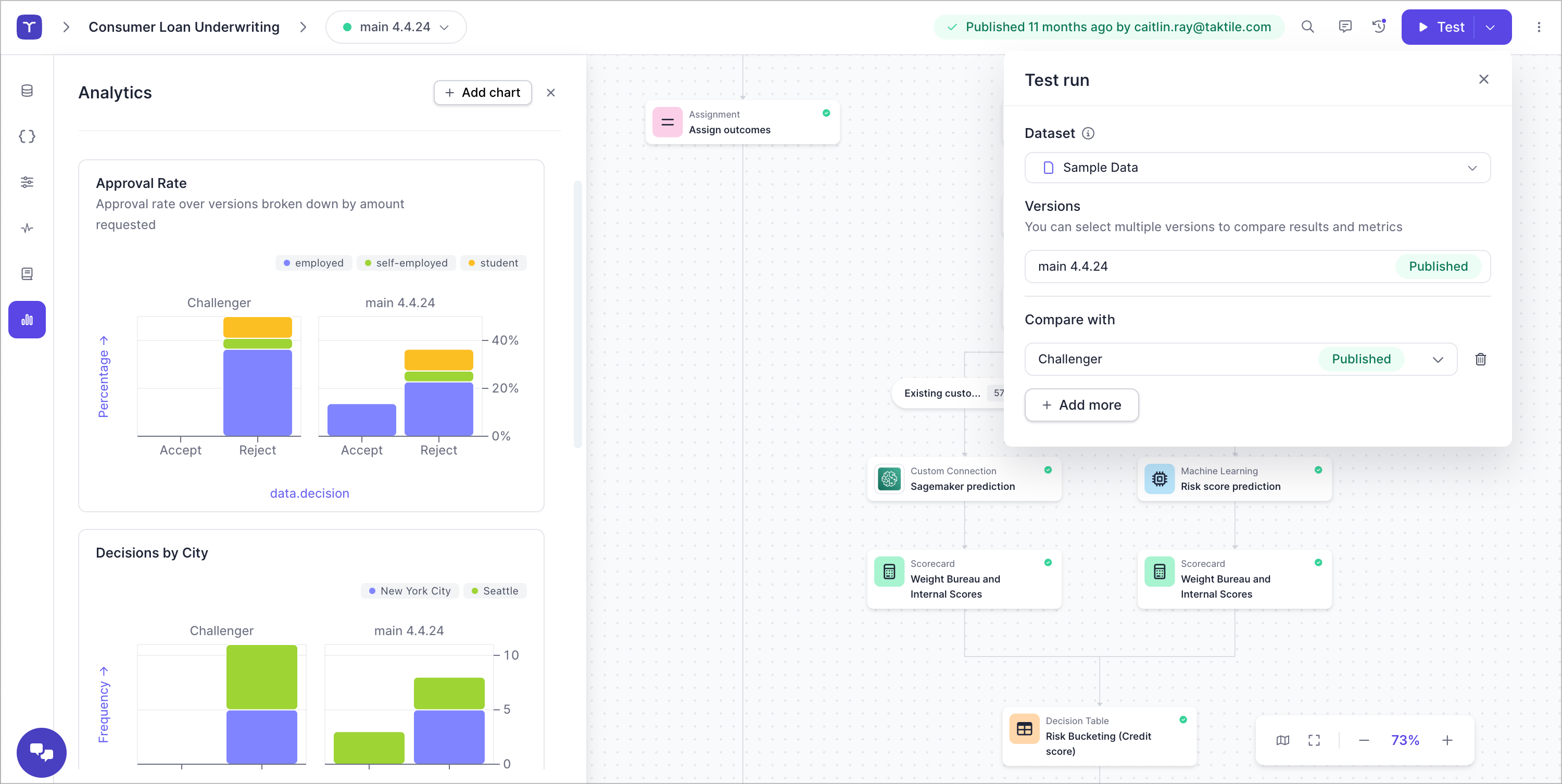

Credit decisioning without limits.

