AI 5 min read

The AI deployment playbook for financial institutions: From idea to scalable impact

Most banks and fintechs face an AI flood. Every team has ideas, vendors pitch daily, and leadership feels mounting pressure to "do something with AI." Yet beneath the surface lies a harsh reality: 30% of GenAI projects will be abandoned after proof-of-concept by end-2025, and fewer than 1 in 4 banks successfully transition from pilots to strategic execution.

The culprits are predictable: misaligned priorities, governance gaps, and resource constraints. Without structured approaches, promising AI initiatives stall despite strong initial results. Organizations cycle through endless proofs-of-concept while competitors build systematic AI capabilities that generate measurable business value.

This playbook provides a pragmatic framework built on continuous portfolio management where all AI initiatives compete for resources using consistent scoring criteria. The framework rests on three pillars: systematic portfolio scoring across six business dimensions, progressive autonomy levels that match AI authority to proven performance, and disciplined four-stage implementation that transforms concepts into production systems.

Quick win: Want immediate clarity on your AI strategy? Score your most promising AI initiative using the framework below. In just 30 minutes, you'll know whether to proceed, pivot, or improve. This exercise alone brings more clarity than most organizations achieve in months of committee meetings.

The foundation: Two essential tools

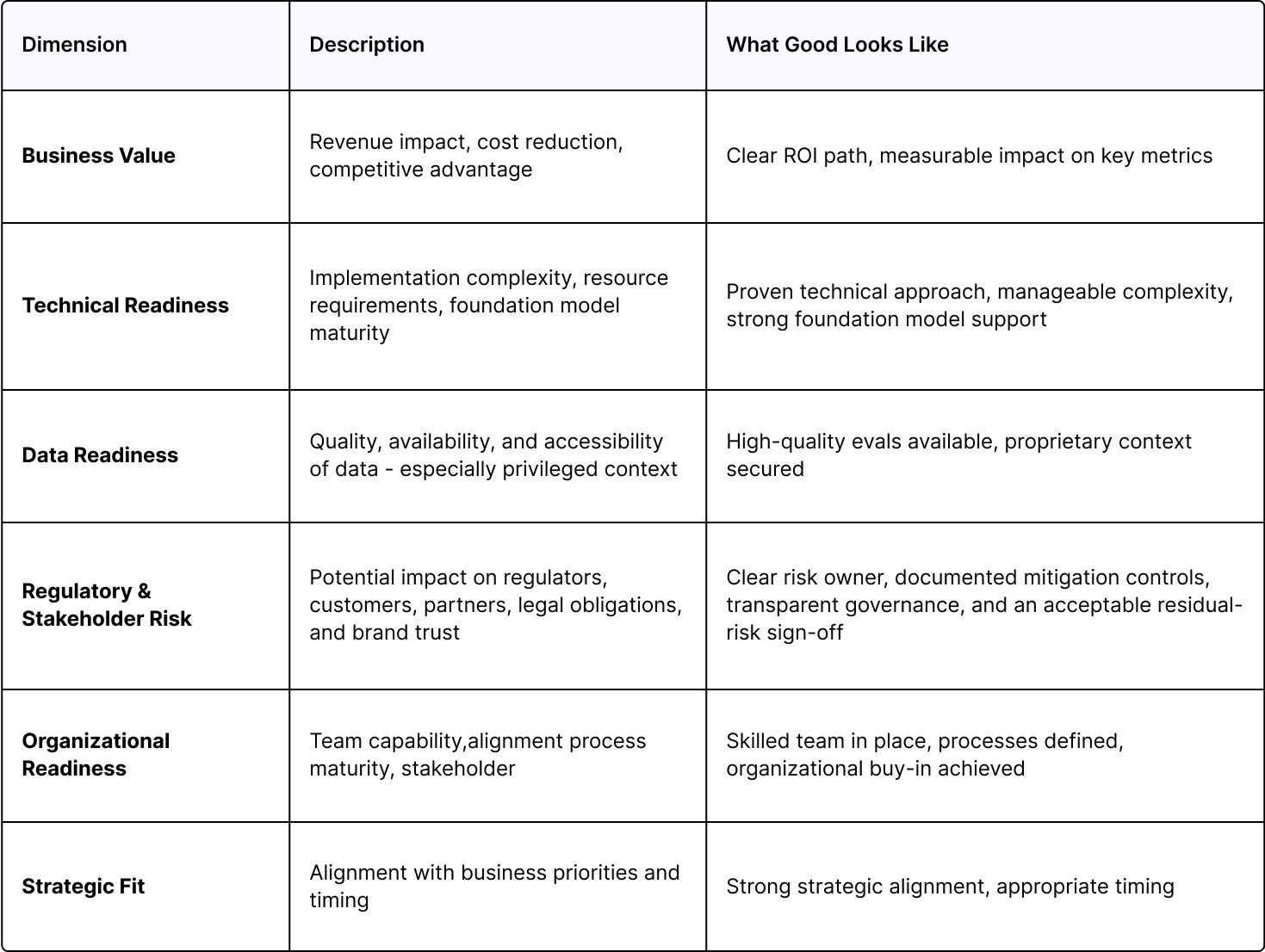

The 6-dimension scoring framework

Rather than debating which AI project is "more strategic," systematic scoring provides objective evaluation criteria that eliminate subjective prioritization debates. Every AI initiative competes using the same six dimensions on a 1-5 scale:

Decision matrix: Use the combined score to assign clear status:

- 18-30 points: ✅ Green Light → Proceed immediately to pilot

- 16-17 points: ⚠️ Amber → Fix weakest dimension urgently

- 14-15 points: 📋 Backlog → Quarterly portfolio review

- 6-13 points: 🗄️ Archive → No action unless conditions change

For example, a fraud detection initiative scoring Business Value (4), Technical Readiness (3), Data Readiness (4), Regulatory Risk (3), Organizational Readiness (3), and Strategic Fit (4) totals 21/30 - a clear green light for pilot investment.

