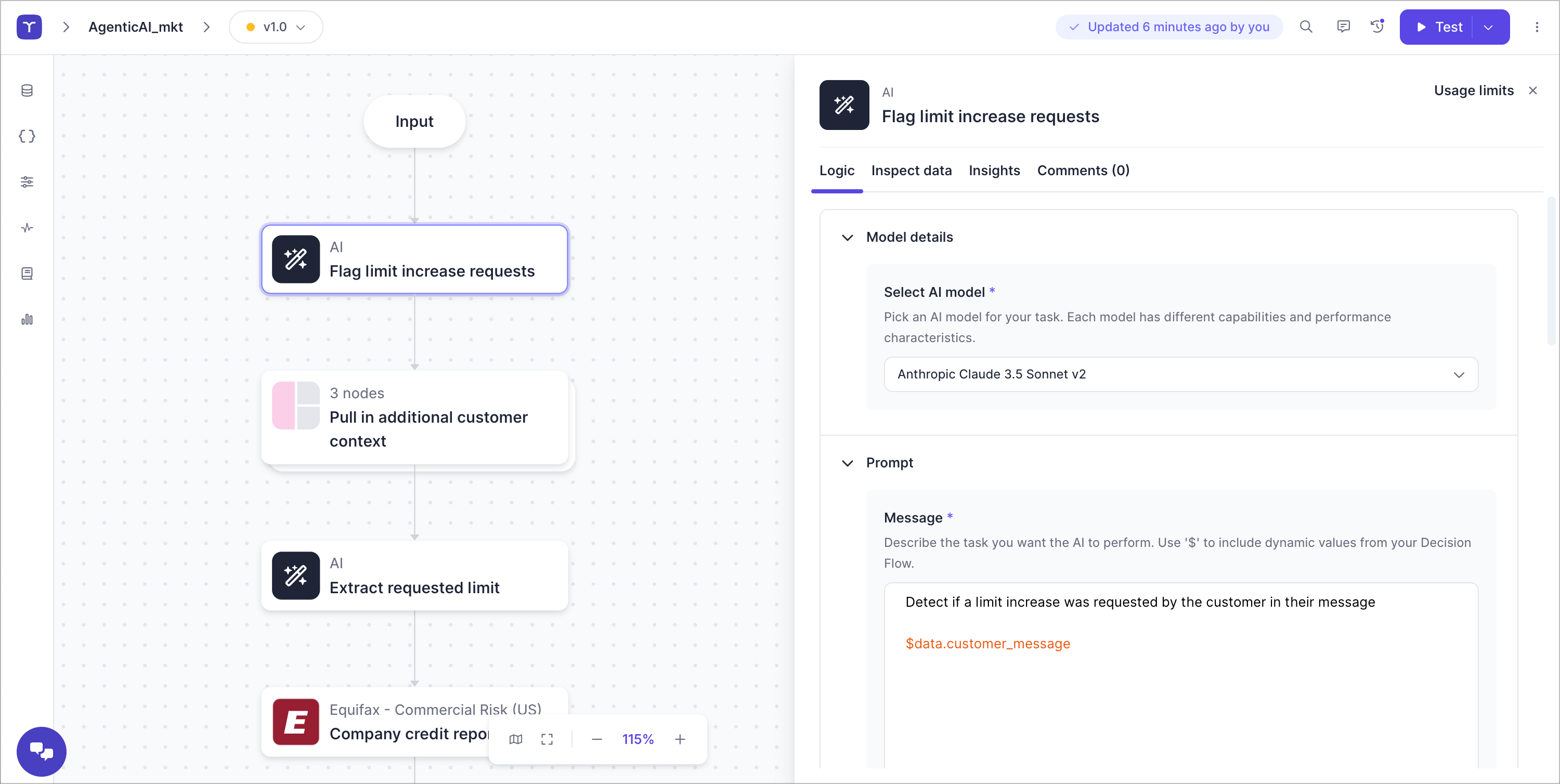

Design, test, and refine AML and transaction monitoring workflows tailored exactly to your business. Customize screening rules, adjust risk thresholds in real time, and automate monitoring activities—all without waiting on engineers.

Leverage the right data to detect financial crime faster.