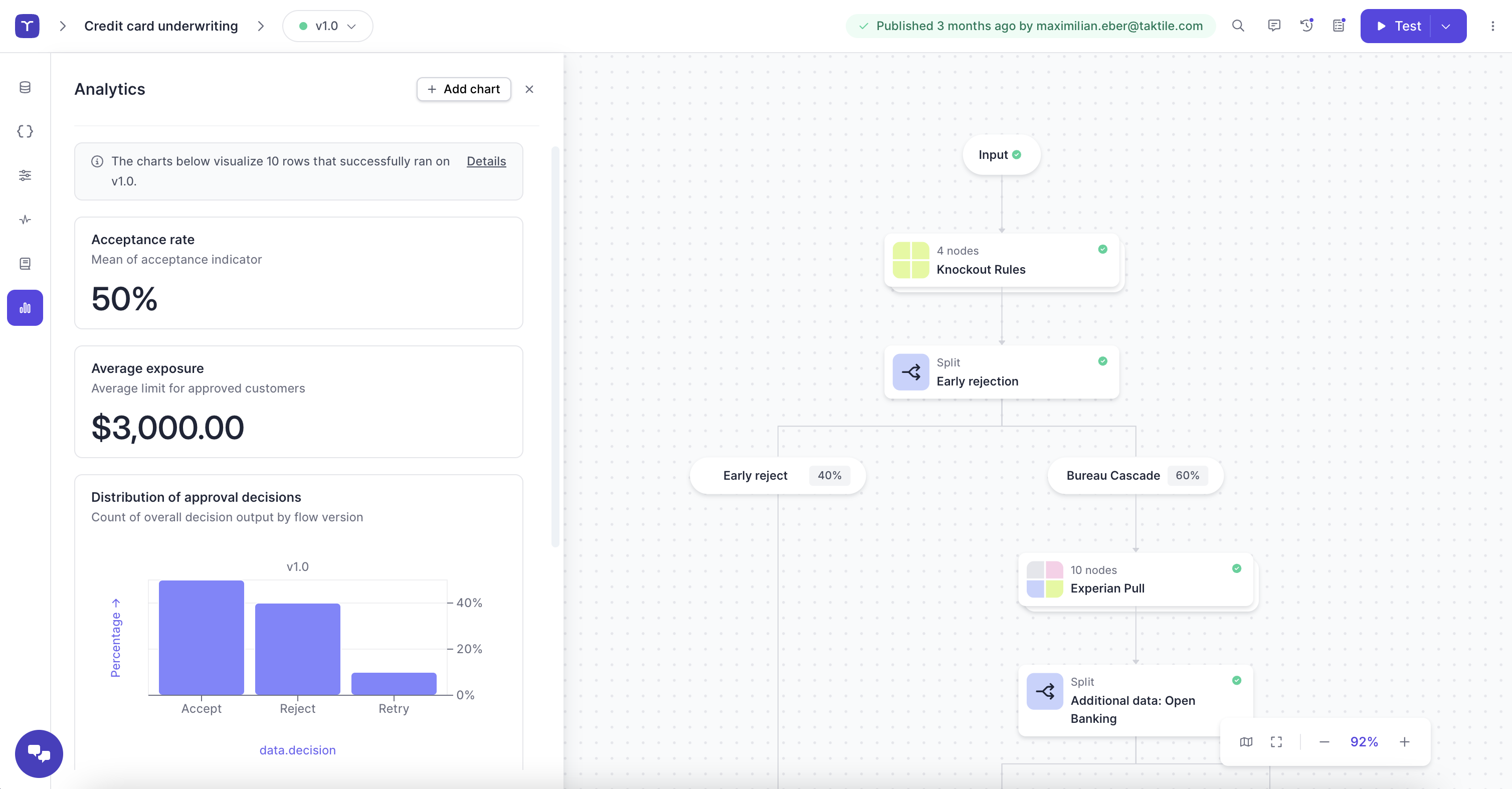

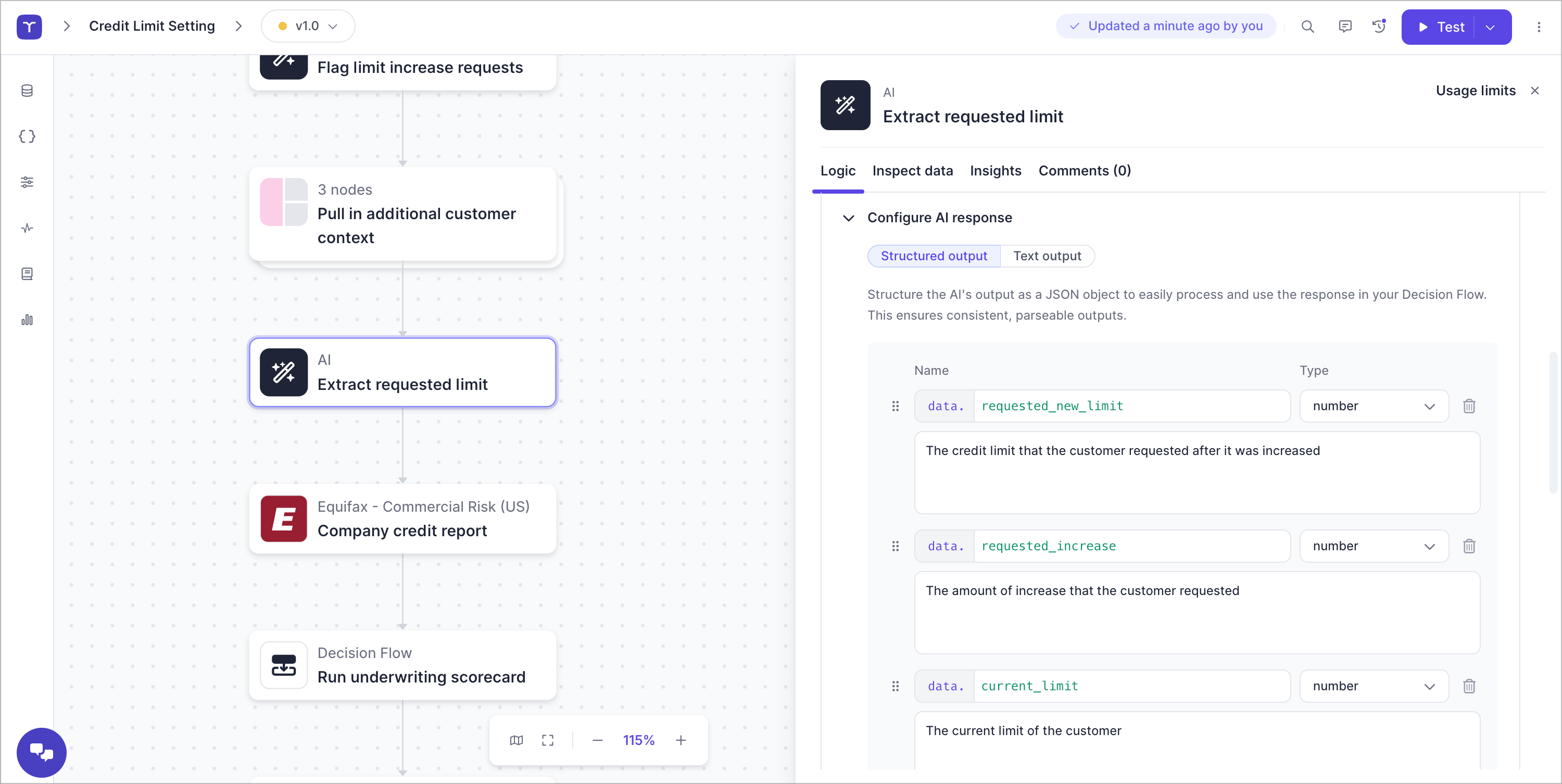

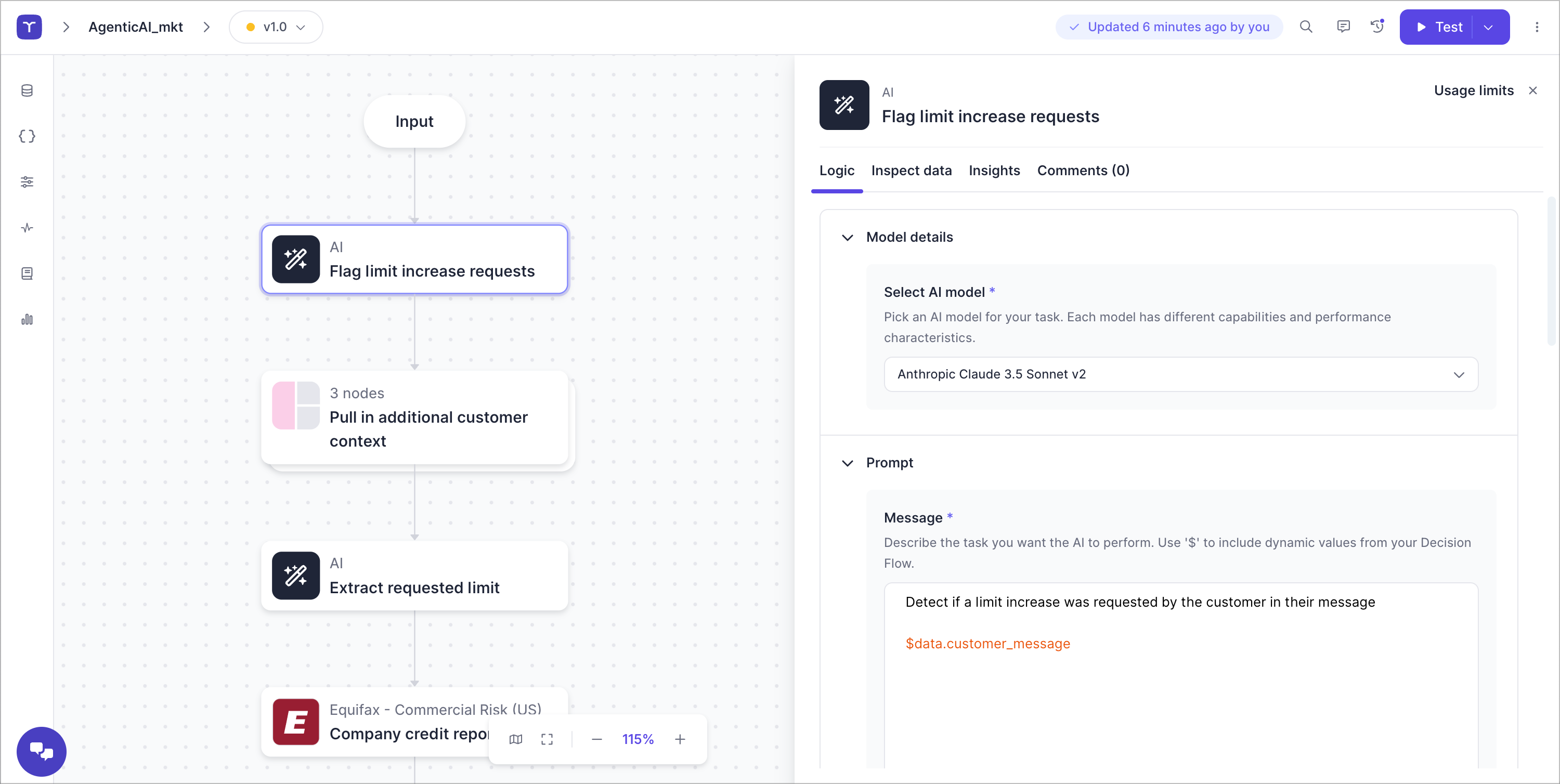

Shape your underwriting, portfolio monitoring, and collections strategies with AI-driven insights and real-time data. Optimize decisions, reduce risk, and approve more of the right customers—without relying on engineers.