Meet Taktile: The platform teams trust.

Comparing AI risk decisioning platforms? Taktile pairs enterprise-grade control with fast, modular design so you can launch AI-driven decision strategies quickly. Empower your teams to start quickly, expand confidently, and adapt on their terms.

See Taktile in Action

Every platform claims flexibility. Only one delivers control.

| Capability | Other platforms |

Taktile

|

|---|---|---|

| Set-up | ||

| Set-up | Lengthy vendor onboarding. Go-live in months. | Live in days. Pre-built connectors, self-service setup. |

| AI Agents | ||

| AI Agents | Black-box models. No explainability or override. | Transparent AI. Configurable agents, explainable outputs, full oversight. |

| AI workflow automation | ||

| AI workflow automation | Limited automation. Vendor-managed rule changes. | Full AI workflow control. Teams deploy, adapt, and scale instantly. |

| Real-time testing | ||

| Real-time testing | Manual QA, delayed results. | Continuous real-time testing. A/B, backtest, and optimize instantly. |

| Data orchestration | ||

| Data orchestration | Rigid pipelines, static integrations. | 100+ data integrations. Dynamic orchestration via open APIs and feature store. |

| Enterprise-grade governance | ||

| Enterprise-grade governance | Fixed logic, limited auditability. | Enterprise-grade governance with audit trails, role controls, and SOC 2 compliance. |

“Taktile’s platform has empowered our teams to take control of our automated underwriting processes, allowing us to build, test, and optimize decisions with unprecedented speed and independence. This shift has not only streamlined our operations but has also resulted in significant cost savings, freeing up resources for further innovation.”

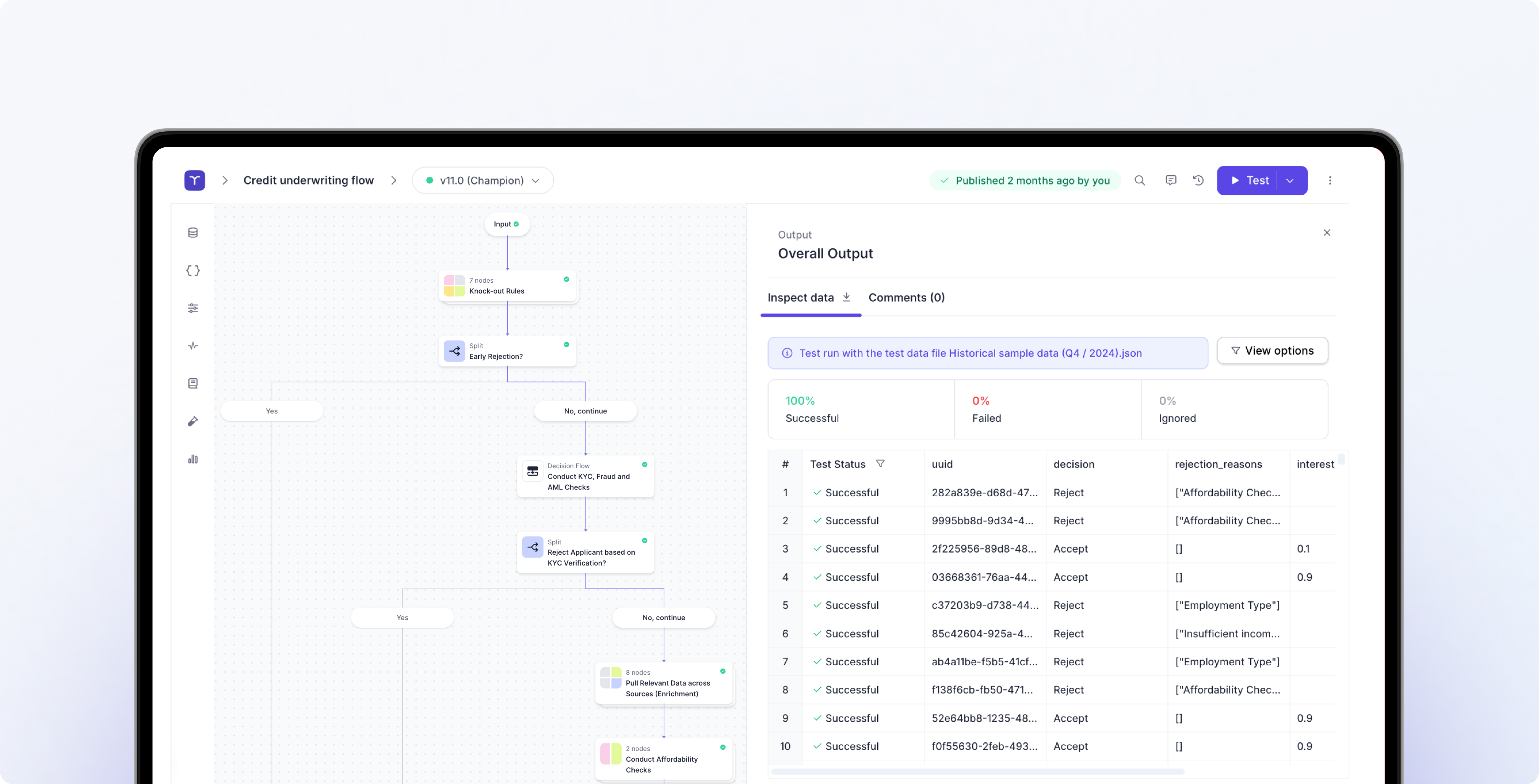

What an AI Decisioning Platform looks like.

