Fraud wins when you don’t adapt.

Design fraud prevention and transaction monitoring strategies tailored to your customers. Use AI and real-time data to detect threats in real time, adapt to new fraud patterns, and stop fraudsters.

Discover Taktile

Join the risk management professionals worldwide who love using Taktile.

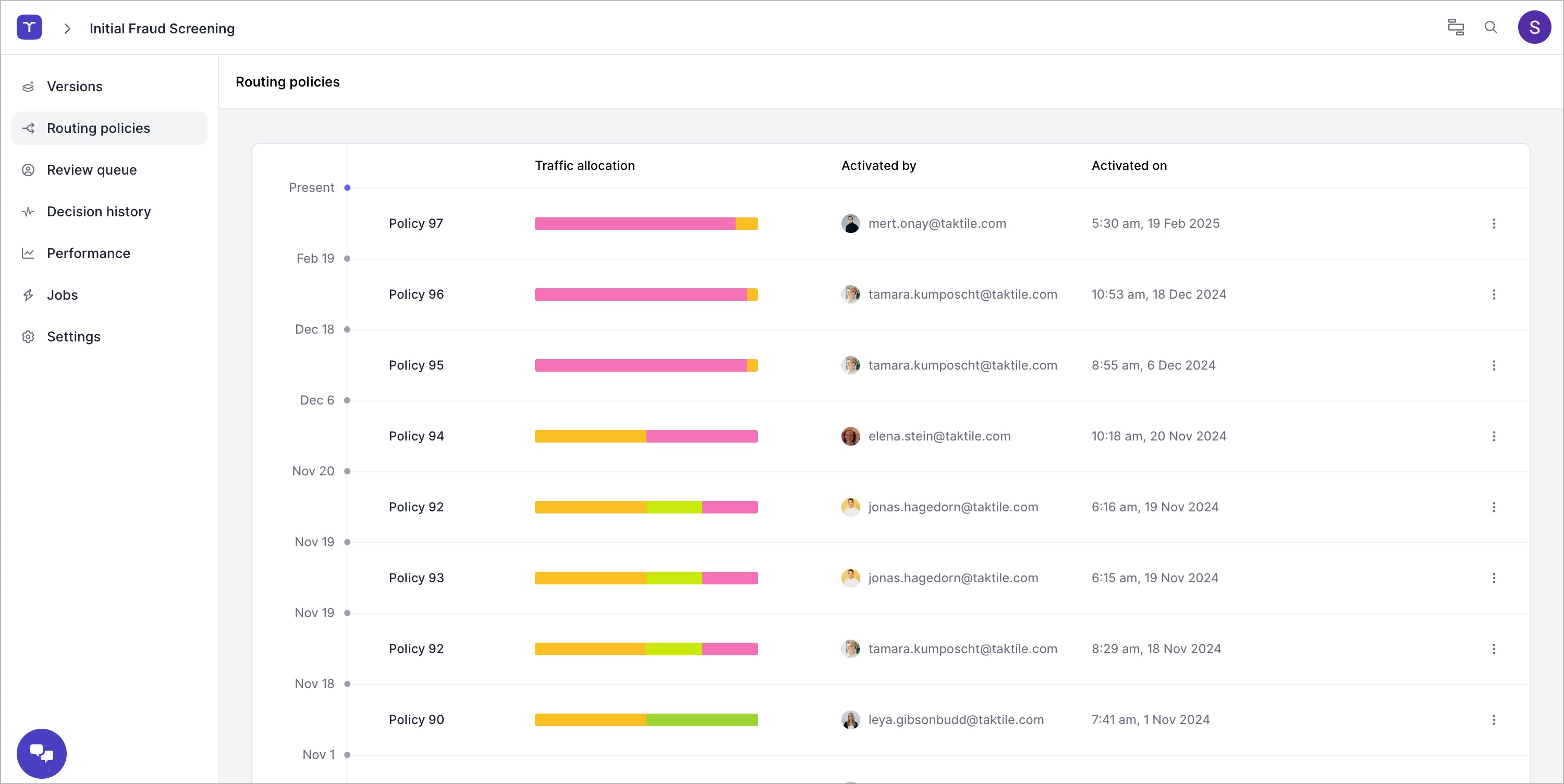