Instantly integrate AI, ML models, and third-party fraud data to monitor and stop fraud faster with fewer false positives.

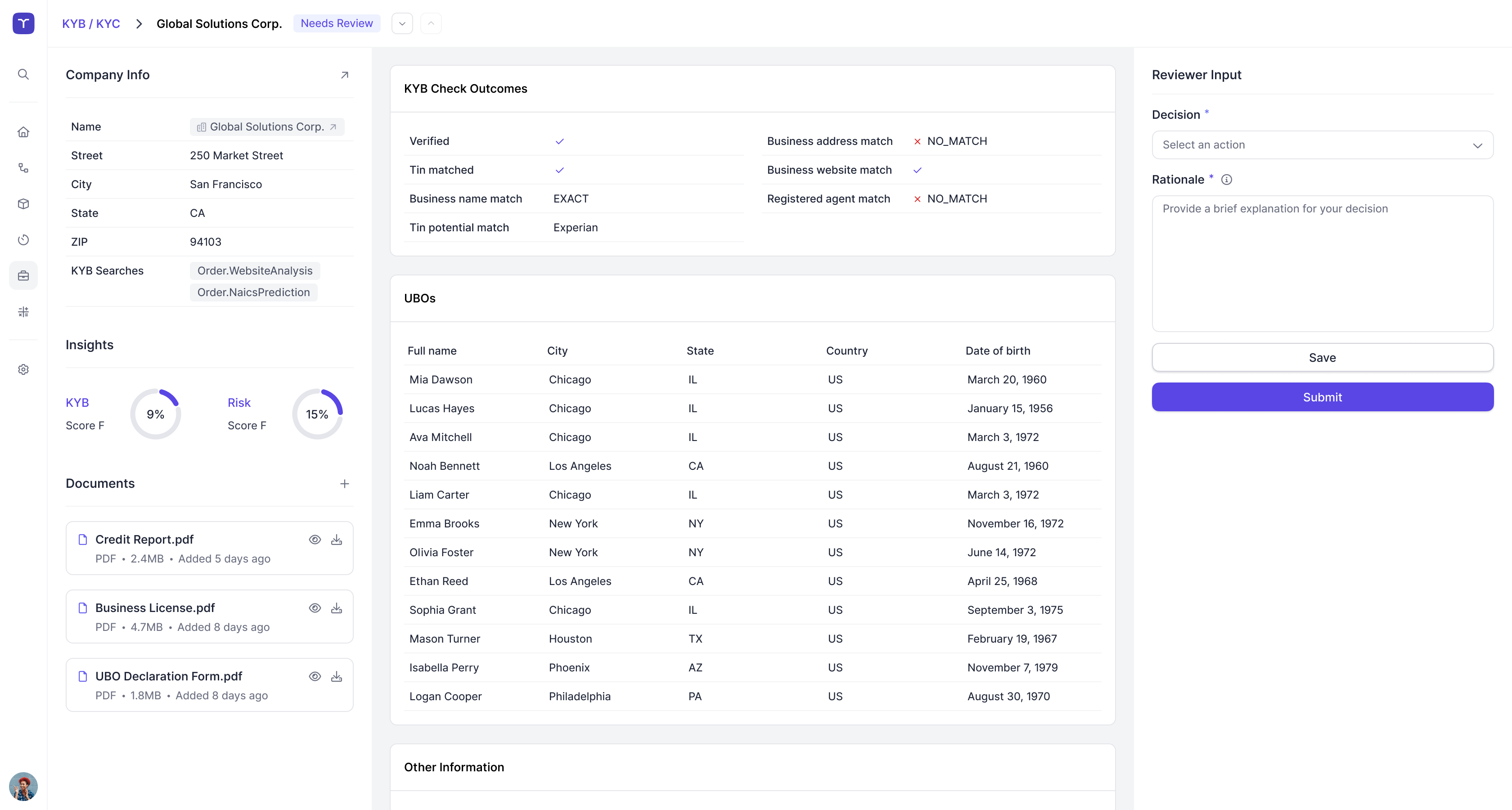

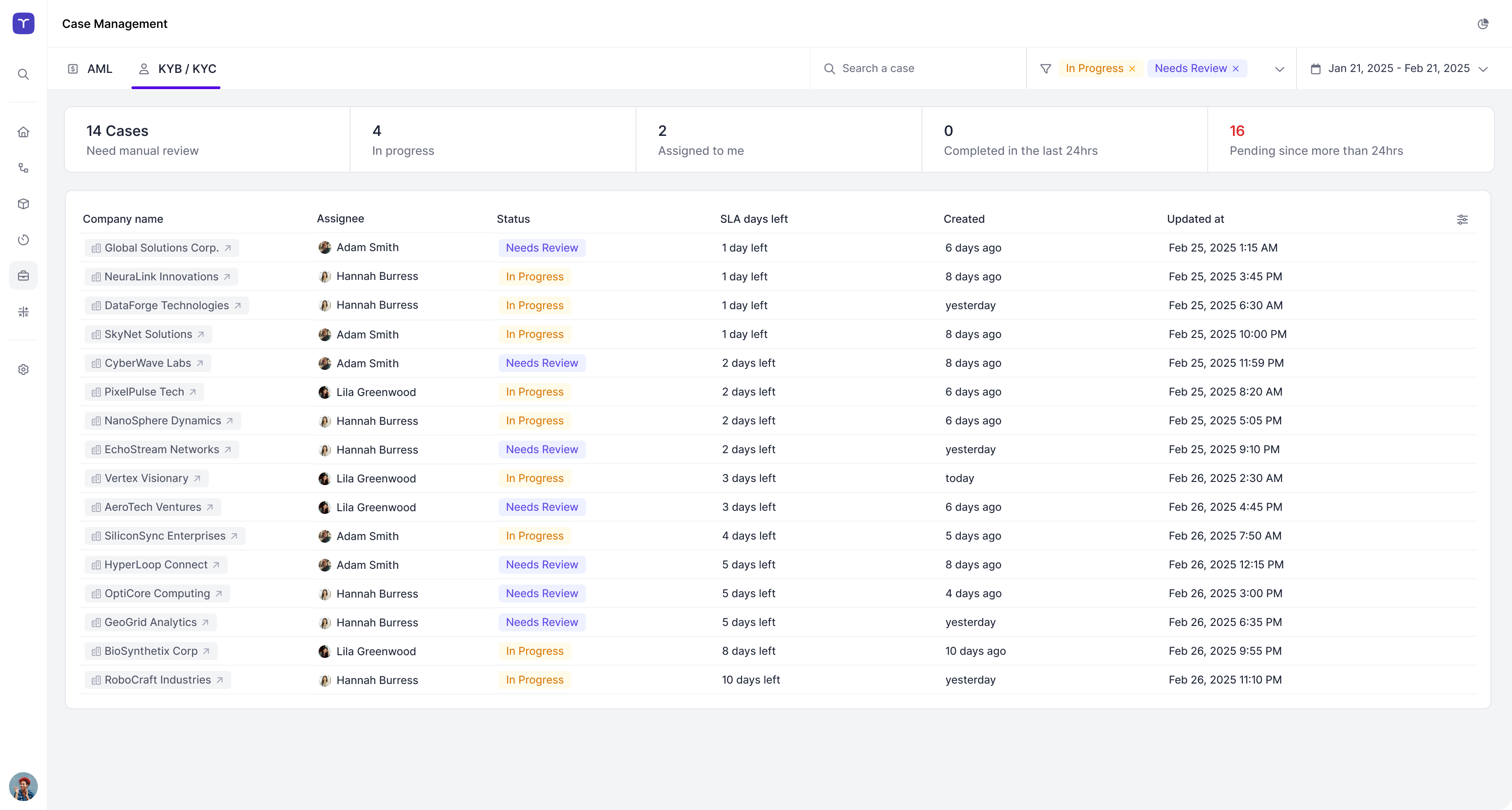

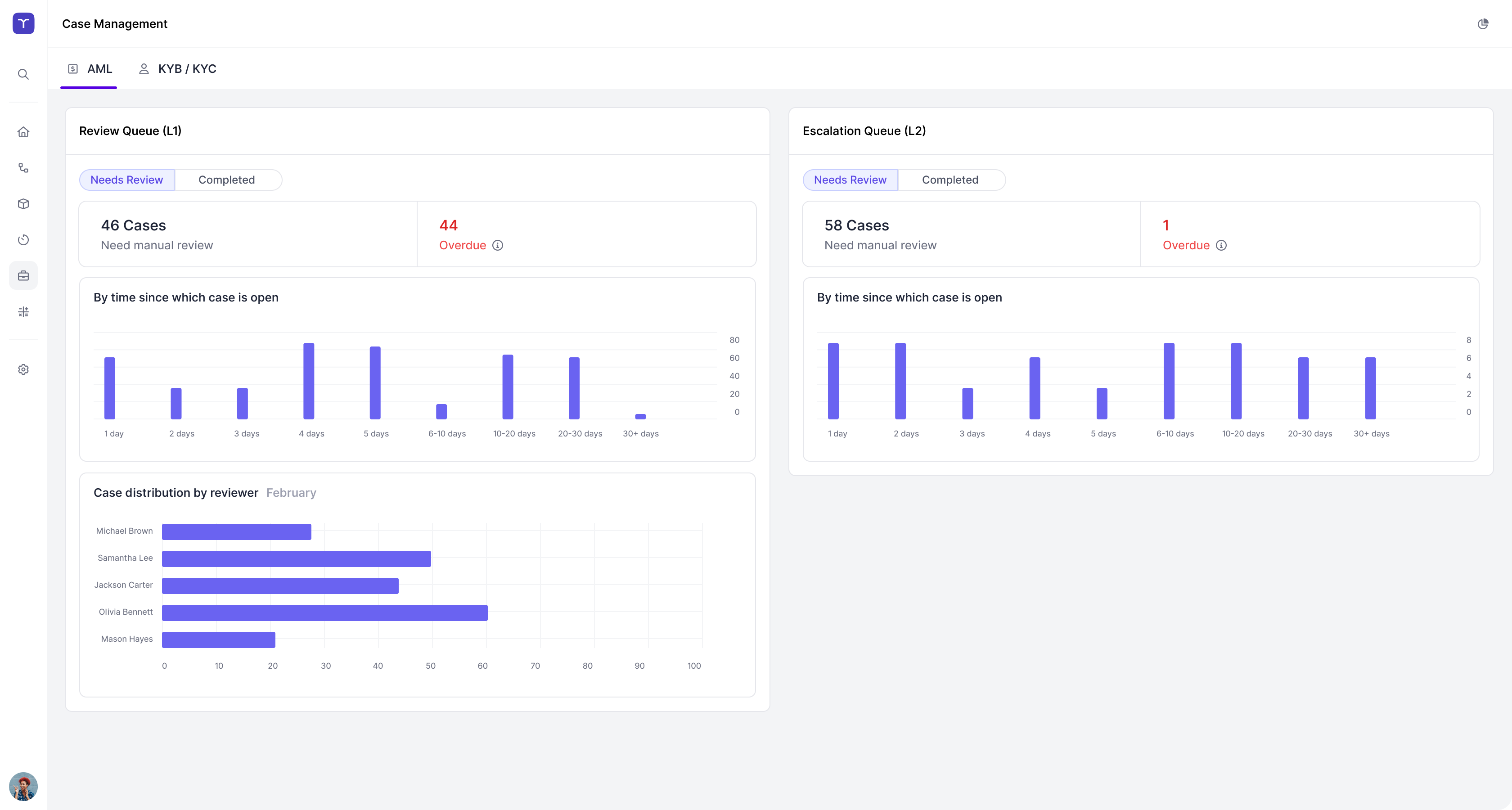

Streamline investigations. Keep compliance airtight.

Leverage customizable case management tools and scheduled monitoring capabilities to proactively reassess risk, flag high-risk cases, and escalate suspicious activity in real-time.

Sophisticated risk teams build on Taktile

The AI Workbench for Risk

AI-powered decisioning, Copilot intelligence, and AI Agent automation—built for risk teams. Enhance your risk management strategies across the entire lifecycle with AI-driven precision.

Discover the latest insights on real-time fraud decisioning

Taktile was recognized as market leader by G2 for three quarters in a row

Optimize your compliance strategy on Taktile.

Let’s start with a conversation—tell us your needs, get your questions answered, and see firsthand how Taktile can support your goals.

Discover Taktile