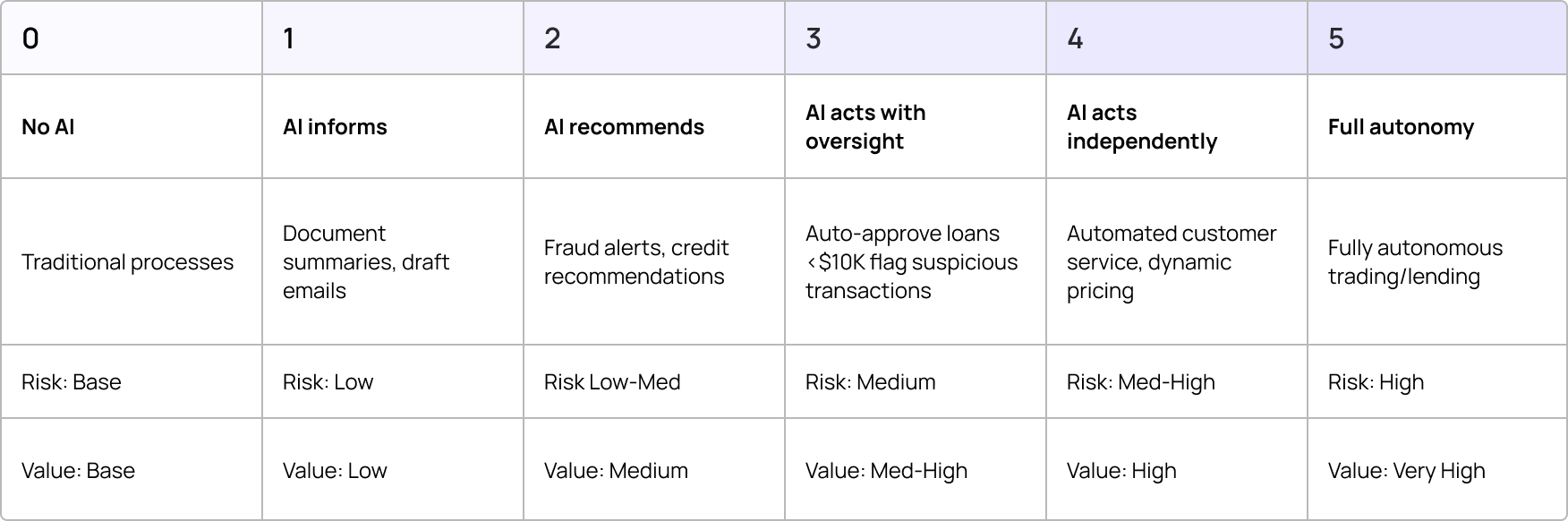

Autonomy levels: The AI authority spectrum

Every AI initiative operates along a spectrum from informing human decisions to operating with full autonomy. Understanding this L0-L5 progression helps determine technical requirements, risk controls, and business value potential:

- L0 (Manual): Human performs all tasks

- L1 (Inform): AI provides information, human decides

- L2 (Recommend): AI suggests actions, human approves

- L3 (Supervised Action): AI acts within boundaries, human monitors

- L4 (Independent Action): AI operates autonomously in defined scope

- L5 (Full Autonomy): Complete AI control over decisions

Reality check: Most financial use cases thrive at Level 2-3. Industry data shows 55% of financial AI has some autonomous decision-making, but only 2% achieve full autonomy. Autonomy is earned through demonstrated performance, not assigned based on business desires. Start at Level 1-2 and progress systematically based on proven results.

Framework in action: Near-real-time fraud intelligence

Consider a specialized digital trade-finance lender for international SMEs with a lean fraud operations team of 6 analysts handling 5,500 monthly transaction alerts. They needed to balance rapid transaction processing with sophisticated fraud detection while maintaining their critical business metric: 80% of financing decisions issued within 72 hours.

The challenge? Current rule-based systems catch obvious patterns but miss coordinated attacks involving shell companies, circular trading schemes, and suspicious supply chain relationships spanning multiple jurisdictions and currencies.

Initial scoring results:

- Business Value (4): Clear ROI through false positive reduction and faster detection

- Technical Readiness (3): Proven capabilities but complex integration requirements

- Data Readiness (4): Rich transaction context and merchant histories available

- Regulatory Risk (3): Manageable with careful autonomy progression

- Organizational Readiness (3): Adequate team with workflow integration needed

- Strategic Fit (4): Strong executive support and competitive advantage

- Total: 21/30 → Green light for pilot

The solution: Deploy an intelligent system with dual-path architecture that operates alongside the critical transaction processing pipeline. While the primary system maintains the 72-hour financing decision target, the secondary analysis layer examines each transaction with deeper context including beneficial ownership mapping, trade route analysis, and relationship graph intelligence across the entire international trade ecosystem.

When high-confidence fraud is detected, the system drafts analyst briefs with supporting evidence, suggests specific actions like transaction holds or enhanced due diligence requirements, and eventually auto-executes limited protective actions within defined risk parameters.

Systematic autonomy progression over 6 Months:

- Level 1 (Months 1-2): AI generates fraud alerts with supporting evidence for analyst review. Human investigators validate patterns and take all actions.

- Level 2 (Months 3-4): AI recommends specific actions with confidence scores. The system successfully progressed to this level with demonstrated performance improvements, enabling supervised recommendations for transaction processing.

- Level 3 (Months 5-6): AI automatically executes limited protective actions within defined boundaries while generating comprehensive audit trails. Each level required demonstrated performance before advancement, preventing premature escalation of AI authority in critical payment infrastructure.

Results: The systematic progression delivered a 28% reduction in false positives, cutting monthly false-positive alerts from ~4,620 to ~3,326 and freeing roughly 180-220 analyst hours per month. The system maintained 94% true positive detection rate while particularly excelling on complex multi-jurisdictional schemes that traditional systems missed entirely.