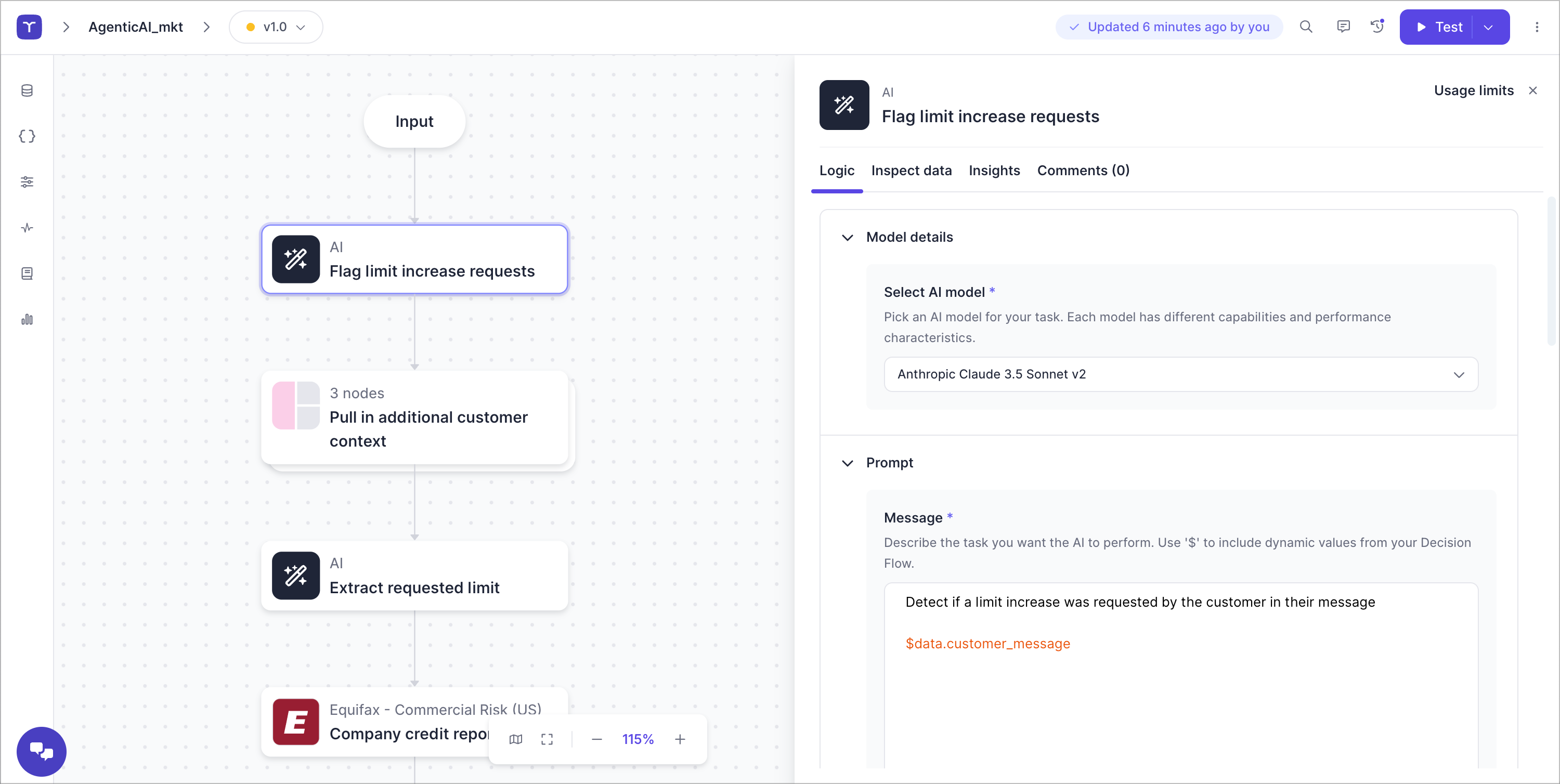

Design, test, and refine fraud prevention and monitoring tailored strategies without engineering support on Taktile's low-code platform. Customize every rule, integrate and adjust risk signals in real time, and seamlessly deploy AI & ML models.

Enrich your fraud strategy with real-time data—no delays, no complexity.