Taktile gives risk teams full command over how AI powers credit, fraud, and onboarding - from data to decision execution.

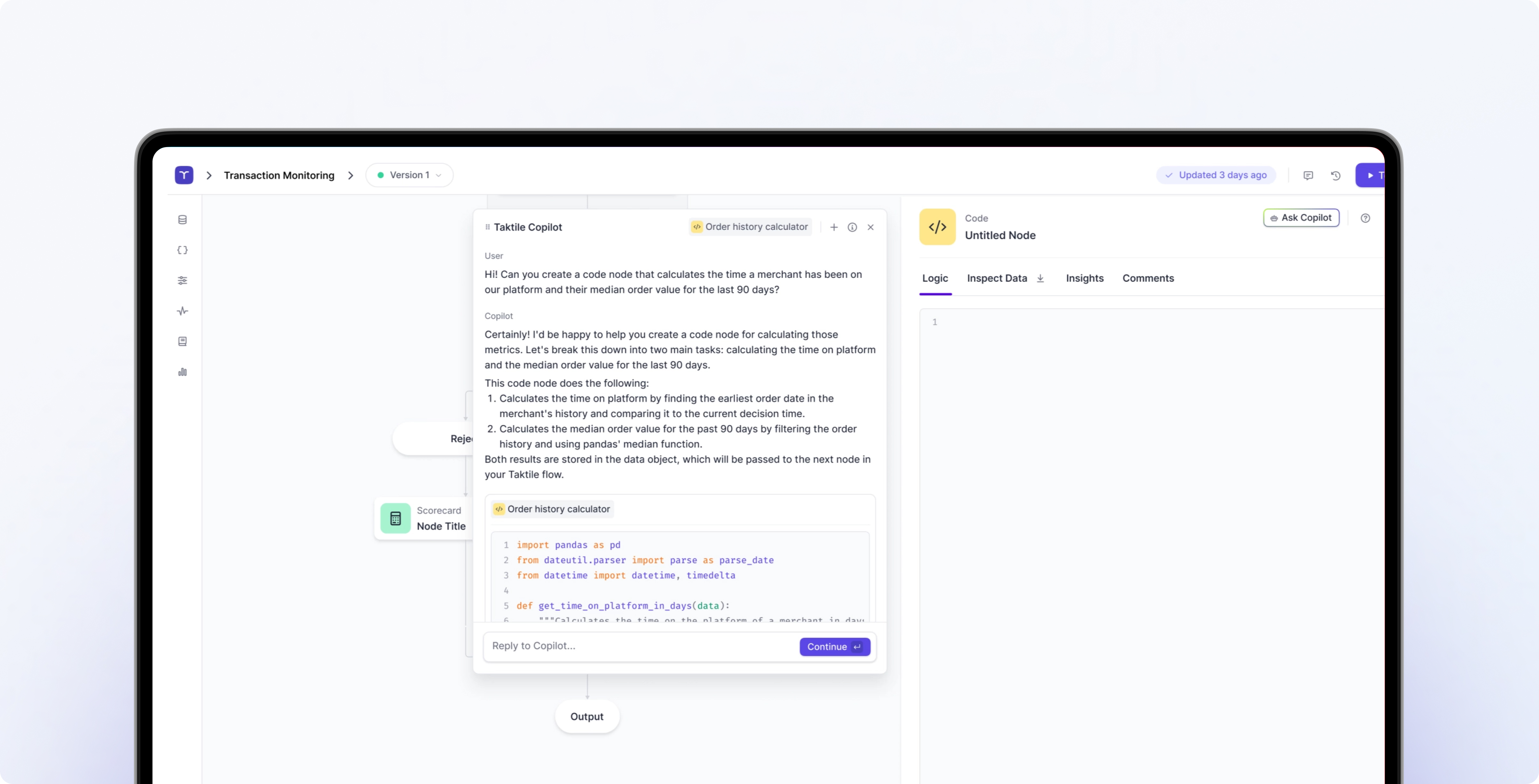

Enhance every decision with agentic AI.

Harness next-generation AI to analyze data, adapt logic, and optimize risk performance autonomously.

Design, test, and deploy AI decisioning

strategies in minutes with helpful AI along the way.

Build decision logic visually using pre-built 'nodes' that empower you to move fast without writing code.

Leverage AI to generate Python, giving you

low-code speed with full code-level flexibility.

Run tests in seconds and see expected outputs immediately to validate changes before deploying.

Benefit from real-time performance and reliability proven at top-tier banks and fintechs.

Protect your systems with bank-grade security and flexible deployment options.

Uphold governance and compliance with robust controls baked in.

Taktile has been recognized by G2 as a market leader for six consecutive quarters.

See why leading fintechs and banks choose Taktile.

Discover Taktile