Framework lessons: The Technical Readiness score of 3 proved accurate during the 8-week pilot period, requiring significant specialized development effort for integration with existing transaction processing systems and cross-border compliance infrastructure. However, the 4-stage approach caught these integration challenges early during pilot preparation rather than during production deployment, preventing disruption to the company's critical 72-hour financing decision target.

The lean fraud team adapted well to AI-augmented workflows, with the system's relationship mapping capabilities proving particularly valuable for analyzing counterparty networks across multiple countries. The autonomy framework enforced disciplined progression where each level required demonstrated performance before advancement.

Application guide: Use this case to calibrate fraud detection scoring. If your Technical Readiness is below 3, expect similar pilot preparation complexity and integration effort before Level 2 autonomy. If your Data Readiness is below 4, prioritize context engineering before attempting real-time systems. The systematic approach transforms AI from experimental technology into reliable business capability that preserves operational speed while enabling sophisticated analysis invisible to traditional rule-based systems.

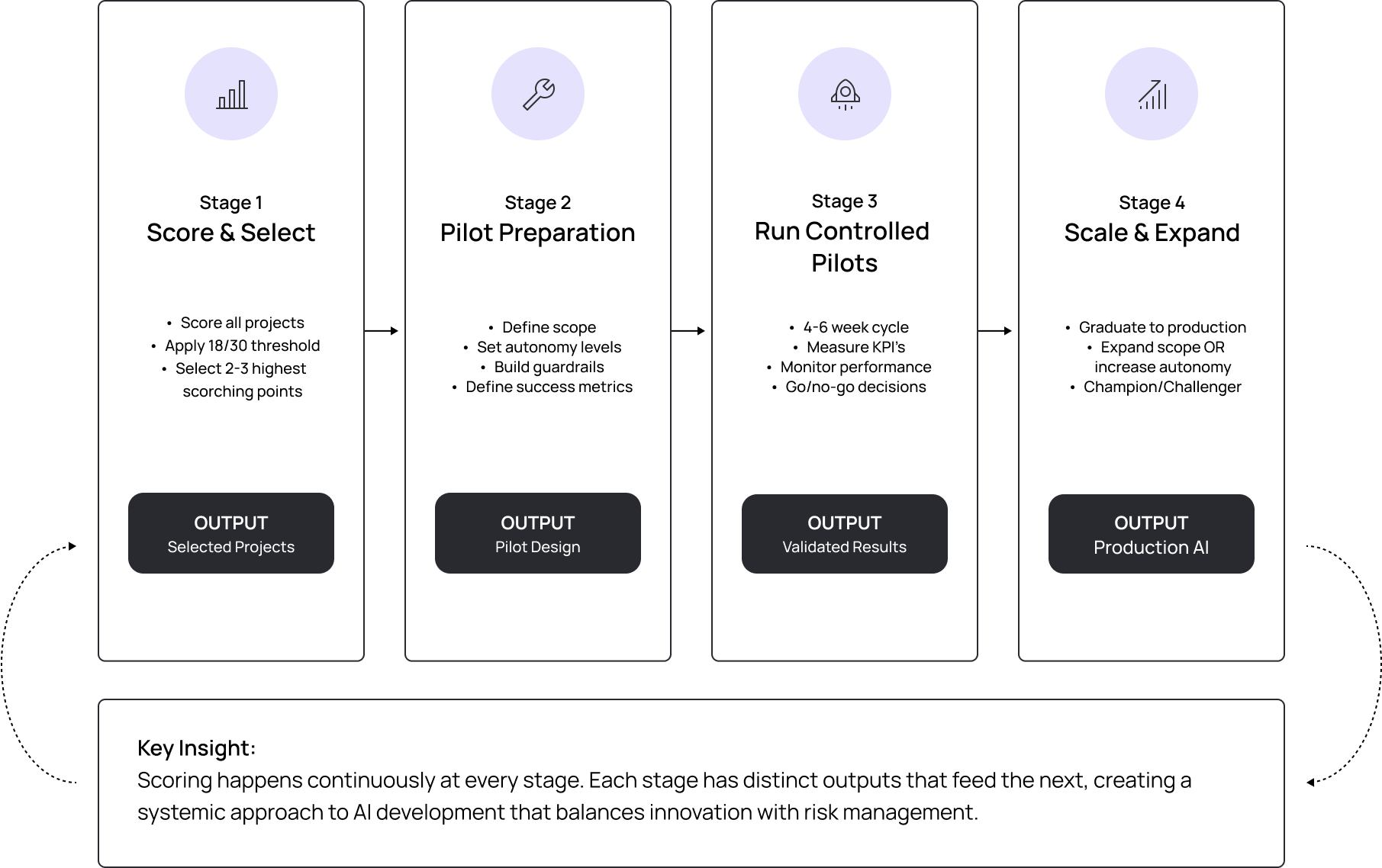

The four-stage implementation process

Successful AI deployment requires disciplined progression through four implementation stages that transform high-scoring initiatives from concepts into production-grade business capabilities.

Stage 1: Initial scoring & selection

- Apply six-dimension framework to AI portfolio

- Identify 2-3 projects above 18/30 threshold

- Secure executive sponsorship for top initiatives

Stage 2: Pilot preparation

- Define exact operational boundaries and initial autonomy level

- Design guardrails and controls (transaction caps, confidence thresholds, kill switches)

- Establish binary success metrics tied to business outcomes

- Document fallback procedures and performance degradation responses

Stage 3: Run controlled pilots

- Execute 4-12 week pilot cycles with disciplined measurement

- Track business KPIs, technical performance, and edge case handling

- Maintain daily monitoring with escalation procedures

- Lock success criteria before launch to prevent metric drift

Stage 4: Scale & expand

- Graduate successful pilots to production with full SLAs

- Expand scope OR autonomy (never both simultaneously)

- Implement Champion/Challenger testing for continuous optimization