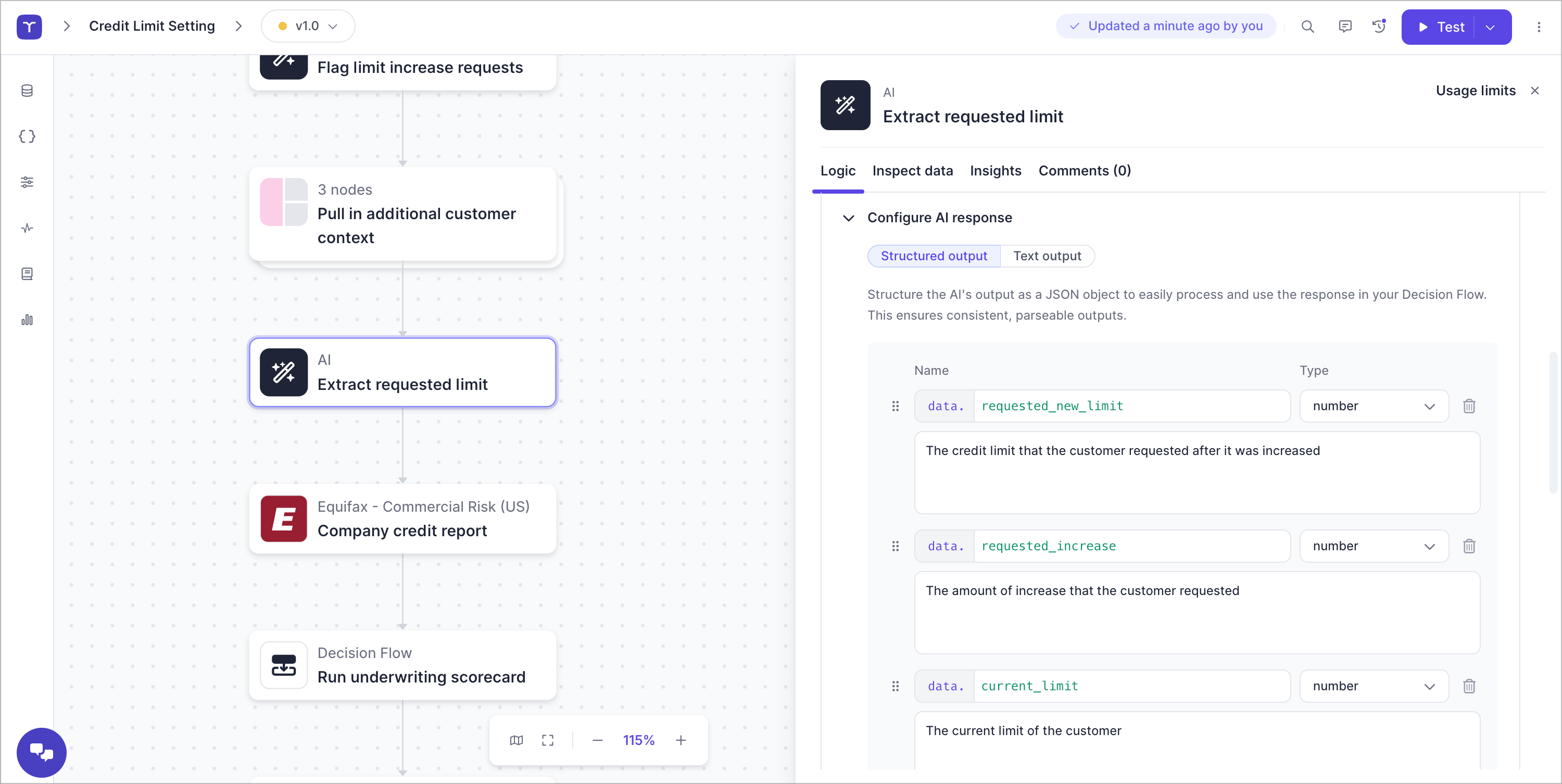

Instantly integrate AI, ML models, and third-party fraud data to monitor and stop fraud faster with fewer false positives.