- Conduct quarterly re-scoring against new opportunities

Common pitfalls - the fatal five:

1. Pilot Paralysis: Endless planning without execution (Solution: 2-week limit for pilot design)

2. Scope Creep: "While we're at it, let's also..." (Solution: Document scope, require approval for changes)

3. Success Criteria Drift: Moving goalposts when pilots underperform (Solution: Lock metrics before launch)

4. Autonomy Overreach: Jumping to Level 4-5 without proving 1-3 (Solution: Enforce sequential progression)

5. Portfolio Amnesia: Forgetting to re-evaluate existing projects (Solution: Mandatory quarterly reviews)

30-day quick start:

- Week 1: Establish AI Steering Committee, complete project inventory

- Week 2: Score top 5-10 initiatives, identify 2-3 above threshold

- Week 3: Define pilot scope, autonomy level, and success metrics

- Week 4: Finalize guardrails, test fallback procedures, launch pilots

Your next move

The path from AI experimentation to production deployment doesn't require perfect technology or unlimited resources. It requires systematic evaluation, controlled testing, and disciplined scaling. Financial institutions that master this approach will build sustainable AI capabilities while competitors cycle through endless proofs-of-concept.

Start today: Score your most promising AI initiative using the 6-dimension framework. Identify its appropriate autonomy level. Design a controlled pilot with clear boundaries and success metrics. In 30 minutes, you'll have more strategic clarity than most organizations achieve in months of committee meetings.

The framework transforms AI deployment from ad-hoc experiments into systematic progression through scored selection, pilot preparation, controlled testing, and disciplined scaling. Organizations implementing this disciplined approach escape proof-of-concept purgatory to deliver compliant, scalable AI that generates measurable business value.

The competitive gap between organizations with systematic AI deployment and those without will become insurmountable. The tools are here. The framework is proven. The question is whether you'll start implementing it this week.

Ready to go deeper? The complete AI Deployment Playbook provides detailed scoring guidelines and comprehensive case studies.

Disclaimer

This information provided in this article does not, and is not intended to constitute professional advice; instead, all information, content, and material are for general informational and educational purposes only. Accordingly, before taking any actions based upon such information, we encourage you to consult with the appropriate professionals.