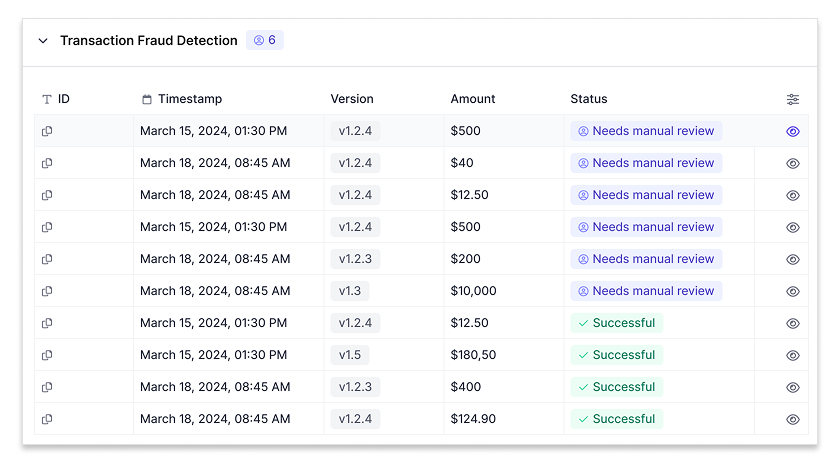

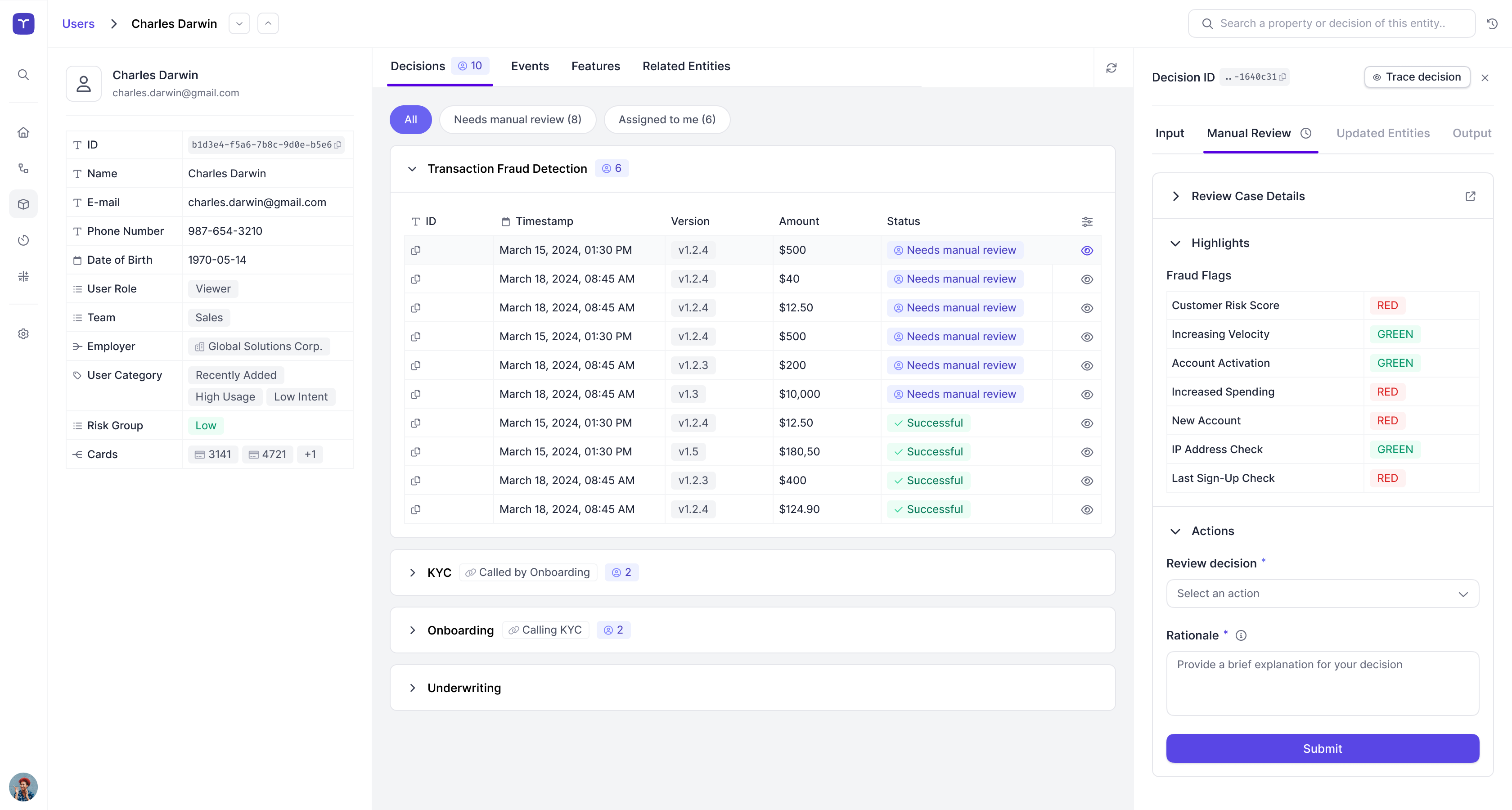

Review flagged transactions, analyze risk signals, and take action—all within a single interface. Automate escalations, collaborate across teams, and enrich investigations with real-time data to stop fraudsters before they strike again.

Optimize strategies with entity-level intelligence.

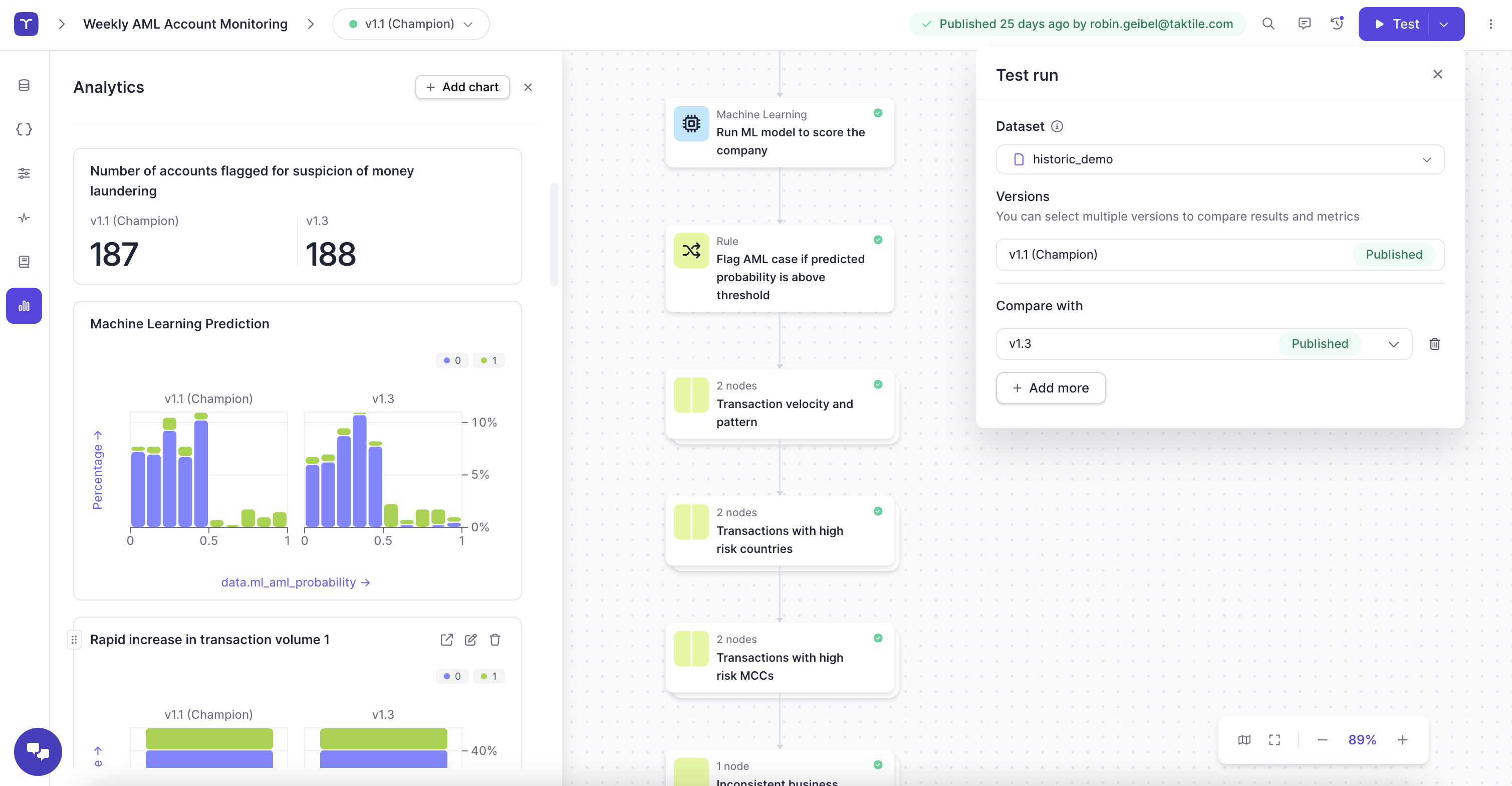

Fraud doesn't happen in isolation—analyze risk at the entity level to detect patterns across transactions, accounts, and behaviors. Run A/B tests, backtest models, and refine fraud rules in real time.

Sophisticated risk teams build on Taktile

The AI Workbench for Risk

AI-powered decision-making, Copilot intelligence, and AI Agent automation—built for risk teams. Enhance your risk management strategies across the entire lifecycle with AI-driven precision.

Discover the latest insights on real-time fraud prevention

Taktile was recognized as market leader by G2 for three quarters in a row

Optimize your fraud prevention strategy on Taktile.

Let’s start with a conversation—tell us your needs, get your questions answered, and see firsthand how Taktile can support your goals.

Discover Taktile